Fed interest rate cuts won't help your credit card debt

The average credit card annual percentage rate is 20.76%: Bankrate

Trajectory Fed chair is talking about is 'important': Kyle Wool

Dominari Financial CEO Kyle Wool discusses the market's performance following the Fed rate cut and highlights A.I. stocks to watch out for.

Wall Street and Main Street are ushering in the fall season with the first interest rate cut since March 2020, the start of the COVID-19 pandemic, and with this comes the hope of lower borrowing costs.

The Federal Reserve cut interest rates by 50-basis points in September, a larger move than some expected, giving investor sentiment a boost.

While it may lower rates for mortgages, auto and personal loans, those carrying credit card debt are likely to be out of luck, in the near-term anyways.

"That's where the real advice is. Don't expect the Fed to ride to your rescue," Ted Rossman, Senior Industry Analyst at Bankrate, told FOX Business ahead of the move. "The change is not going to be that significant. My other big point is that a quarter point, half point, even if credit card rates fell a couple of points, it's not that much of a difference. Just because rates are so high," he warned.

A customer inserts a Visa credit card using touch screen credit card payment at a Five Guys restaurant in Queens, New York. (Lindsey Nicholson/UCG/Universal Images Group via Getty Images)

CREDIT COUNSELING DEMAND SURGES IN THESE STATES

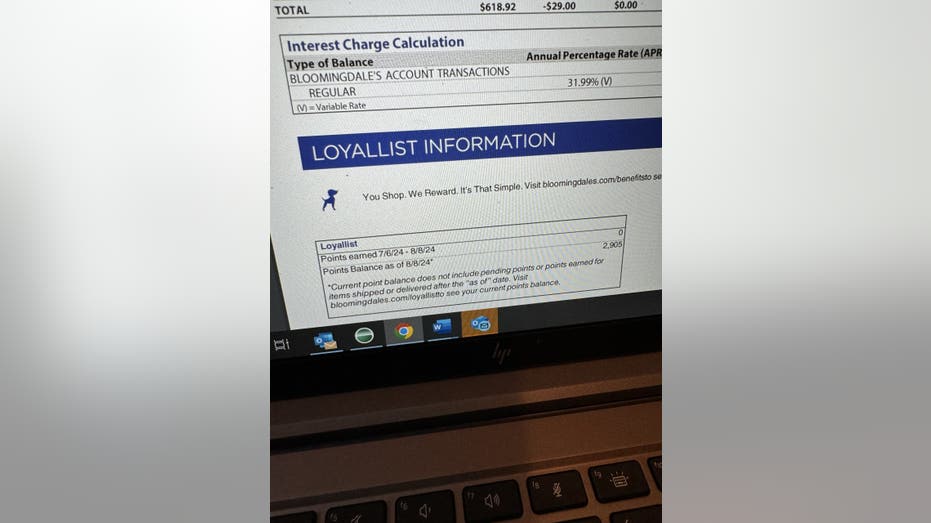

The average annual percentage rate on standard credit cards is about 20.76%, according to Bankrate, with some in-store retail cards, such as Bloomingdale’s, as high as 31.99%.

Bloomingdale's credit card statement (FOX Business )

As an example, for those carrying a $1,000 balance on a credit card, a 50-basis point rate cut may lower your APR to 20.26% vs. 20.76%, according to Bankrate estimates. The drop in the monthly finance charge would be a paltry $0.42 less. Your minimum payment would likely remain unchanged, as outlined by Greg McBride, chief financial analyst, Bankrate.

Fed Chairman Jerome Powell also signaled that policymakers will continue to cut rates through this year and maybe even further.

"This recalibration of our policy stance will help maintain the strength of the economy and the labor market, and will continue to enable further progress on inflation as we begin the process of moving toward a more neutral stance, we are not on any pre-set course. We will continue to make our decisions meeting by meeting. We know that reducing policy restraint too quickly could hinder progress on inflation", Powell said during his press conference.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| M | MACY'S INC. | 15.25 | +0.04 | +0.26% |

| V | VISA INC. | 275.17 | +3.48 | +1.28% |

| JPM | JPMORGAN CHASE & CO. | 210.40 | +0.58 | +0.28% |

| DFS | DISCOVER FINANCIAL SERVICES | 139.22 | +0.92 | +0.67% |

| COF | CAPITAL ONE FINANCIAL CORP. | 149.09 | +1.28 | +0.87% |

FED CHAIR POWELL REVEALS RATE CUT PLANS

The Fed's current target is now 4.75%-5.00% with a projected target of 4.4% by year end, 3.4% by the end of 2025 and 2.9% by 2026. All of course could change depending on overall economic conditions.

Currently, market participants are divided over whether the Fed will cut by 25 or 50 basis points at the November meeting, according to the CME’s FedWatch Tool, which measures the probability of future rate moves. The final meeting of the year will take place in December.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| M | MACY'S INC. | 15.25 | +0.04 | +0.26% |

| V | VISA INC. | 275.17 | +3.48 | +1.28% |

| JPM | JPMORGAN CHASE & CO. | 210.40 | +0.58 | +0.28% |

| DFS | DISCOVER FINANCIAL SERVICES | 139.22 | +0.92 | +0.67% |

| COF | CAPITAL ONE FINANCIAL CORP. | 149.09 | +1.28 | +0.87% |

Even if policymakers stick to an easing cycle, it will still take a few rounds to make a meaningful difference for credit card APRs.

401(K) MILLIONAIRES HIT NEW RECORD HIGH: FIDELITY

"The Fed's going to be much slower, we think, on the way down than they were on the way up," cautions Rossman.

Rather than wait for the Fed, Rossman suggests exploring other options.

"Maybe get a 0% balance transfer card or take out a side hustle. Cut your expenses. I mean, there's other stuff you can do, but fed rate cuts, in and of themselves, aren't going to make a big difference in the credit card world," he said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

*This article, originally published on Sept. 1, 2024, has been updated.