45% of Disney-Going Parents With Young Children Have Gone Into Debt for Trip

With Disney prices as high as they are, once upon a dream has become once upon a debt for many Americans — particularly parents with young children.

According to the latest LendingTree survey of over 2,000 U.S. consumers, 24% of Disney-goers have gone into debt for a trip, a figure that rises to 45% among parents with children younger than 18.

Here’s what else we found.

Key findings

- The magic of Disney is sending parents into debt. Among the 77% of theme park-going parents with children younger than 18 who’ve been to Disney, 45% have gone into debt for a Disney trip, with 83% acquiring it most recently in the past five years. Among Disney-goers, 24% have gone into debt for a trip — a 33% increase from 18% in our 2022 survey.

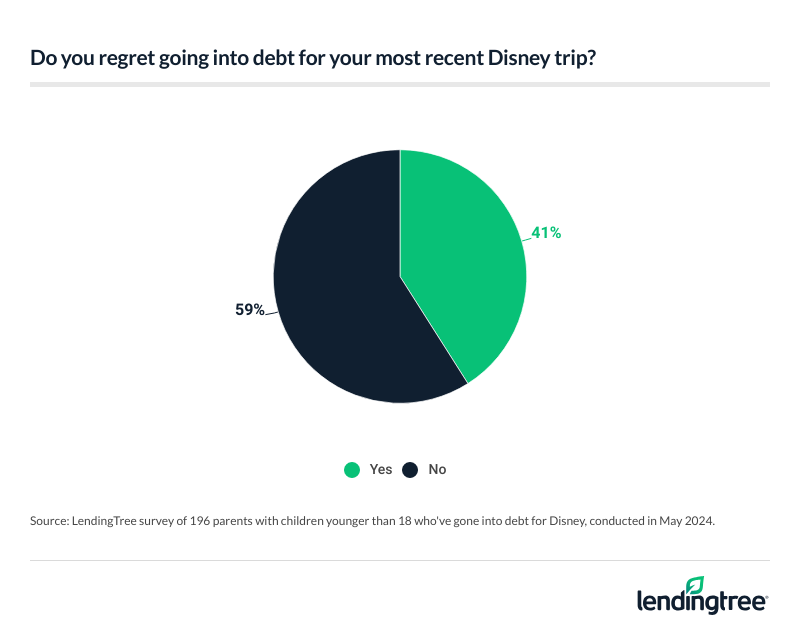

- The memories are worth the debt for most parents. Among parents of young children who’ve gone into debt for a Disney trip, 59% say they have no regrets. Additionally, 90% of parents who’ve taken their children to Disney say it was a treat. Overall, parents of young children took on an average of $1,983 in Disney-related debt.

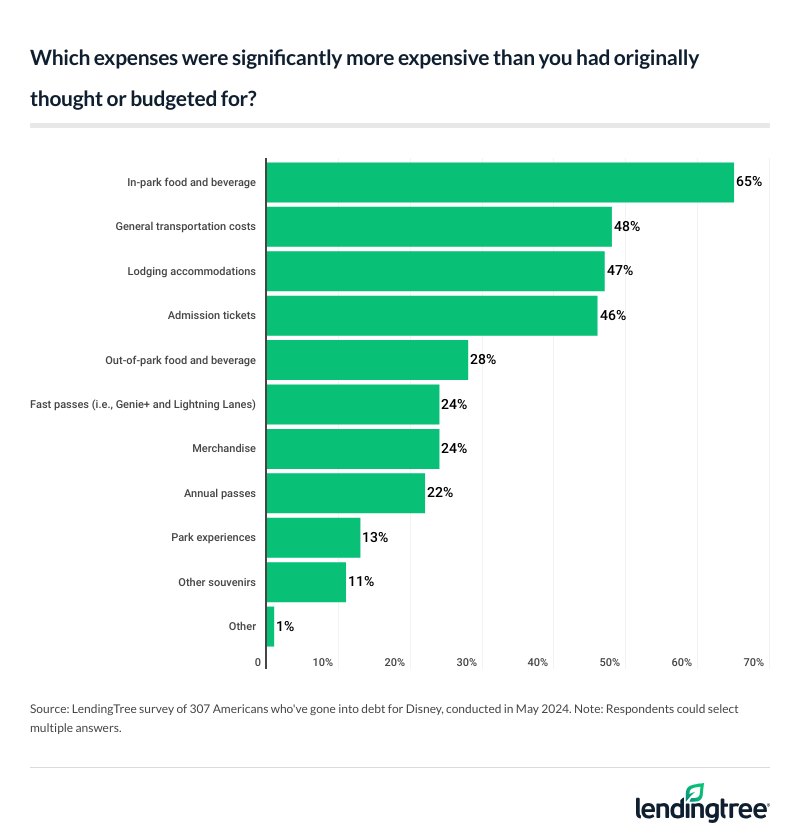

- Concessions broke the budget for many Disney-goers. When asked what expenses cost significantly more than planned, 65% of those with Disney debt said in-park food or beverages, 48% said general transportation costs and 47% said accommodations. Fortunately, 41% of Disney parkgoers were able to use a discount on their most recent trip.

