Marriage Loan—

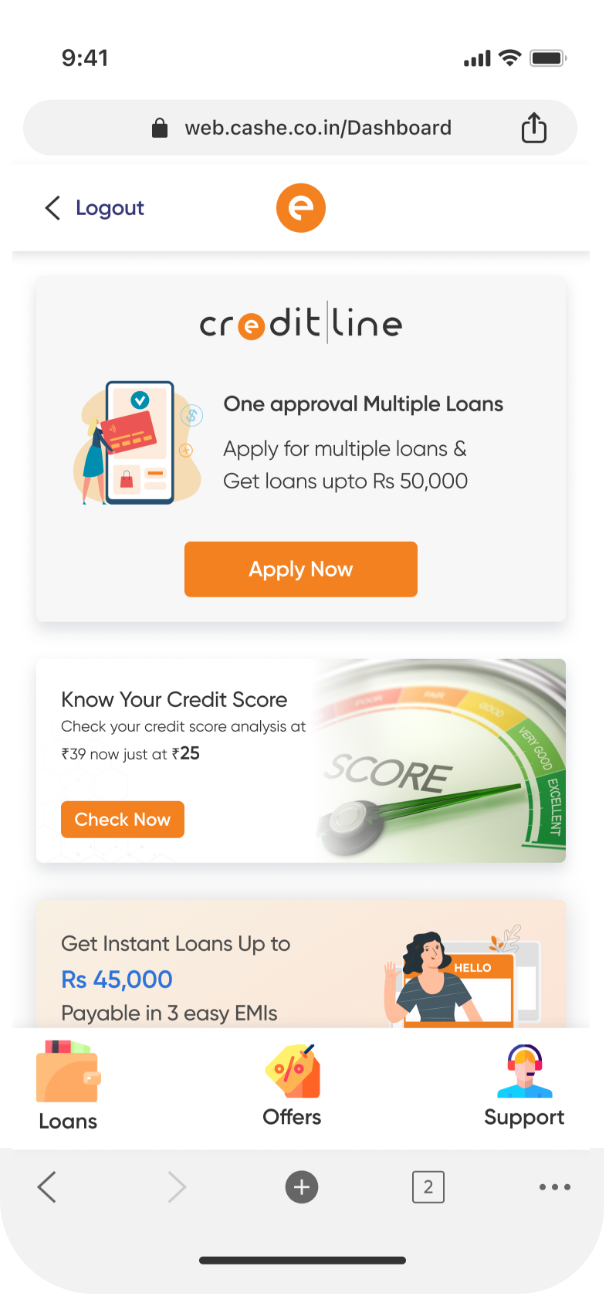

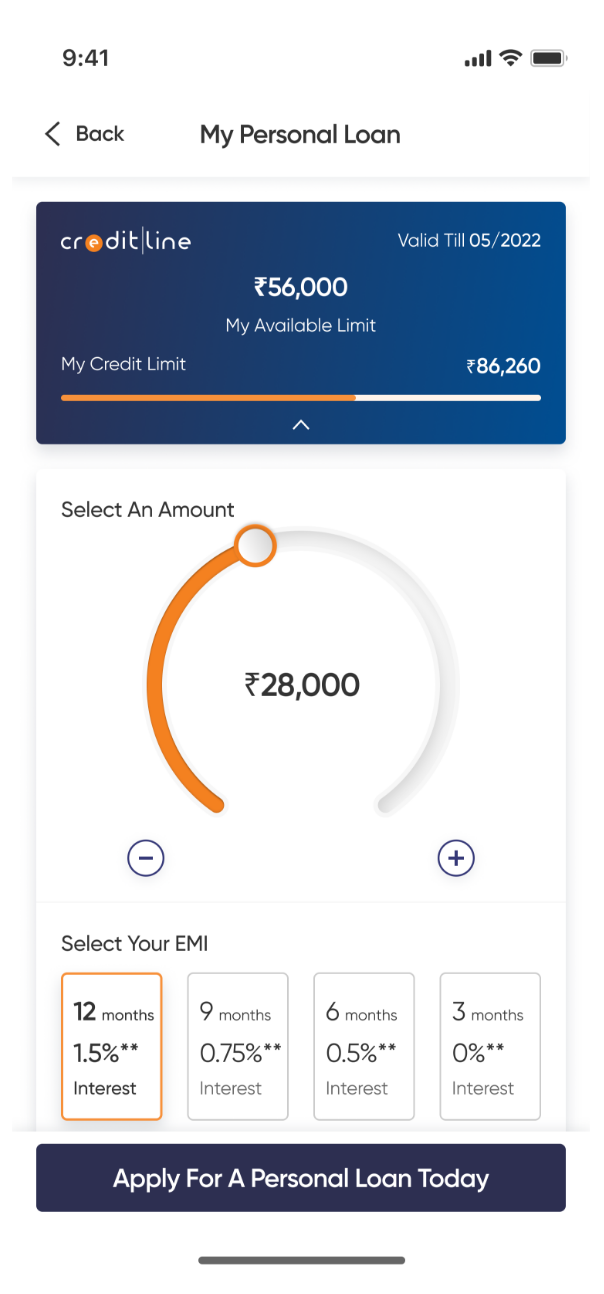

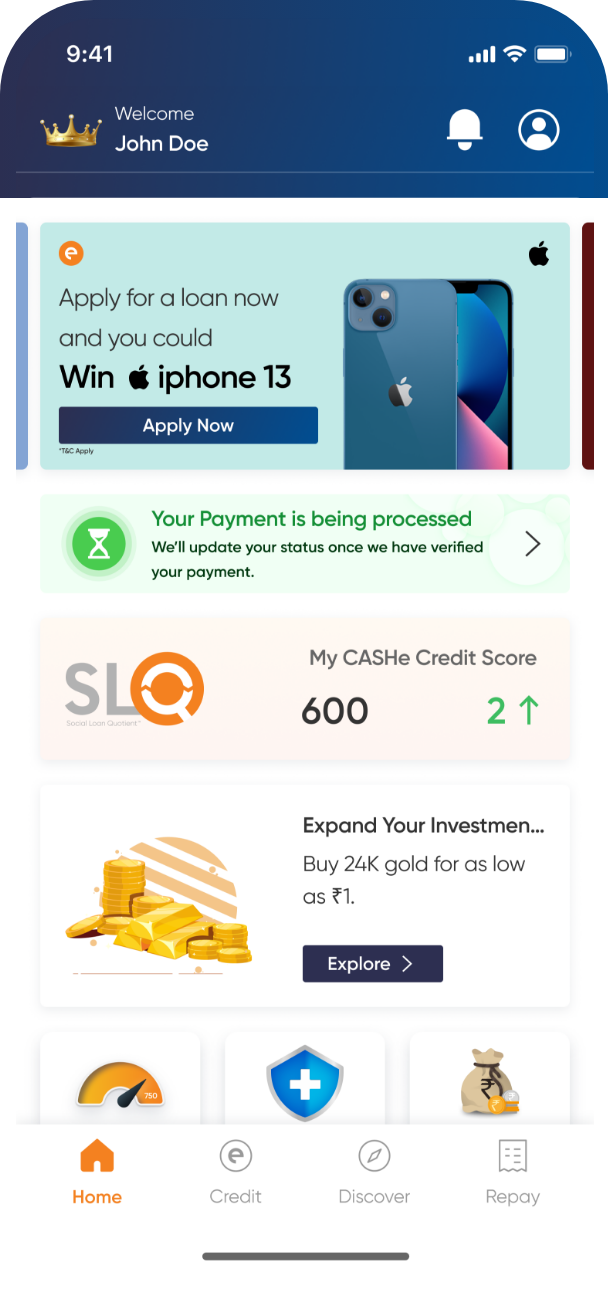

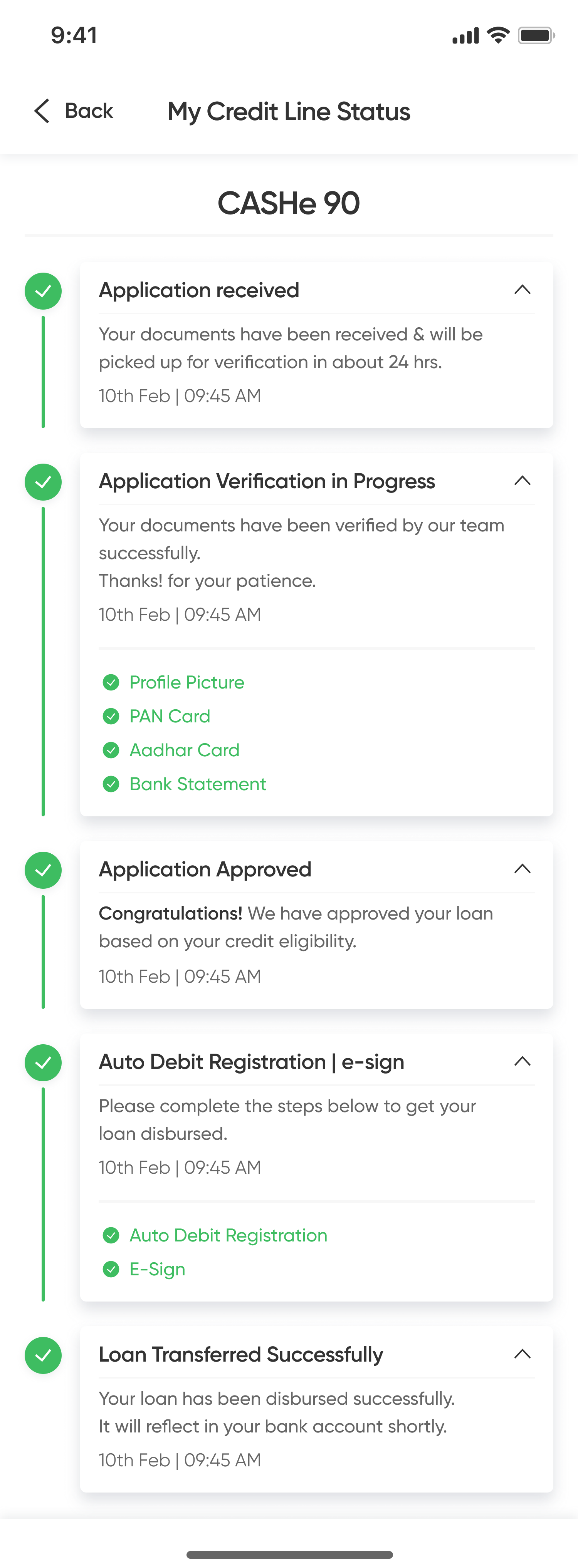

