How to view and pay Apple Card Monthly Installments

Learn about Apple Card Monthly Installments, view them in Wallet, and see how to pay each month.

View Apple Card Monthly Installments

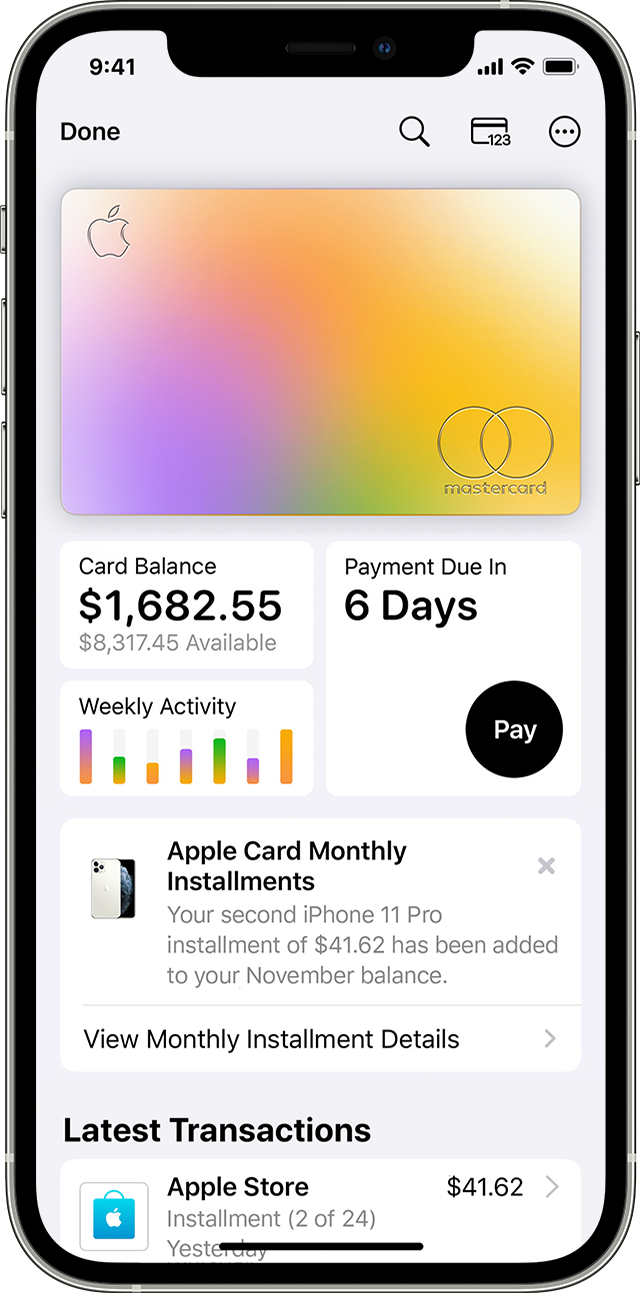

On your iPhone, open the Wallet app and tap Apple Card.

Tap the , then tap Monthly Installments.

