Blackstone's Stephen Schwarzman practices philanthropy for the long haul

Firm's co-founder has said he pursues projects whose benefits will outlive him

At age 8, Stephen Schwarzman watched his grandfather pack up wheelchairs every few months from a warehouse behind the family’s Philadelphia store to send to people in Israel, then a fledgling nation.

Bewildered, the often curious Schwarzman asked why.

His grandfather's answer was simple: "People need help, and I believe in helping them."

It was a response that has guided Schwarzman, who went on to co-found and helm the Blackstone Group -- one of the largest private equity firms in the world, ever since.

Stephen Schwarzman, co-founder and chief executive officer of Blackstone Group. (David 'Dee' Delgado/Bloomberg via Getty Images)

“My grandfather was a very powerful force in all of our lives," Schwarzman, 73, explained to FOX Business in an exclusive interview. "He just learned that was the type of thing you were supposed to do: It was part of his life; it was supposed to be part of our lives, and we should always be looking out for other people. That was a paradigm for me when I was growing up.”

So was earning his own money. As a child in the middle-class suburbs of Philadelphia during the 1950s, Schwarzman helped out in his family’s linen store, sold candy bars and light bulbs door-to-door and delivered telephone books. At 14 years old, he embarked on his first business venture: a lawn-mowing service with two part-time employees -- his younger twin brothers.

"Can you change something that's really important, that you think without it, it's going to go the wrong way?"

After graduating in 1969 from Yale University, an institution he credits with shaping how he thinks and approaches the world, Schwarzman made his Wall Street debut at the private investment bank Donaldson, Lufkin & Jenrette.

He later obtained a master's degree in business from Harvard and worked for the investment bank Lehman Brothers before co-founding the Blackstone Group in 1985 with former Lehman Brothers CEO Peter Peterson. Since then, the investor dubbed the "King of Capital" in a 2011 book by David Carey and John Morris has amassed both a fortune that Forbes magazine pegs at $18.1 billion and a reputation for philanthropic endeavors.

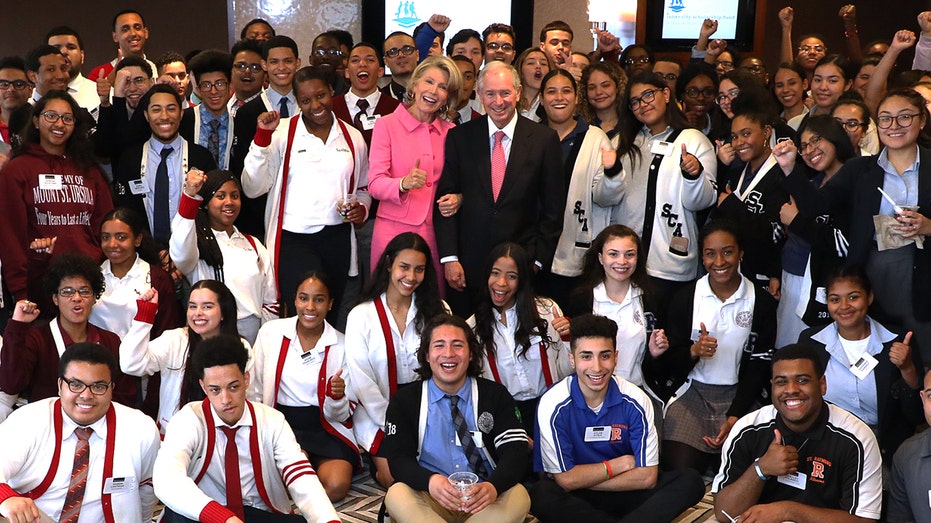

Stephen and Christine Hearst Schwarzman, center, with a group of more than 90 beneficiaries of the Inner-City Scholarship Fund. (Courtesy of Blackstone Group)

Earlier this month, Schwarzman signed the Giving Pledge, becoming the latest of more than 200 of the world’s wealthiest individuals to commit to giving the majority of their fortunes to philanthropic causes. The initiative was started in 2010 by Bill and Melinda Gates and billionaire Warren Buffett to "address some of society’s most pressing problems."

Originally focused on the U.S., it went global three years later and has now garnered participants from 23 countries working to set "a new standard for generosity" among the ultra-wealthy.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"It's important to help provide an example of what people of means should do," Schwarzman said.

His previous contributions include $150 million to his alma mater, Yale, to establish its first student and culture center, slated to open in September, and 150 million British pounds to the University of Oxford to create a new Centre for the Humanities. He's not only the single largest private donor to the USA Track and Field Foundation, he and his wife, Christine Hearst Schwarzman, are major contributors to Catholic schools.

“I move from thing to thing with what strikes me at that moment as needing attention, and then I create something or really develop it and stay involved,” added Schwarzman, who once said he pursues projects whose benefits will outlive him. “These aren’t like one-hit wonders. They’re meant to be part of my life. And when I’m gone, somebody else can be looking after them, to make sure they’re always great.”

Inspiration can come from anywhere. For instance, Schwarzman recalls reading about a runner who injured her leg while training for the Olympics and wanting to help, since he had been a runner himself.

Ultimately, that desire translated into financial support for scores of U.S. track and field athletes, whose photos and notes of appreciation sit on a mantel inside Blackstone's New York headquarters. Schwarzman hosts an annual lunch for the entire group and keeps in touch with them individually throughout the rest of the year.

He and his wife also take the time to write notes to each child they sponsor through the Inner-City Scholarship Fund, which provides tuition assistance to underprivileged students attending Catholic schools in the Archdiocese of New York.

For Schwarzman, it's more than merely handing over a check, it's investing in efforts that will effect change for the better.

"Can you change something that's really important, that you think without it, it's going to go the wrong way?" Schwarzman said.

Stocks In This Article:

Among the philanthropists who have inspired him is Eli Broad, the billionaire behind KB Home, the first homebuilder traded on the New York Stock Exchange, and SunAmerica, the retirement-savings firm acquired by AIG. Afterward, Broad and his wife, Edythe, signed the Giving Pledge, committing to giving away 75 percent of their wealth.

The organization they established, the Broad Foundation, has funded high-quality charter schools, stem-cell research centers and museums such as The Broad, in downtown Los Angeles.

When considering an investment, the foundation routinely assesses whether the project will happen without its contribution and whether it will last for at least the next two decades.

“I’ve never told Eli this, but he’s done an amazing job with philanthropic activities,” Schwarzman said. “I admire what he’s chosen to do in his lifetime and how he’s executed it, which is always at the highest quality in every way.”