Managing taxes and staying compliant is difficult, especially as your business scales. You have to understand where your business has tax obligations, how much tax you should collect, and what you should do with the taxes you collect. This process can be costly and time-consuming; companies often spend months integrating with tax engines in an effort to offload this work.

The more products you sell and the more locations you sell into, the more difficult taxes become. Taxes are especially complicated for online businesses, which often serve customers who are based in many different states and countries. This means you need to understand tax rules in every jurisdiction to ensure compliance and avoid paying penalties and interest in addition to unpaid taxes.

On top of that, tax rates change regularly. In 2024 alone, the United States introduced around 500 local sales tax rate changes. And many European countries changed their VAT rates as a response to economic factors like inflation.

This guide covers the basics of indirect taxes, such as value-added tax (VAT), goods and services tax (GST), and sales tax. You’ll also learn how Stripe Tax can help you comply.

What are indirect taxes?

Businesses collect indirect taxes on behalf of municipalities and governments. Regulations vary significantly from country to country, and even from state to state, and can apply to physical goods, digital products and services.

These taxes are not the same as direct taxes, such as income tax, which individuals or organizations pay directly to a government based on their earnings or profit. Instead, indirect taxes are levied on the sales of goods or services and paid for by the customer through the business.

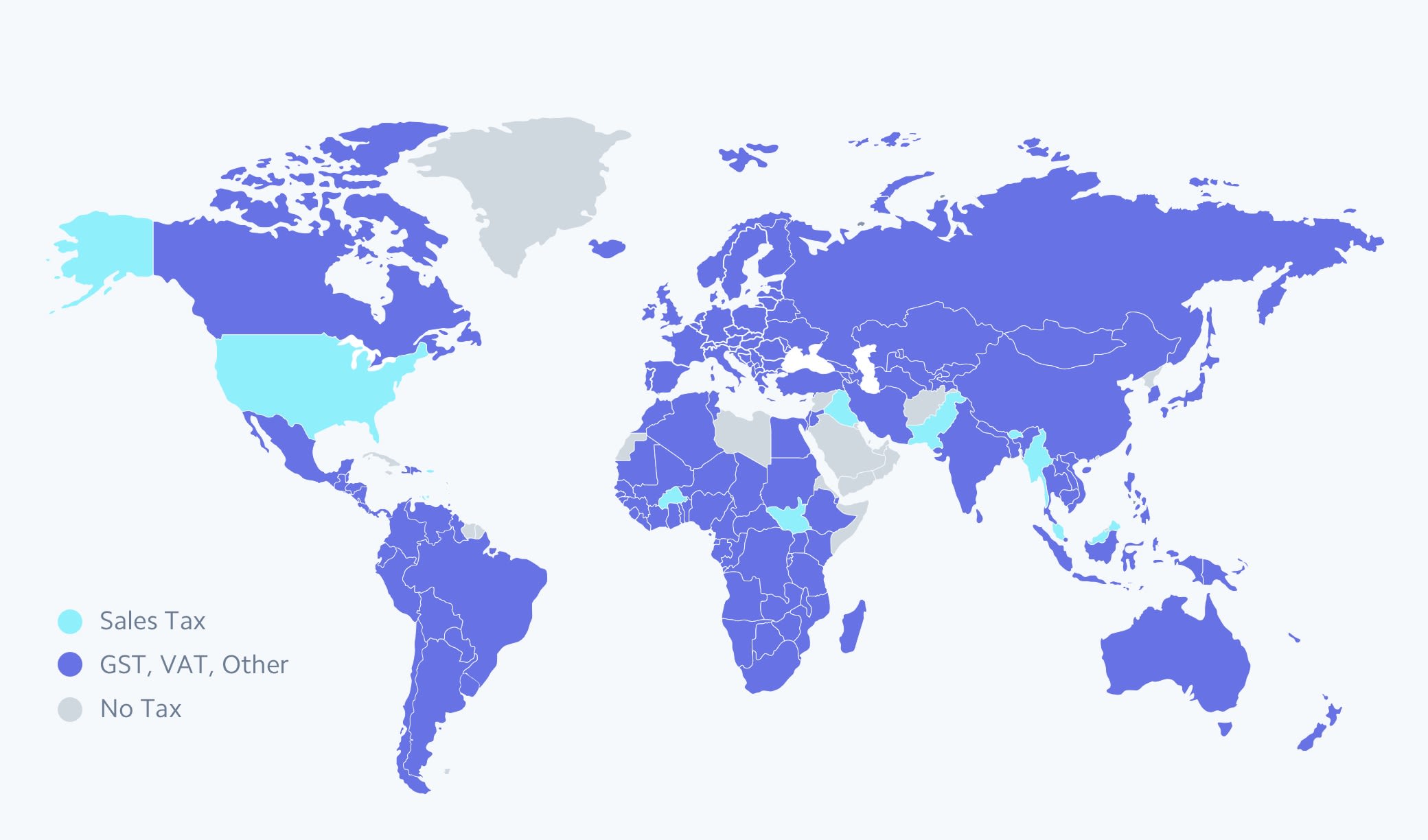