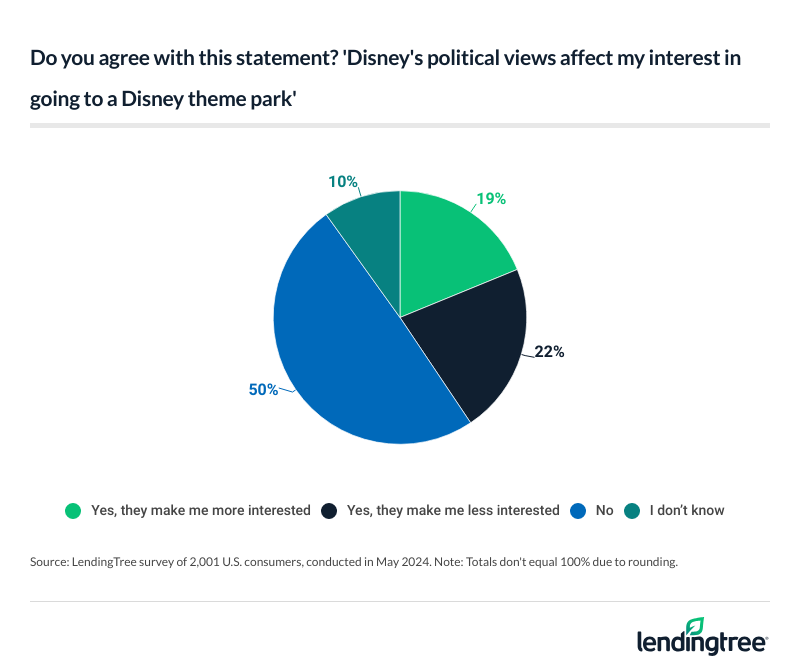

- Cost is the biggest factor for those who haven’t visited a theme park. Of the Americans who’ve been to a theme park, just 25% haven’t visited a Disney park. 60% of those who’ve never visited a theme park say it’s too expensive. Meanwhile, 31% say it’s too far away and 26% say they can’t stand the lines. Across all Americans, 40% say their willingness to visit Disney has been affected by its political views — either positively or negatively.

Magic Kingdom, empty wallet: Disney comes with debt

Experiencing the magic of Disney comes at a hefty cost. Across the 77% of theme park-going parents with kids younger than 18 who’ve been to Disney, 45% have gone into debt for a Disney trip. That’s up a whopping 50% from the 30% of Disney-going parents with young kids who said they took on debt in our 2022 Disney debt survey.

Tighter budgets and rampant inflation mean these parents are more likely to take on debt than before. Of parents with young children who’ve taken on debt for a Disney trip, 83% did so in the past five years, with 35% taking it on in the past year alone. Comparatively, just 17% took on their Disney debt greater than five years ago.

Looking more broadly at the 75% of theme park-going Americans who’ve been to Disney, 24% have gone into debt for at least one trip. That’s up 33% from 18% in our 2022 survey. Of this 24%, 74% took on their debt in the past five years, with 29% doing so in the past year.

By age group, Gen Zers ages 18 to 27 are the most likely to take on Disney debt, at 39%. That compares with:

- 36% of millennials ages 28 to 43

- 20% of Gen Xers ages 44 to 59

- 7% of baby boomers ages 60 to 78

Additionally, men who’ve been to a Disney park (32%) are twice as likely as women (16%) to take on related debt.

Disney’s not just for the littlest Mouseketeers

A trip to Disney may be the ideal holiday for kids, but they’re not the only ones looking for a good time. In fact, 29% of Disney-goers typically make their trips an adults-only affair. That breaks down to 20% who go with their adult family and 10% who go with adult friends.

Gen Zers and baby boomers are the most likely to typically have an adults-only Disney trip, at 35% for both. That’s followed by Gen Xers at 28%, while millennials (24%) are the least likely to do so.

Of course, the more you go, the more likely you can plan an adults-only trip. While the majority of Disney-goers have only been to a park once (26%) or twice (24%), 22% have gone five or more times.

Parents think the memories are worth the splash of cash

Despite a hefty bill waiting at home, parents don’t regret overspending for Disney. Of parents with young kids who’ve taken on debt, 59% have no regrets. Across all Americans who’ve taken on Disney debt, that figure is 64%.

