A very clever car finance calculator

Not sure what your monthly repayments might be? Our calculator will estimate how much interest you'll be paying and how much your payments might be each month.

How does the car finance calculator work?

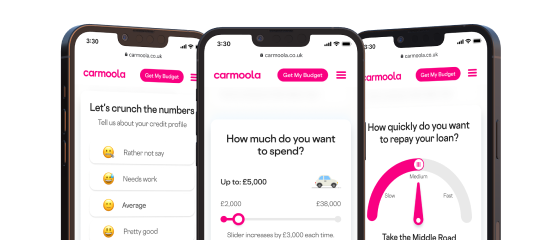

Our super-simple calculator uses four different inputs to work out an estimate of what your monthly payments might be:

Borrowing amount

Intrest rate (APR)

Contract length

Deposit amount

How do I use the calculator?

Option 1

Don't know where to start?

Click 'Need some help?' and we'll ask you a handful of simple questions about your credit profile, budget and ideal repayment terms to help get you started.

Option 2

Get straight to calculating

Click 'Ready to calculate?', enter the amount you'd like to borrow, over what length of time and your APR to estimate your monthly repayments.

How does the car finance calculator work?

Our super-simple calculator uses four different inputs to work out an estimate of what your monthly payments might be:

Borrowing amount

Interest rate (APR)

Contract length

Deposit amount

Feel free to play with any of these inputs to see what difference it makes to the repayments. For example if you fancy seeing how your monthly costs change when you extend or reduce your contract length, then our handy calculator will do all the hard work for you. Our calculator provides a breakdown of how much a loan will cost you in clear and simple terms, helping you highlight important aspects of an agreement such as the total cost of credit alongside the total amount repayable.

Our calculator offers a variety of example APRs based on some credit scores ranging from 'Excellent' to 'Fair'. If you decide to proceed and apply for finance, your APR will be tailored to your specific circumstances, credit score, employment status and other factors.

Am I eligible for car finance?

Answer a few questions to find out if you qualify for a Carmoola loan.

Check My EligibiltyRates from as low as 6.9% APR,

Representative 15.7% APR

.png?width=287&height=260&name=image-mob%20(1).png)

HOW IT WORKS

Out with the old. Drive in with the new.

STEP 1

Get a budget in 60 seconds

In a few questions, find out how much you can spend on your car

STEP 2

Buy your car from anywhere

Pay swiftly online or at the showroom with your Carmoola card

STEP 3

Hit the road and pay monthly

It's time to plan your next adventure in your shiny new ride

HELPING YOU

5 ⭐️ support

Got a question? Our friendly, UK-based team is here from 8am - 9pm EVERY day, via WhatsApp, email, SMS or phone.

“Such a simple way to get car finance and at a good rate too. Easy to use app with step by step process. Love the finance calculator, which allows you to adjust the amounts and see the payments instantly. Would definitely recommend!”

Simon.

“Easy to use and to get a budget with their online calculator! The best part is the flexibility, you can choose how much within your allocated budget and for how long to repay. Will defo use again in the future. *****”

Dean

“Absolutely amazing service, super quick to respond and it couldn’t have been easier, I would 100% recommend Carmoola to anyone!”

Joanne

“Not just a normal car Finance company!! Very fast and efficient and they make you feel like a valued family member, lots of unexpected after sales benefits that have been very much welcomed and appreciated too!!”

Burrow

“Incredible experience! Omg! The way forward in car finance. I’d use these guys again and thoroughly recommend them. 🚘”

Richard

New to car finance?

Check out our guides

HP vs PCP: Which is right for me?

HP vs PCP is the big debate in car finance. They’re two of the most popular ways to spread the cost of buying a new or used and have many...

How does Hire Purchase finance work?

Considering financing a car with a Hire Purchase (HP) agreement? Check out our guide to all things HP to help you decide...

What is car finance and how does it work?

At first glance, car finance can look complicated. With so many different types of loan available and a sea of acronyms to navigate, it can feel like...

FAQs about calculating car finance

Check below for the answers to some of our most frequently asked questions, related to our Hire Purchase car finance calculator. Got more questions? Check out our FAQs page 👍

How does the car finance calculator work?

How does the car finance calculator work?

Our calculator uses a number of variables to work out your result including the amount you’d like to spend on your car, the length of the agreement and the APR applied to the car finance. It uses these figures to help illustrate an example of what monthly repayments on this loan example might be.

How are interest rates calculated?

How are interest rates calculated?

Each lender has specific criteria that looks at your individual financial circumstances and calculates the interest rate based on these details. Car finance rates usually range between 6% and 30% APR. Car loan rates are subject to change

What is a good APR for car finance?

What is a good APR for car finance?

Car finance lenders determine the APR they can offer you, based on your individual credit profile. A good APR for one person, may be a terrible APR for another! To find out what APR you would get, why not answer a few quick questions on Carmoola? We only run a soft credit search when you do this, so there's no impact on your credit score just to find out.

Does paying a deposit make a difference to my monthly payments?

Does paying a deposit make a difference to my monthly payments?

Yes! Here's an example to help you understand how it works. Let's say you're buying a car that costs £10,000. Some lenders such as Carmoola will be able to help you borrow the whole £10,000 if you want to. However, if you decide to add a small deposit, let's say £2,000, then you'd only need to borrow £8,000 to buy the car. Borrowing less, means your monthly payments will be less, and you'll pay less interest overall.

Are interest rates fixed?

Are interest rates fixed?

When you take out a Hire Purchase car finance agreement, your APR is set at the beginning and is fixed throughout the term you choose.

Takes 60 seconds, no impact on your credit profile to see if you're approved 👍

Rates from as low as 6.9% APR, Representative 15.7% APR

.jpg?width=500&height=356&name=Vintage%20car%20going%20to%20an%20old%20town-1%20(1).jpg)