Indirect taxes have various names around the world. Indirect tax is called sales tax in the United States, value-added tax (VAT) in Europe, goods and services tax (GST) in Australia, and consumption tax (JCT) in Japan. The process for collecting these taxes can vary significantly, but the outcome is the same: The end customer pays the tax.

Most countries require businesses to collect some kind of tax.

Indirect taxes on physical products

The tax treatment on physical goods depends on the ship-from and ship-to locations, plus how each jurisdiction categorises the product. There are many differences across city, state and country lines.

For example, if a customer in downtown Los Angeles buys a jumper, they pay 9.5% in sales tax. A buyer in nearby Culver City, which is part of Los Angeles County, would have to pay 10.2% in sales tax for the same jumper.

These local differences also extend to types of products. In Texas, cowboy boots are tax free, but hiking boots are not. In Ireland, children's footwear is tax free, but footwear for adults is not.

Indirect taxes on digital products

Tax jurisdictions set regulations based on their own definition of a "digital product". In general, digital products and services have no tangible form. You can't hold them in your hands, and customers have most likely downloaded them from the internet or accessed them through an app or website. Examples of digital products and services include e-books, online courses, music files and website memberships.

In the EU, digital products are taxable if they fit four criteria:

- They're not a physical product.

- The merchant delivers the goods online.

- The service involves minimal human interaction.

- The goods are made with and by technology.