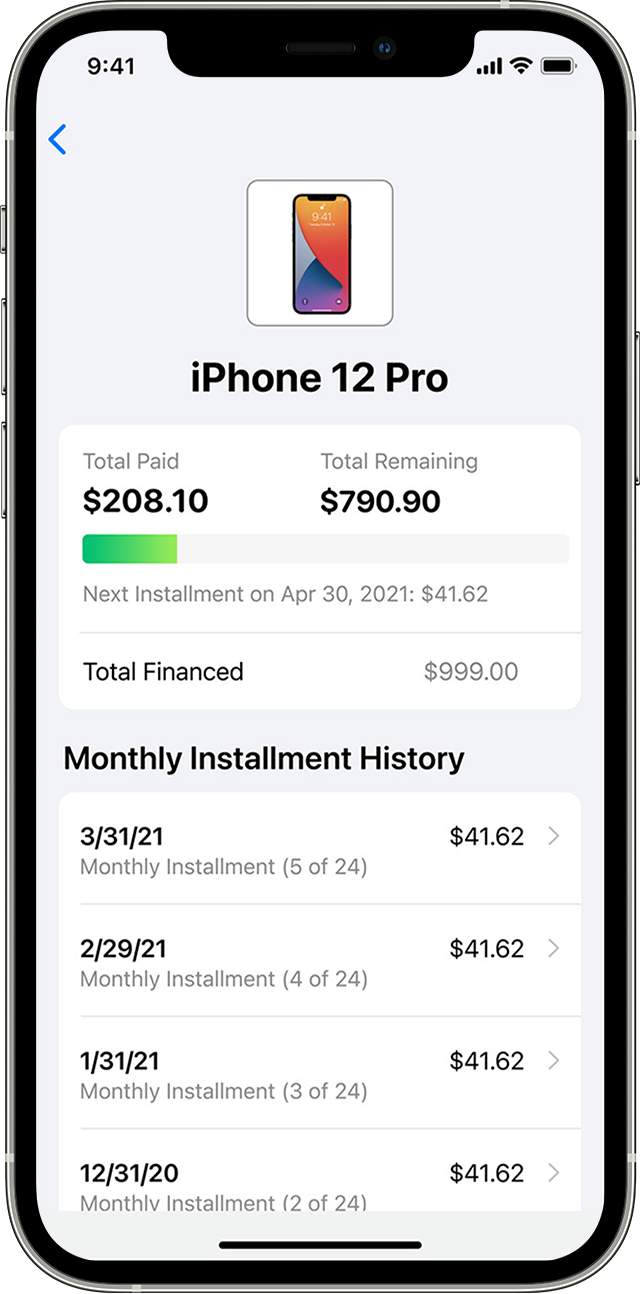

If you have multiple monthly installment plans, tap the one that you want to see.

To see more details, tap Total Financed. You can also view Apple Card Monthly Installments online.

When you buy an eligible Apple product at checkout by choosing Apple Card Monthly Installments as your payment method, you receive a 0% APR installment.1 After your installment purchase, you'll receive a notification on the device where you manage your Apple Card Monthly Installments. Tap the notification and unlock your device to see the installment details.

If you use your Apple Card to pay for a purchase all at once instead of over time, your purchase will be subject to your standard purchase APR.2

Pay your monthly installment

Your minimum payment for Apple Card includes your monthly Apple Card installment. When you pay your minimum payment each month, you automatically pay the monthly installment for each of your installment plans.

Pay extra

To pay extra on your Apple Card Monthly Installments, you need to first pay your entire Apple Card balance. Then, to make an additional payment towards your installment balance, choose Pay Early. If you have multiple installments, your extra payment is applied to the outstanding balance of your oldest installment plan.

To Pay Early

On your iPhone, open the Wallet app and tap Apple Card.

Tap the , then tap Monthly Installments. If you have multiple monthly installments, you see the balance for all of your monthly installments.

Tap Pay Early, then tap Continue.

Choose an amount to pay, then tap Pay Now or Pay Later and follow the instructions on your screen.

If you don't pay a monthly installment, you aren't charged a fee or interest. To keep your Apple Card account in good standing, pay your monthly installments on time as part of your Apple Card minimum payment due every month.

See your Apple Card Monthly Installment payment history

On your iPhone, open the Wallet app and tap Apple Card.

Tap the , then tap Monthly Installments.

If you have multiple Apple Card Monthly Installments, tap the device you want to view monthly installments for.

About Apple Card Monthly Installments

Apple Card Monthly Installments is an easy payment option. You can pay for a new iPhone, iPad, Mac, Apple Vision Pro, or other eligible Apple products with Apple Card Monthly Installments — instead of paying all at once — to enjoy interest-free, low monthly payments. Just be sure to choose Apple Card Monthly Installments when you check out if you want to pay for your purchase over time at 0% APR.

You can use Apple Card Monthly Installments to buy more than one device. Each new device that you buy has its own installment plan. The amount you finance for each device is subtracted from your available Apple Card credit. The number of devices you can buy with Apple Card Monthly Installments is only limited by your available credit.

What you need

An Apple Card account with enough available credit to cover the cost of your new device.3

The latest version of iOS or iPadOS, visionOS, or macOS.

How monthly installments are calculated

The total amount that you finance for your new device is divided into interest-free monthly installments. Each installment is included in your Apple Card minimum payment and is due every month for the duration of the installment plan.

The total amount that you finance increases if you buy an AppleCare+ plan. If you use Apple's Trade In program, your total financed amount decreases by the amount you get for your old device.

Taxes and shipping aren't included in your monthly installments — they're billed to your Apple Card and are subject to your Apple Card variable APR.

