Innovation may require investment and therefore feel counterintuitive in a crisis. Against a backdrop of uncertainty, it can seem far more natural as a business decision maker to freeze budgets, stick with a tried-and-tested approach and play it safe until some semblance of normality returns.

But the evidence is clear: this isn’t the best strategy for long-term success.

Instead, those brands and retailers within Consumer Technology and Durables that continue to innovate across different facets of their business are far more likely to sustain market share and emerge stronger from a crisis than those that don’t.

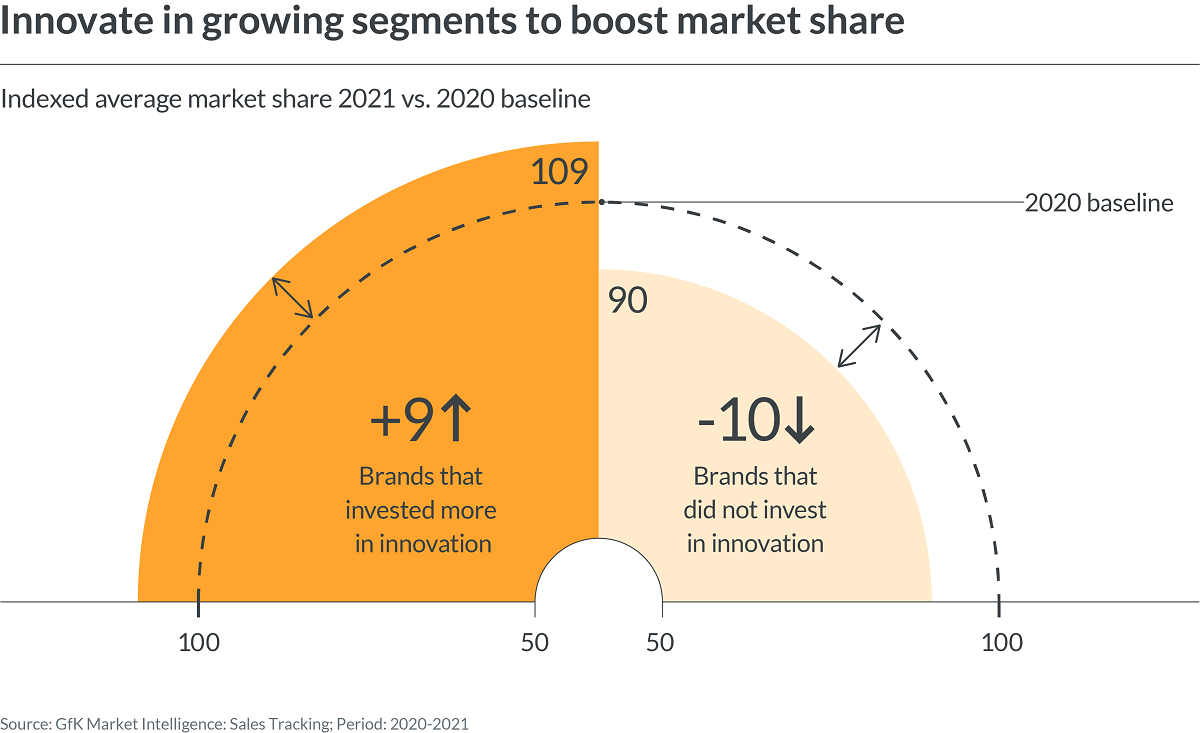

It’s a lesson learned from previous crises, such as the 2008 economic crash. Brands that invested in innovation during this period saw, on average, 46 point increase in indexed market share between 2008 and 2012 (with 2008 performance as a baseline), while those that didn’t saw an average decrease of 20 points over the same period.

This same trend is already emerging from the global pandemic, with those businesses that continued to invest in supply chains, new product development, and maintaining brand awareness and engagement enjoying a far faster recovery rate than their competition.

For both brands and retailers this creates a clear blueprint for how to navigate the current cost of living crisis that’s gripping global markets.

So, where should senior leadership in the sector focus their efforts when it comes to innovation in the months (and years) ahead?

Tailoring product mixes

Product is a key avenue of innovation for business decision makers to explore. In particular, drawing on real-time data and insights to adapt product portfolios to reflect the changing priorities of consumers grappling with the cost of living crisis.

There is no doubt that in many regions, consumer confidence has been dented. 43% of global consumers feel it’s a good time to wait to make any purchases, more than double the percentage who feel it’s a good time to buy. But there is still a willingness to spend within Consumer Technology and Durables on products that provide tangible benefits or added convenience.

That includes devices that help cut energy use and thereby reduce household bills, as well as those that add value via multifunctionality, such as hot air fryers that can also grill and steam, or innovative premium features, such as eco wash cycles in washing machines. Brands and retailers should highlight these product categories and tailor promotional strategies to reflect this shift in the drivers behind purchases.

Optimizing supply chains

Though some pandemic-related pressures on global supply chains have eased in recent months, a mix of inflationary pressures and geopolitical disruption will continue to add ongoing cost and complexity into 2023, hampering product availability. Exploring ways to mitigate this volatility, both in the short and longer term, is therefore a solid strategy for any brand or retailer.

