Buying a home is one of the most exciting and stressful milestones we face, and as one of the largest financial commitments you’ll make, it’s important to be prepared with the right information to understand what you can afford, up front and ongoing. Here are a few first steps you should take in the process:

Your credit report tells a detailed story about you, your financial accounts and your payment history. This information is important to potential lenders and creditors and can help them decide to accept or deny your application, and what interest rate to charge you if accepted.

They tend to look at:

- Payment history: Are you paying your credit accounts as agreed, or do you have missed or late payments? Do you have accounts in collection? While a few missed payments may not result in a denial, they can result in less favorable loan terms.

- Debt to credit ratio: Using a large percentage of your available credit can be a red flag to potential lenders.

- Length of credit history: Do you have a long track record of responsible credit use?

- Types of credit: Lenders generally like to see a good mix of different credit types, showing that you have a history of managing multiple sources of credit reliably.

- New accounts: Have you opened or tried to open a large number of new credit accounts recently? If so, lenders may question your ability to repay.

Potential lenders for a purchase or lease loan look at the same criteria on your credit report. But even renting a car can affect or be affected by your credit.

When you rent a car you're usually required to use a credit or debit card. If you use a debit card, car rental companies may pull your credit report to determine the risk of renting to you. When a company pulls your credit report it may impact your credit scores. For that reason, you may want to consider using a credit card instead.

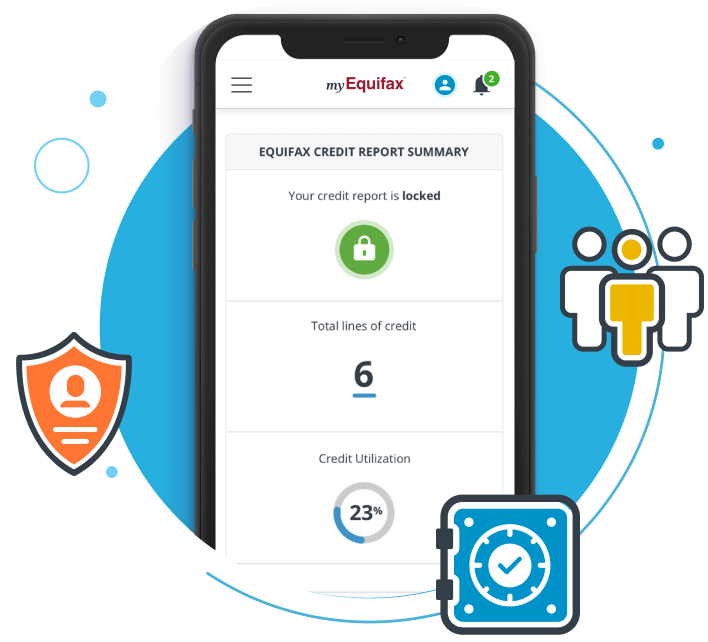

To view your Equifax credit report just sign into a free Equifax Core Credit™ account and click “View your credit report” under the Equifax Credit Report Summary card on your dashboard. You can also get your free annual credit report from each of the three nationwide agencies (Equifax, Experian, TransUnion) through annualcreditreport.com.

Understand the role your credit plays in the home buying process

Before even starting your search for a home it’s best to check your credit to see what it shows, and to see if there’s anything you didn’t expect on it, so you have time to clear it up before your search begins in earnest.

Check your credit for free

Check your Equifax credit report monthly for free with Equifax Core Credit™ to help you better understand your current credit position. Checking your own credit scores and reports will not impact your credit scores.

Figure out how much home you can afford

Create a monthly budget and review your available finances for a down payment. That will help give you a starting point, but remember a home’s purchase price is only part of the picture; you may also be responsible for a down payment, closing costs, taxes, insurance and other expenses. Online mortgage calculators may help you find a starting range.

Gather your documents

Realtors, not just potential lenders, will want to make sure they show you homes in your budget, and with their experience, they know where some of the gaps may be. Be prepared for questions with any required documents, such as tax returns, pay stubs, and bank statements, which you’ll also need to prequalify and apply for a mortgage.

One important thing you can do as soon as you start thinking about buying a home is checking your credit report. Ideally, this should be done at least six months before you purchase to give yourself time to dispute any information you believe is inaccurate or incomplete, if needed. It’s also important to know how your payment history is being reported by your current creditors.

Look for any information that might be inaccurate or incomplete. Is your personal information, including your address, correct and up to date? Are there any addresses you don’t recognize? Are all of the accounts listed complete and accurate? Do the balances appear accurate? Are there any accounts you don’t recognize?

If you see something that appears inaccurate or incomplete, contact the company. You can also file a dispute with the credit bureau that provided the report. To file a dispute with Equifax, visit our dispute page.

Technology has changed the process of obtaining a mortgage, with online mortgages becoming more popular. But because so much personal information is required to get a mortgage, it’s a good idea to keep security in mind.

Here are some suggestions:

- Use reputable companies. Check out lenders you’re unfamiliar with. Make sure the company’s web site is secure and offers a contact number for you to call with any questions or concerns. You can check to see if each lender you consider is registered in your state through the Nationwide Multistate Licensing System Registry. You can also search the Better Business Bureau for information on lenders.

- Use a secure network. Don’t apply for loans on public WiFi.

- Be careful sending information over email. Make sure the company uses a secure, password-protected online portal. If you’re faxing documents, make sure someone is on the receiving end to pick them up.

- Don’t respond to suspicious emails. If you receive an email that seems to be from your lender, but it appears suspicious, contact the company to verify it’s legitimate

- Monitor your credit reports and bank accounts after you’ve applied. Keeping an eye on your credit reports and accounts may help spot suspicious activity early.

Remember, applying for a mortgage will likely appear as an inquiry on your credit report, so think twice before applying to multiple lenders individually.

To view your VantageScore® 3.0 credit score just sign into your free Equifax Core Credit account. Your current credit score will appear right there on your dashboard.

You did great, you got from out of 0 correct.

Buying a home is daunting and you should enter the process with as much information as possible to ensure you are making decisions that are right for you and your financial lifestyle.

Now take the next step towards helping to better monitor your credit and prepare for this next step.

Get 3-bureau credit file monitoring and receive alerts if your personal information is found on the dark web with Equifax ID Patrol™.

Whether you’re buying or leasing, considering new or used, navigating the ins and outs of financing can be tricky. Understanding how your credit report and score can play a role in what you can afford, and how lenders and insurers both use the information is the first step in being prepared.