Get Daily Cash with Apple Card Monthly Installments

When you buy a new iPhone, iPad, Mac, Apple Vision Pro, or other eligible Apple product with Apple Card Monthly Installments, you get 3% Daily Cash on the total amount you finance. This includes taxes and shipping charges.

You receive your Daily Cash when your device ships or when you buy your device at an Apple Store.

If you haven't set up Apple Cash4 yet, your Daily Cash accumulates and you can apply it towards your Apple Card balance.

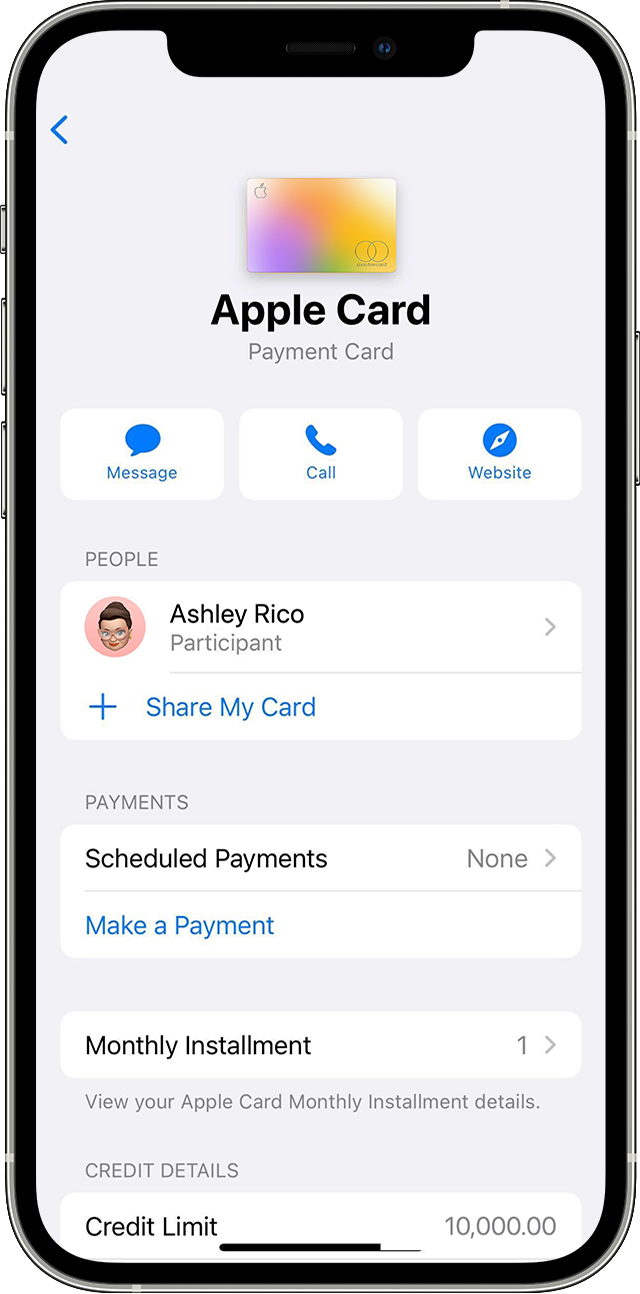

Monthly installments with Apple Card Family

Apple Card Family5 participants6 can make a purchase using Apple Card Monthly Installments if the account owner or co-owner7 has not set a transaction limit for the participant. If the account owner or co-owner has set a transaction limit for the participant, it must be at least equal to the total purchase price of the eligible Apple product. This includes tax and shipping.

When your monthly installments start

Apple Card Monthly Installments are billed to your Apple Card statement on the last day of the month. Your first monthly installment is billed at the end of the same month that your device ships or you pick it up at the Apple Store.

If you return a device that you bought with Apple Card Monthly Installments

When you return the device you bought, the remaining monthly installments are closed, and the Daily Cash you received is charged to your Apple Card. The Apple Card Monthly Installment for the device you return is credited to the remaining installment balance. If there's a remaining credit, it's applied to your Apple Card account to cover other transactions you might have made.