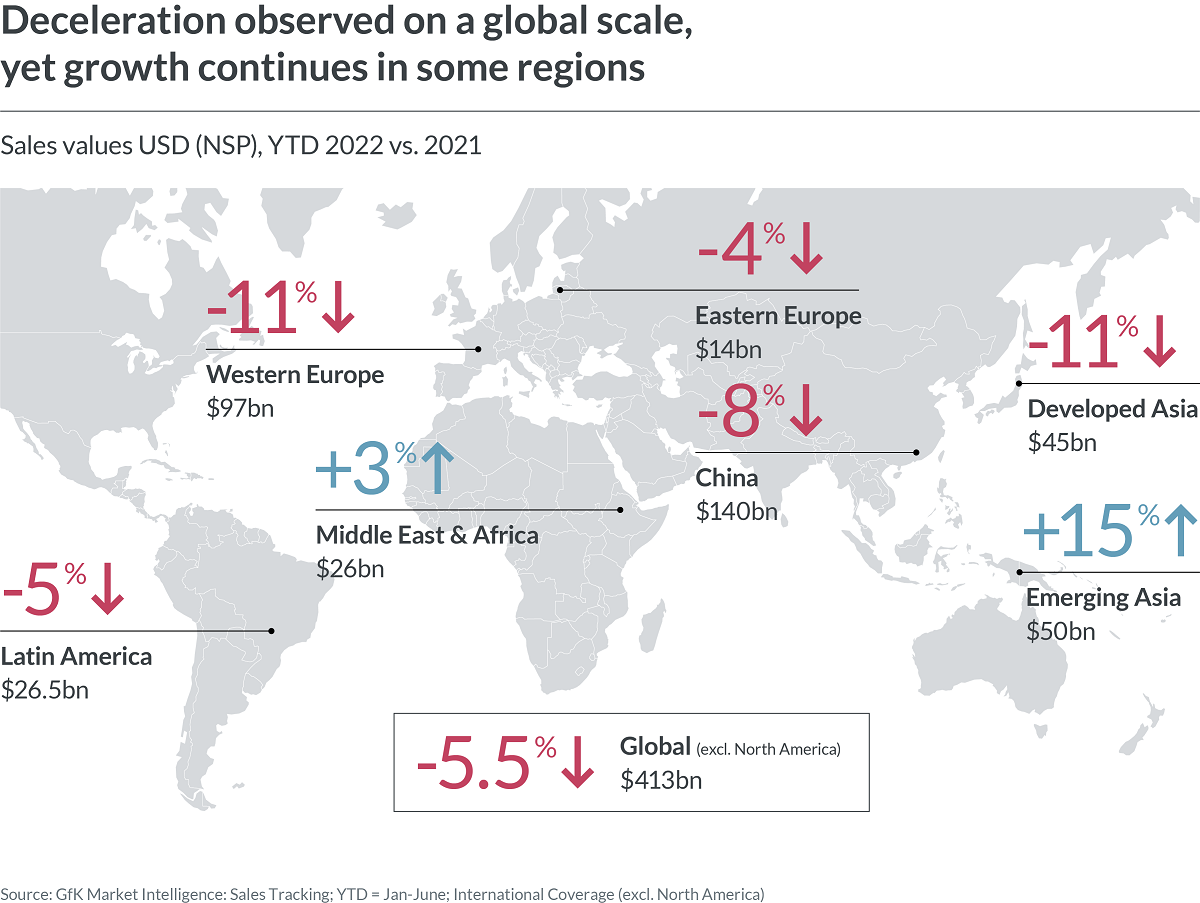

In the shorter term, innovation could include increasing distribution to those markets less exposed to disruption and inflationary pressures. In particular, there is a notable split between the performance of developing and developed economies within Consumer Technology and Durables. While in Western Europe there was an 11% deceleration in value growth in H1 2022, for example, in developing Asian markets, comparably lower inflationary pressures, coupled with lower penetration rates and previous year baseline effects, saw sales soar by 15% in the same period. Exploring a greater presence in these growing markets could therefore provide brands and retailers with the chance to offset poorer performance elsewhere.

In the longer term too, strengthening partnerships and diversifying production sites could improve agility and provide the means to mitigate future supply volatility. This is clearly a significant strategic shift for any business and won’t be an option for all but may be for those businesses with the capacity for sizable capital investment. To understand what strategy may be the best fit and learn how to deliver value for consumers battling inflation in alternative ways, click here.

Building share of voice

Building brand engagement and awareness should form a core part of any team’s innovation strategy. Even more so during a crisis. Indeed, as many competitors freeze or slow down investment on building share of voice during a crisis, now is a prime opportunity to create campaigns that achieve far greater reach and impact – and ultimately ROI – than during periods of stability when there is always more clamor for consumer attention.

“Aim to build campaigns that optimize omnichannel behaviors too, combining engaging social media content, with next-gen digital innovation in stores and in-depth product guides on retail websites,” says Namrata Gotarne, Global Strategic Insights Director at GfK. “Each channel should be optimally leveraged to drive maximum sales activations that provide inspiration, information and support at each touchpoint.”

More broadly, there is plenty of reason to think that consumers will continue to care about trends such as sustainability despite pressures on household spending, so don’t press pause on campaigns centered around ESG goals.

Innovate, innovate, innovate

The bottom line is that now is not the time to stop investing in either the business as a whole, or individual brands. Though limiting innovation can feel like the safer option, the reality is it’s a far bigger risk in the long term. Right now, facing their own uncertainties, consumers are looking for brands and retailers that can adapt to their changing needs. To meet those needs will require a balanced product mix that caters to consumers of varied income levels, as well as clear and compelling brand positioning that reflects the current climate.

For a detailed look at how brands and retailers can achieve this, download our latest State of Consumer Technology and Durables report.

The data in this article has been collected from GfK Market Intelligence: Sales Tracking and GfK Consumer Life Global.