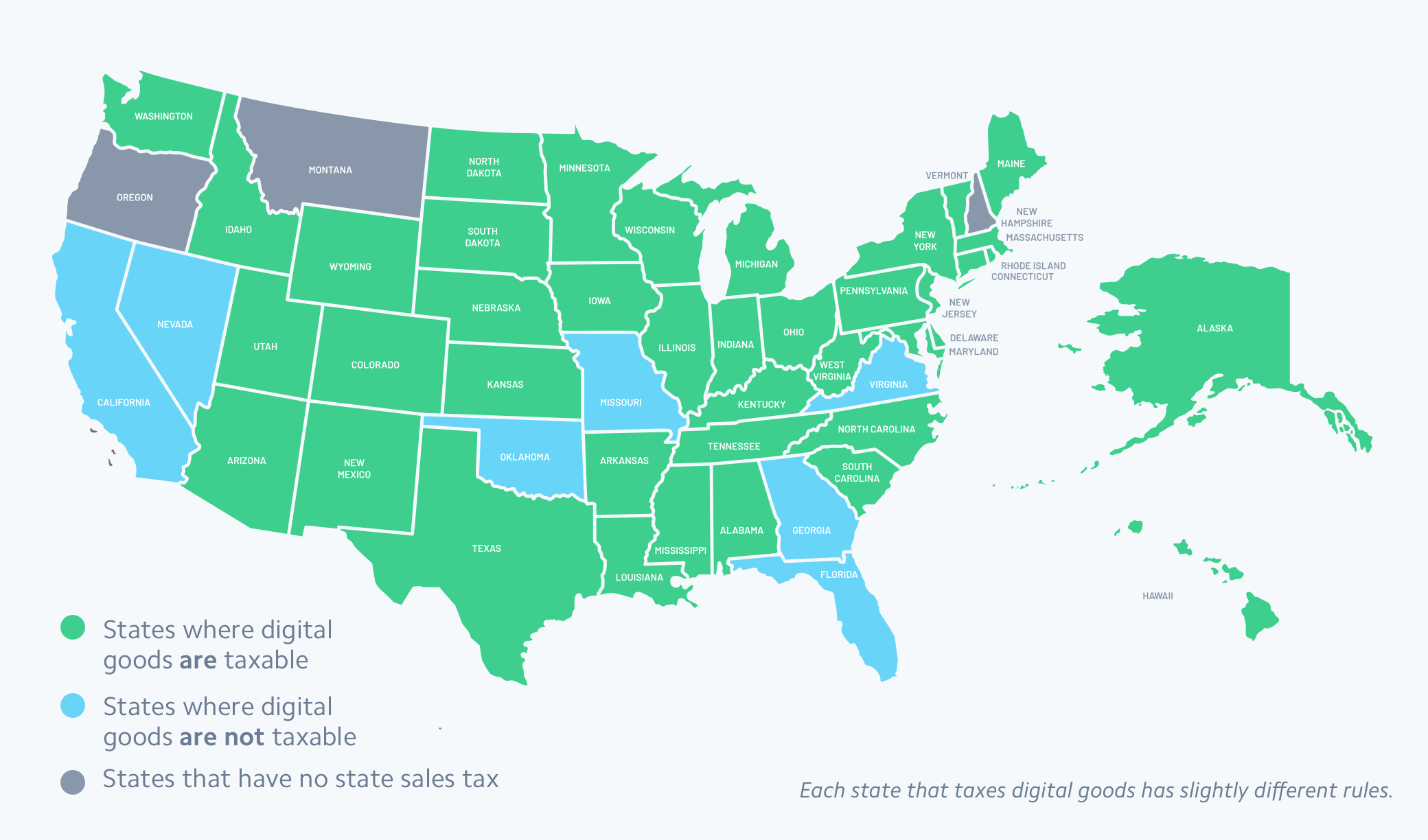

In the US, tax regulations on digital products vary significantly by state. Currently, the majority of states require merchants to collect sales tax on digital products. You'll want to understand and account for the variations across state, county and city lines.

Other countries take their own approaches to taxing digital products. Given how relatively new digital goods are to the global economy – and how new the regulations are – compliance standards and national laws continue to evolve, requiring businesses to stay up to date on regulatory changes.

How does the indirect tax compliance process work?

No matter where your customers are located, you’ll need to answer these questions related to indirect tax compliance:

- Where and when am I obligated to collect taxes?

- How do I register to collect taxes?

- How much tax should I charge on each product or service?

- How do I file and remit the money I collect?

Step 1: Assess your tax obligation where needed

To be compliant, you first need to understand your tax liability. You typically need to collect taxes wherever you have customers, even if your business is located in another part of the world. Some jurisdictions only require that businesses collect taxes when they’ve surpassed a sales threshold (a specific amount of revenue or transactions acquired within a certain period in a country).

In the US, the sales tax thresholds differ from state to state. They can be based on annual revenue or the number of transactions. In the EU, the threshold to register varies by country, but non-EU businesses selling digital products to EU customers must collect tax from their first transaction.

Step 2: Register to collect taxes

Before you collect tax from any customers, you’ll need to register with the state or country where you’ve met the registration threshold.

