A decade of growth sees Irish businesses process more than €20 billion on Stripe

- New Stripe data reveals a rapid expansion in Ireland’s internet economy over the past decade.

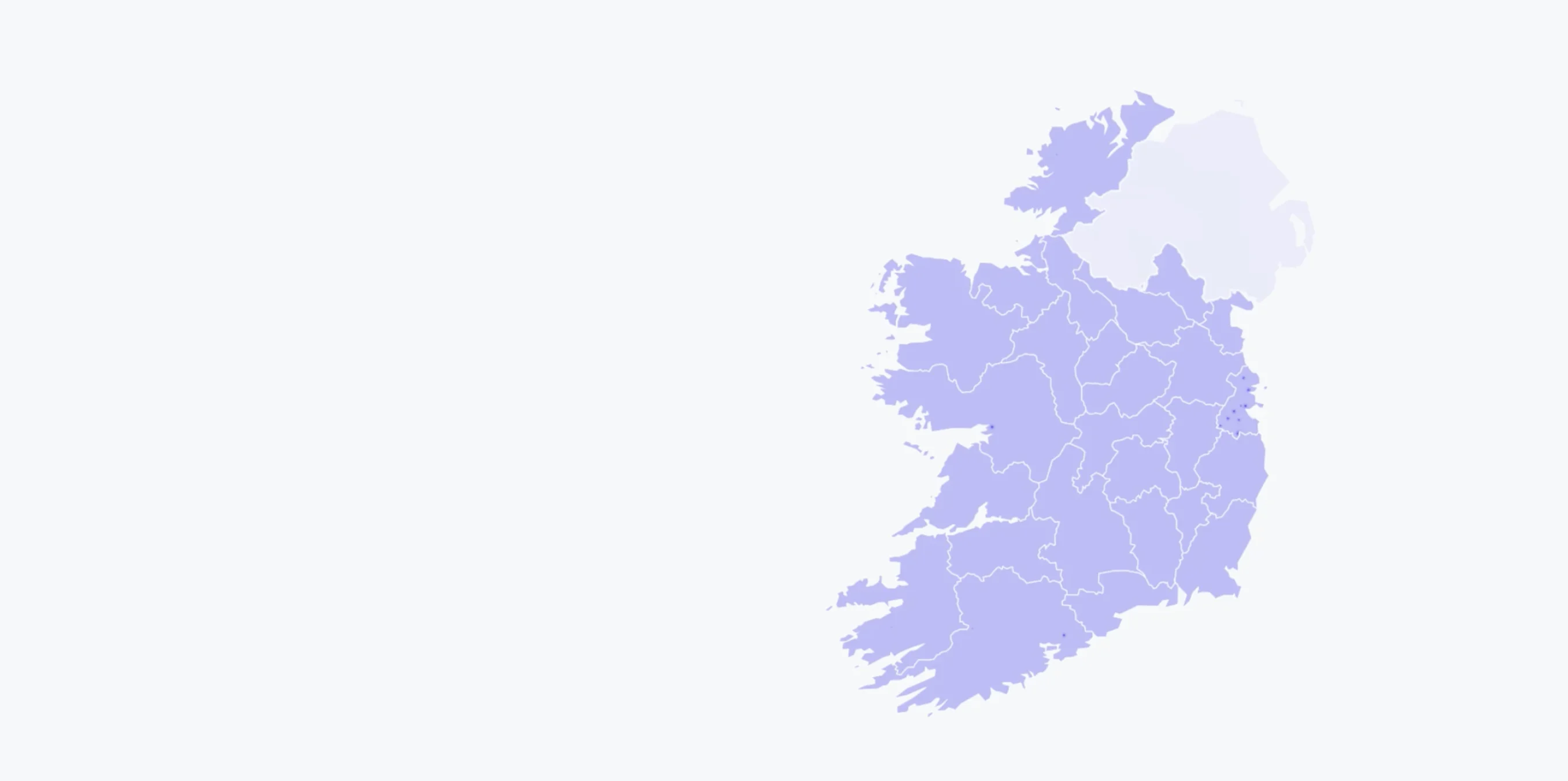

- Growth is distributed across the country, with almost all Irish counties now growing faster than Dublin.

- Irish businesses are seizing international opportunities, with nearly 56% of payment volume from overseas.

DUBLIN—Stripe, a financial infrastructure platform for businesses, today marked its tenth anniversary serving Irish businesses, with the release of data revealing widespread, rapid growth in the country’s internet economy.

Over the last decade, conditions for Ireland’s internet businesses have improved dramatically. Homegrown startups now have access to a more established venture capital ecosystem, a talent pool trained at the world’s largest technology companies, and a network of experienced founders. Many of these companies have built tools that also help less technical businesses join the internet economy, enabling a dramatic increase in online economic activity across the country.