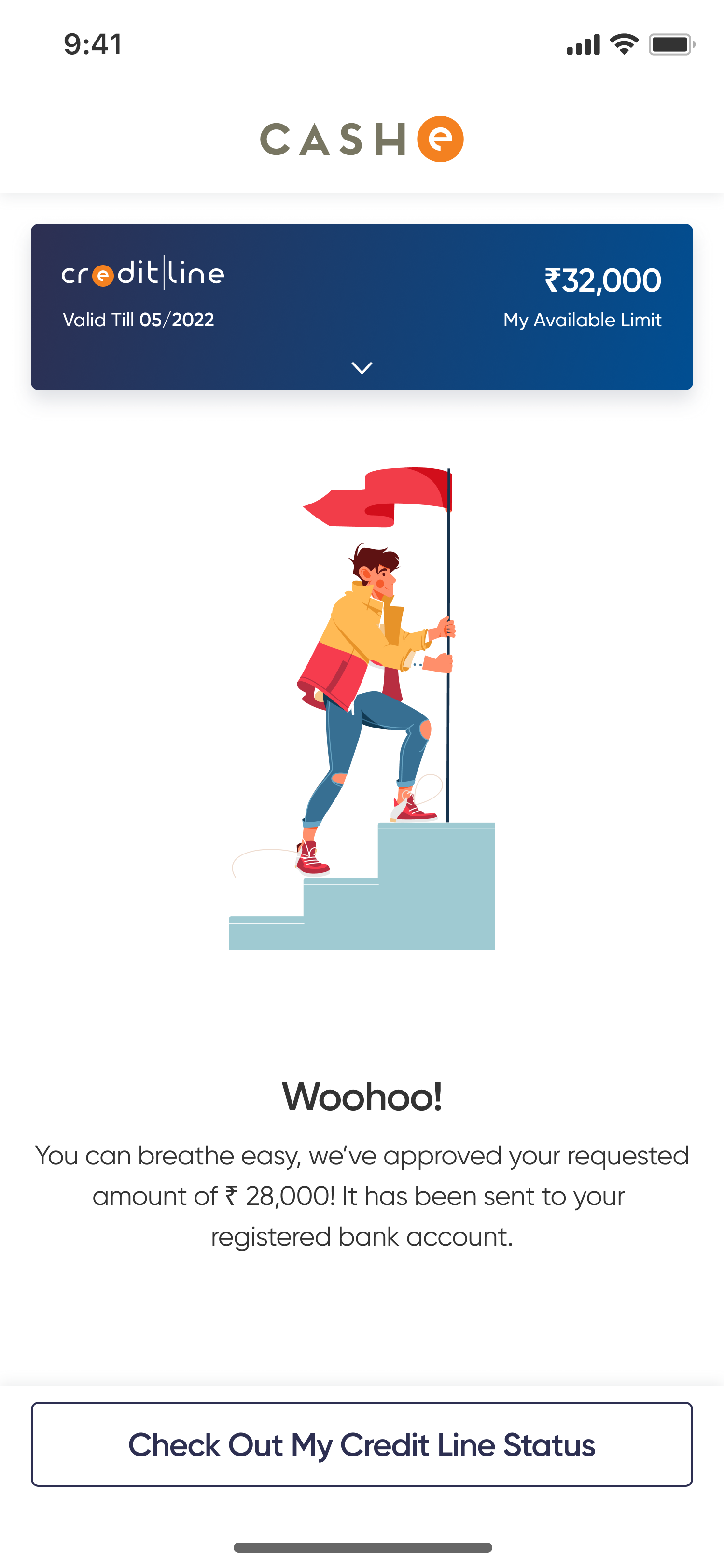

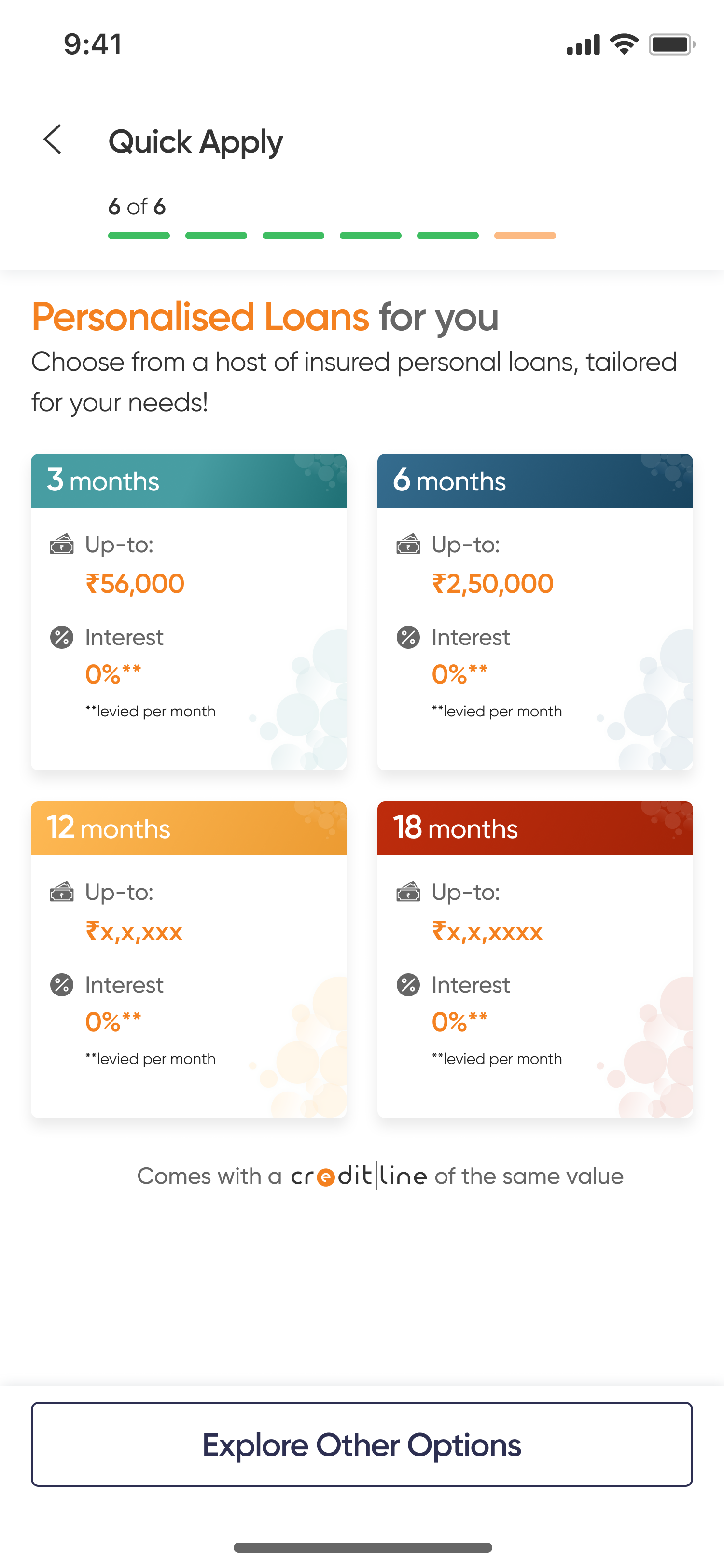

Apply for a marriage loan on CASHe to manage your wedding expenses.