Registering in the US

For each state where you’re meeting registration thresholds, visit the website of the agency responsible for sales taxes for details on how to register. The deadlines to register once you reach the registration threshold will vary from state to state. For example, in Texas, out-of-state businesses would need to register on the first day of the fourth month after they reach the registration threshold, typically referred to as the economic nexus threshold in the US. In Rhode Island, businesses have until 1 January of the year after they reach the economic nexus threshold to register, collect, and begin remitting sales tax.

Let Stripe manage your tax registrations in the US and benefit from a simplified process that prefills application details – saving you time and ensuring compliance with local regulations.

Registering in Europe

Europe introduced VAT OSS (VAT One-Stop Shop) to simplify the registration process across European countries. If you sign up for VAT OSS, you don’t have to register with each country within the EU where you sell goods or services remotely. If you are based in an EU country, you can register with your home country’s OSS portal. But if your business is based outside the EU, you can choose any European country to register for OSS. All non-EU-based businesses selling in the EU must register for OSS. Post-Brexit, the UK now has a VAT registration process that’s separate from Europe’s VAT OSS.

Step 3: Determine the tax rate and treatment

Tax rates differ by jurisdiction and by product and service. You’ll need to account for those nuances across everything you sell.

Tax rates in the US

There’s no national sales tax system in the US. Forty-five states, plus the District of Columbia, collect statewide sales tax that ranges from 2.9% to 7.25%. Thirty-eight states have some additional form of local sales tax, which can average more than 5.0% in some states. The more jurisdictions (cities, counties, states) you sell into, the more complex taxes become.