Stripe’s data provides a window into Ireland’s growth. In 2013, only a few hundred Irish businesses used Stripe. Now, tens of thousands of ventures run on Stripe, with hundreds more joining every week. They include technology companies such as Glofox and Wayflyer that were built on Stripe from day one, and heritage enterprises like the GAA, Irish Life, and Smyths Toys Superstores that are reinventing themselves for the digital age. Over the last decade, Irish businesses have processed more than €20 billion on Stripe.

“Thinking back to when we launched Stripe, Ireland’s tech scene is like night and day. Tech founders would find it impossibly difficult to raise money and compete for talent, and small businesses simply didn’t have the tools to operate online. Nowadays, Ireland produces software companies at industrial scale, and the internet economy is everywhere. With new talent coming through courses like the University of Limerick’s Immersive Software Engineering and accelerators like NDRC, I’m excited to see what Irish founders build next,” said John Collison, cofounder and president of Stripe.

Entrepreneurs everywhere

Dublin is undeniably dominant in Ireland’s internet economy. The county is home to all seven Irish companies valued at $1 billion or more, and to more Stripe users than any other part of the country. But easy access to online financial infrastructure has provided the foundation for rapid growth beyond the capital city.

Over the past five years, nearly all of Ireland’s counties grew their payment volume on Stripe faster than Dublin, with the fastest acceleration occurring in counties as varied as Cork, Carlow, and Galway.

County-level online economic growth can occur in a variety of ways. Sometimes it’s the result of a large homegrown enterprise transitioning online. But other times, it’s the result of many small local businesses ramping up internet commerce. Stripe data reveals that’s exactly what’s happening in many Irish counties, where online economy activity is being propelled by businesses of all sizes and technical capabilities. Over the past five years, median-sized businesses in Wexford, Cavan, and Tipperary counties have tripled the amount of money they collect on Stripe.

In Wexford, a sunny county on the southeastern coast known for its strawberries and annual opera festival, more than 1,000 local businesses run on Stripe. They include makers of handcrafted ash hurleys, vintage stores, craft breweries, and a virtual dating app created by a local DJ. Delivery management software Scurri joined Stripe shortly after it launched in Ireland in 2013, and now handles more than 110 million shipments each year.

A similar story has unfolded in Sligo, a northwestern county of rugged landscapes home to more prehistoric monuments than anywhere else in Western Europe. Despite its rural nature, hundreds of local businesses in Sligo use Stripe to participate in the internet economy—including seaweed bathing experiences, surf schools, Bodhrán teachers, and the local Wild Roots festival. Stripe data shows these businesses are prospering, growing their collective online payment volume more than 8x over the last five years.

Going global

New online platforms and financial tools have removed the barriers to international trade, making it easy to accept local payment methods, fulfill tax obligations, and comply with overseas regulations. Ireland’s businesses have seized these opportunities: nearly 56% of the payment volume processed by Irish businesses in the last decade came from consumers and businesses in foreign markets.

Ireland’s software platforms and established digital native companies account for a significant portion of this cross-border money movement, with more than 80% of their payment volume coming from overseas last year. But businesses of all sizes are using the internet to expand into new markets. Small businesses collected over €500 million in revenue from international customers last year, and early stage startups pursued an international strategy from the beginning, receiving 51% of their payment volume from outside Ireland.

As well as finding new customers in well-established export markets, Irish businesses have used the internet to forge new digital trade routes. While official figures for 2022 show Irish exports overall went primarily to the US (31% of total export volume), Germany (12%), the UK (11%), and Belgium (9%), Irish businesses on Stripe were able to reach a more diverse set of export markets. Their non-Irish sales originated primarily from the US (17%), the UK (16%), France (14%), and Spain (8%). Last year, some of the fastest-growing export markets for Irish businesses on Stripe were France (which grew 78%), Sweden and Canada (+50%), and Japan (+43%).

The broader picture

After a decade of expansion, Ireland’s internet economy has a lot more room to grow. Official statistics reveal that, even during the pandemic, only 22% of goods and services were ordered online. Businesses in health, education, and other large Irish industries are only just starting to transition to the internet. The country’s small businesses still generate four-fifths of their revenue from in-person sales, according to the European Commission.

The next decade looks particularly promising. Technology that helps businesses operate online will soon permeate the Irish economy, unlocking growth for even more traditional industries. Every value chain will be redesigned around the internet, and new innovations—from artificial intelligence to fintech regulation—will unleash business models that aren’t possible today. With extra help for fast-growing startups, many more generations of technology companies will be built in Ireland.