Apple Card Monthly Installments (ACMI) is a 0% APR payment option that is only available if you select it at checkout in the U.S. for eligible products purchased at Apple Store locations, apple.com, the Apple Store app, or by calling 1-800-MY-APPLE, and is subject to credit approval and credit limit. See support.apple.com/102730 for more information about eligible products. APR ranges may vary based on when you accepted an Apple Card. Cardholders who accept an Apple Card on and/or after October 1, 2024: Variable APRs for Apple Card, other than ACMI, range from 18.74% to 28.99% based on creditworthiness. Rates as of October 1, 2024. Existing cardholders: See your Customer Agreement for applicable rates and fee. If you buy an ACMI-eligible product by choosing to pay in full with Apple Card (instead of using ACMI), that purchase is subject to the Apple Card variable APR, not 0% APR. Taxes and shipping on ACMI purchases are subject to the variable APR, not 0% APR. When you buy an iPhone with ACMI, you’ll need to select AT&T, Boost Mobile, T-Mobile, or Verizon as your carrier when you check out. An iPhone purchased with ACMI is always unlocked, so you can switch carriers at any time. ACMI is not available for purchases made online at the following special stores: Apple Employee Purchase Plan; participating corporate Employee Purchase Programs; Apple at Work for small businesses; Government and Veterans and Military Purchase Programs; or on refurbished devices. The last month’s payment for each product will be the product's purchase price, less all other payments at the monthly payment amount. ACMI financing is subject to change at any time for any reason, including but not limited to installment term lengths and eligible products. See support.apple.com/102730 for information about upcoming changes to ACMI financing. See the Apple Card Customer Agreement for more information about ACMI financing.

Variable APRs for Apple Card range from 18.74% to 28.99% based on creditworthiness. Rates as of October 1, 2024. Existing customers can view their variable APR in the Wallet app or card.apple.com.

If your Apple Card application is approved with insufficient credit to cover the cost of your new iPhone, iPad, Mac, or other eligible Apple product, see what you can do.

Apple Cash services are provided by Green Dot Bank, Member FDIC. Apple Payments Services LLC, a subsidiary of Apple Inc., is a service provider of Green Dot Bank for Apple Cash accounts. Neither Apple Inc. nor Apple Payments Services LLC is a bank. Learn more about the Terms and Conditions. Only available in the U.S. on eligible devices. To send and receive money with an Apple Cash account, you must be 18 and a U.S. resident. If you’re under 18, your family organizer can set up Apple Cash for you as part of their Apple Cash Family account, but you may not be able to access features that require a supported payment card. Security checks may require more time to make funds available. Apple Cash Family accounts can only send or receive up to $2000 within a rolling seven-day period. Tap to Cash transactions can only be used to sendor receive up to $2000 within a rolling seven-day period. Other limits apply, see Terms and Conditions for details. To access and use all Apple Cash features, you must have an eligible device with Wallet that has the latest version of iOS.

Apple Card Family Participants and Co-Owners do not need to have a familial relationship but must be part of the same Apple Family Sharing group.

If you are a Participant, you are able to spend on the account but are not responsible for payments. Being a Participant who is reported to the credit bureaus on an account that has a negative payment history (e.g., the account goes past due) or is overutilized can have negative effects on your credit. The account owner remains responsible for all purchases made by a Participant. For more details including some risks and benefits of being a Participant, click here.

Each Co-Owner is individually liable for all balances on the Co-Owned Apple Card, including amounts due on your Co-Owner's account before the accounts merged. Each Co-Owner will be reported to credit bureaus as an owner on the account. In addition, Co-Owners will have full visibility into all account activity and each Co-Owner is responsible for the other Co-Owner’s instructions or requests. Co-Ownership involves risk, including payment history and other information about your Apple Card, including negative items like missed payments. The addition of a new Co-Owner or merging existing accounts is subject to credit approval and general eligibility requirements. For Apple Card eligibility requirements, click here. Either Co-Owner can close the account at any time, which may negatively impact your credit, and you will still be responsible for paying all balances on the account. For details on account-sharing options, including some of the risks and benefits, click here.

To access and use all Apple Card features and products available only to Apple Card users, you must add Apple Card to Wallet on an iPhone or iPad that supports and has the latest version of iOS or iPadOS. Apple Card is subject to credit approval, available only for qualifying applicants in the United States, and issued by Goldman Sachs Bank USA, Salt Lake City Branch.

If you reside in the U.S. territories, please call Goldman Sachs at 877-255-5923 with questions about Apple Card.

Information about products not manufactured by Apple, or independent websites not controlled or tested by Apple, is provided without recommendation or endorsement. Apple assumes no responsibility with regard to the selection, performance, or use of third-party websites or products. Apple makes no representations regarding third-party website accuracy or reliability. Contact the vendor for additional information.