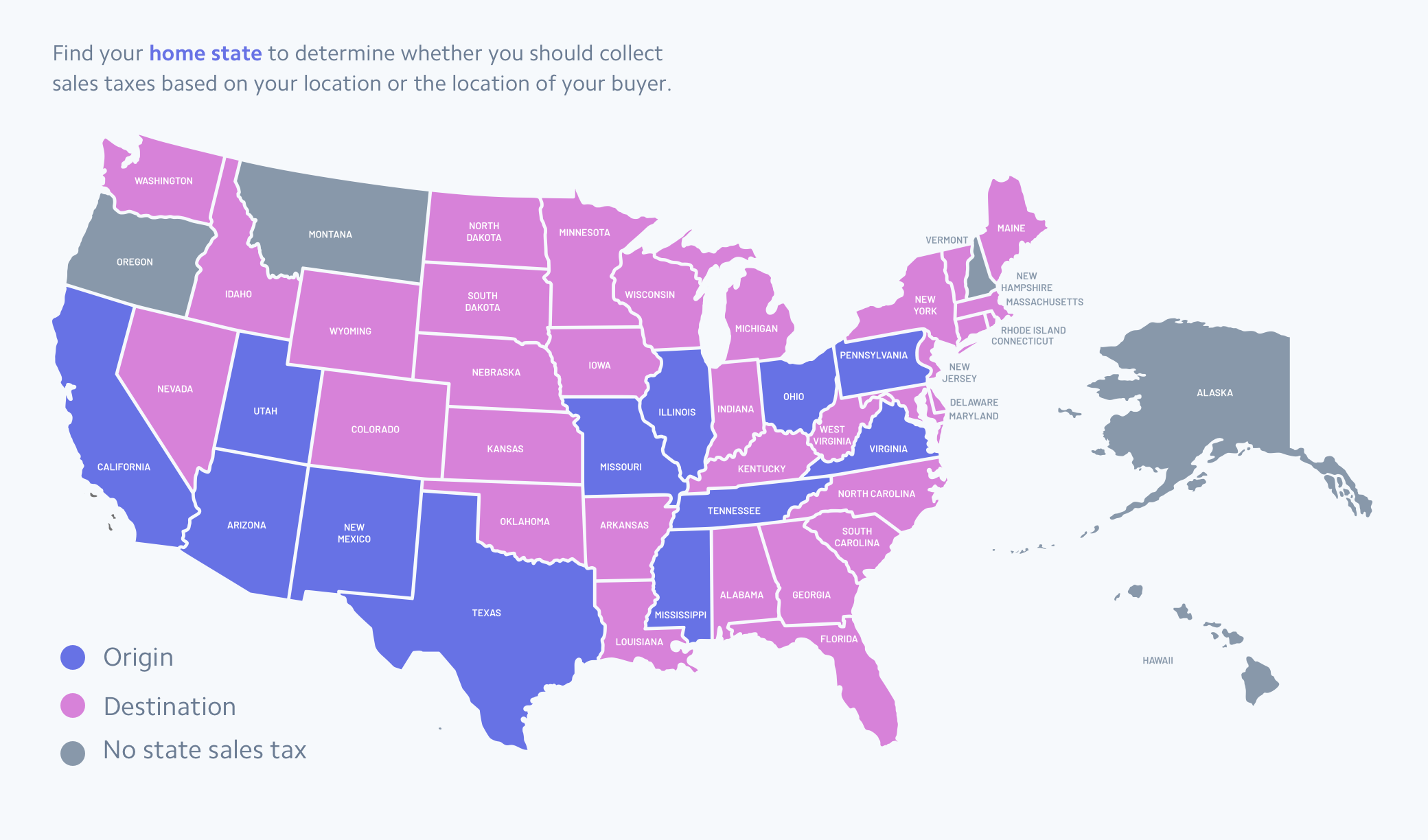

Many states have hundreds of tax jurisdictions, so identifying which jurisdiction’s rate applies to a transaction can be complex. For example, if your home state is located in an origin-based state, sales tax is collected based on where you, the seller, are located. If your home state is located in a destination-based state, sales tax is collected based on where your customer is located.

An image that shows which states you should collect RevRec in based on your location or your buyer's location

Tax rates in Europe

Just as there’s diversity among different tax rates in the US, there’s a range of VAT rates within the EU. Hungary has the highest VAT rate in the EU at 27%, while Luxembourg has the lowest rate at 17%. For cross-border EU transactions, you need to determine which country may collect VAT and who is liable to remit tax (you, as the business owner, or the customer).

An image that highlights how VAT rates differ across European countries

Step 4: File and remit taxes

To file taxes, you need to submit returns to each agency; generally the administering state or country where you are registered and have collected taxes. In some US states, you may also need to file at the city or county level if the sales taxes are not administered at the state level. Deadlines for filing depend on the state or country, and they can shift based on your annual revenue and other factors. You could be required to remit taxes weekly, monthly or annually. And if you didn’t sell any products in a state where you’re registered, you may still be required to report that.

How Stripe can help

Stripe Tax reduces the complexity of global tax compliance so you can focus on growing your business. It automatically calculates and collects sales tax, VAT, and GST on both physical and digital goods and services in all US states and more than 30 countries. Stripe Tax is natively built into Stripe, so you can get started faster – no third-party integration or plug-ins are required.

Stripe Tax can help you:

- Understand where to register and collect taxes: See where you need to collect taxes based on your Stripe transactions and, after you register, switch on tax collection in a new state or country in seconds. You can start collecting taxes by adding one line of code to your existing Stripe integration; or add tax collection to Stripe’s no-code products, such as Invoicing, with the click of a button.

- Register to pay tax: Stripe Tax provides links to the websites where you can register once you reach the threshold to register.

- Automatically collect taxes: Stripe Tax always calculates and collects the correct amount of tax, no matter what or where you sell. It supports hundreds of products and services, and constantly monitors and updates tax rules and rates.

- Simplify filing and remitting: With our trusted global partners, users benefit from a seamless experience that connects to your Stripe transaction data – letting our partners manage your filings so you can focus on growing your business.

Find more information about Stripe Tax.