Indian weddings are all about pomp and ceremony, and they’re so much fun! It is a once-in-a-lifetime event which you would like to be perfect. But it also comes with expenses that you need to plan for, in advance..

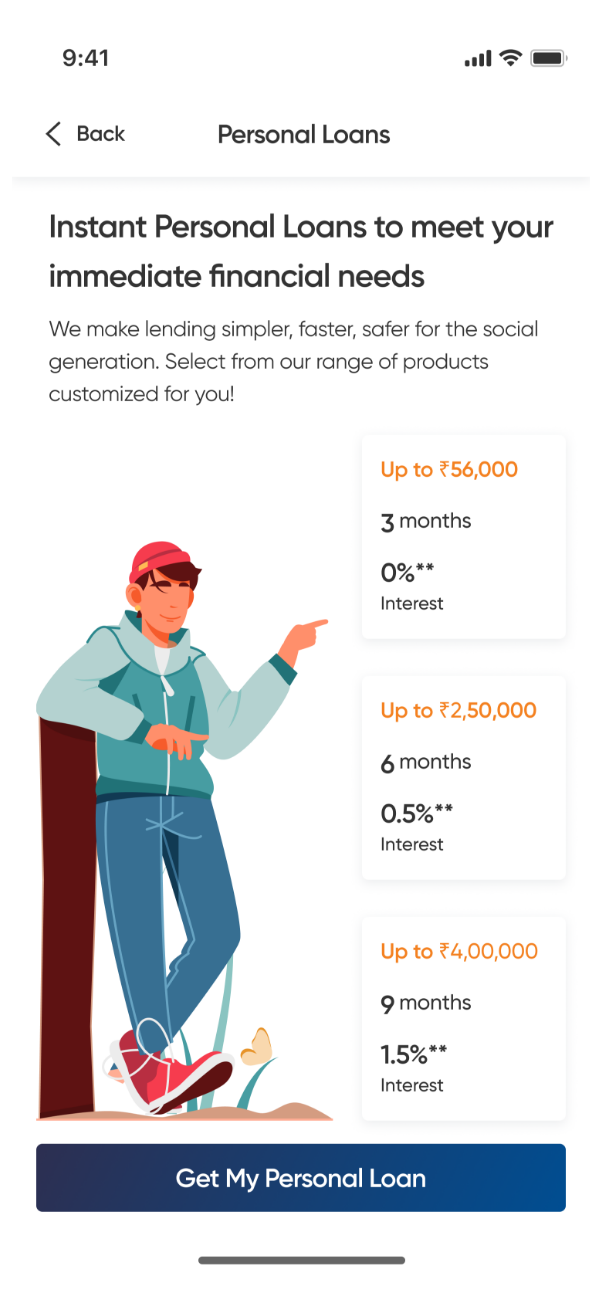

From preparing invitations to booking a venue, you need to put in a lot of planning and thought to organise the wedding of your dreams. However, do you have enough funds to cover those expenses? A personal loan catering to your wedding expenses might be the right option for you to look at.