Notably, women with Disney debt (75%) are more likely to say they have no regrets than men with Disney debt (58%).

Additionally, 90% of parents who’ve taken their children to Disney say it was a treat, rather than saying they felt obligated or indifferent (10%). Once again, women (93%) are more likely to share this sentiment than men (87%). By income group, parents earning between $30,000 and $49,999 (92%) are the most likely to say taking their children to Disney was a treat.

When it comes to how much debt they took on, parents of young children took on an average of $1,983 for Disney — the highest across all demographics. Across all Americans who took on Disney debt, that figure was $1,690. (As of June 2, standard date-based tickets for Disney World guests 10 and older start at $109.00 a day.)

Schulz — author of “Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life” — says the debt figures are about in line with what he’d expect. While it may seem high, he says it may do more good than harm.

Most Americans won’t carry their Disney debt for long. For their last trip, 75% of indebted Disney-goers say it would take (or took) six months or less to pay it off. And 32% say it would take specifically three to six months, the most common response.

Food, transportation broke the budget for most

Theme park food may be notoriously expensive, but many Disney-goers didn’t expect costs to be as high as they were. In fact, 65% of those with Disney debt say in-park food and beverages were significantly higher than they budgeted for — the most common response. (Some Disney World restaurants advertise dining costs of more than $60 per adult.)

But Schulz says there’s a workaround. “One of the best ways to cut costs is to bring your own food and nonalcoholic drinks to the park,” he says. “There are limits as to what you can bring, but packing snacks and refillable water bottles, for example, can make a real difference in the overall cost of your Disney experience.”

Following food, 48% say they didn’t budget enough for general transportation costs and 47% say accommodations. (A random search for Disney World resort hotels for a Wednesday in July for two adults and two young children showed standard-room rates ranging from $182 to $1,079 a night.)

There are some ways to save, however. In fact, 41% of Disney parkgoers were able to use a discount on their most recent trip. These include ticket discounts (e.g., state resident, corporate or military), dining discounts (e.g., memberships or online rewards for off-site chain restaurants) and hotel discounts (at Disney resorts and on-site or off-site hotels not owned by Disney).

Cost and politics stop some Americans from going

Overall, just 25% of Americans who’ve been to a theme park haven’t been to a Disney park. When those who’ve never been to a theme park were asked why, most (60%) said it’s too expensive, particularly women (67%). Following that, 31% said it’s too far away and 26% said they can’t stand the lines.

That’s not the only thing stopping Americans from visiting — recent political events have swayed some. Across all Americans, 40% say their willingness to visit Disney has been affected by its political views, with 22% less interested and 19% more interested in visiting.

(The Tampa Bay Times offered a timeline in 2023 on the feud between Disney and Florida Gov. Ron DeSantis.)

By age group, 29% of millennials and 28% of Gen Zers are more interested in visiting Disney because of its political views. On the other hand, 28% of baby boomers and 21% of Gen Xers say they’re less interested. Meanwhile, 27% of six-figure earners say they’re more interested in visiting because of Disney’s political stances, the highest percentage among income groups.

Managing Disney debt: Top expert tips

Although Disney is meant to be fun, Disney debt shouldn’t be a beast. To help manage your budget and juggle potential debt, Schulz recommends the following:

- Save up. “If you’re not going for a few months, start stashing some money away in a high-yield savings account to help you pay for the trip,” he says. “Now that returns are 4% or 5% or higher, even a little bit of savings can grow pretty quickly.”

- If you’re considering a personal loan for your vacation, shop around. “Generally speaking, it’s not a great idea to finance a vacation with a personal loan,” Schulz says. “However, if you’re going to get one, it’s crucial that you shop around and compare rates at multiple lenders via sites like LendingTree. There can be significant differences among lenders when it comes to rates and fees and other terms, so it’s well worth your time to look around.”

- Spend based on your priorities. “What matters most to you on a Disney trip doesn’t matter to someone else,” he says. “Some may splurge on a hotel and pack lunches. Others may just look for the lowest hotel rate but seek out the best dining. Spend the most on what gives you the most joy, and then be judicious spending elsewhere.”

Methodology

LendingTree commissioned QuestionPro to conduct an online survey of 2,001 U.S. consumers ages 18 to 78 from May 1 to 2, 2024. The survey was administered using a nonprobability-based sample, and quotas were used to ensure the sample base represented the overall population. Researchers reviewed all responses for quality control.

We defined generations as the following ages in 2024:

- Generation Z: 18 to 27

- Millennial: 28 to 43

- Generation X: 44 to 59

- Baby boomer: 60 to 78