Product

Our top product updates from Stripe Tour New York

We announced expanded interoperability, major upgrades to Stripe Billing, new embedded components for financial services, and a lot more.

We announced expanded interoperability, major upgrades to Stripe Billing, new embedded components for financial services, and a lot more.

We’re excited to announce a host of partnerships that allow Terminal to work with more third-party hardware, processors, and point-of-sale (POS) systems. This provides more choice and flexibility for integrating Terminal into your existing in-person payment stack and adding innovative checkout experiences.

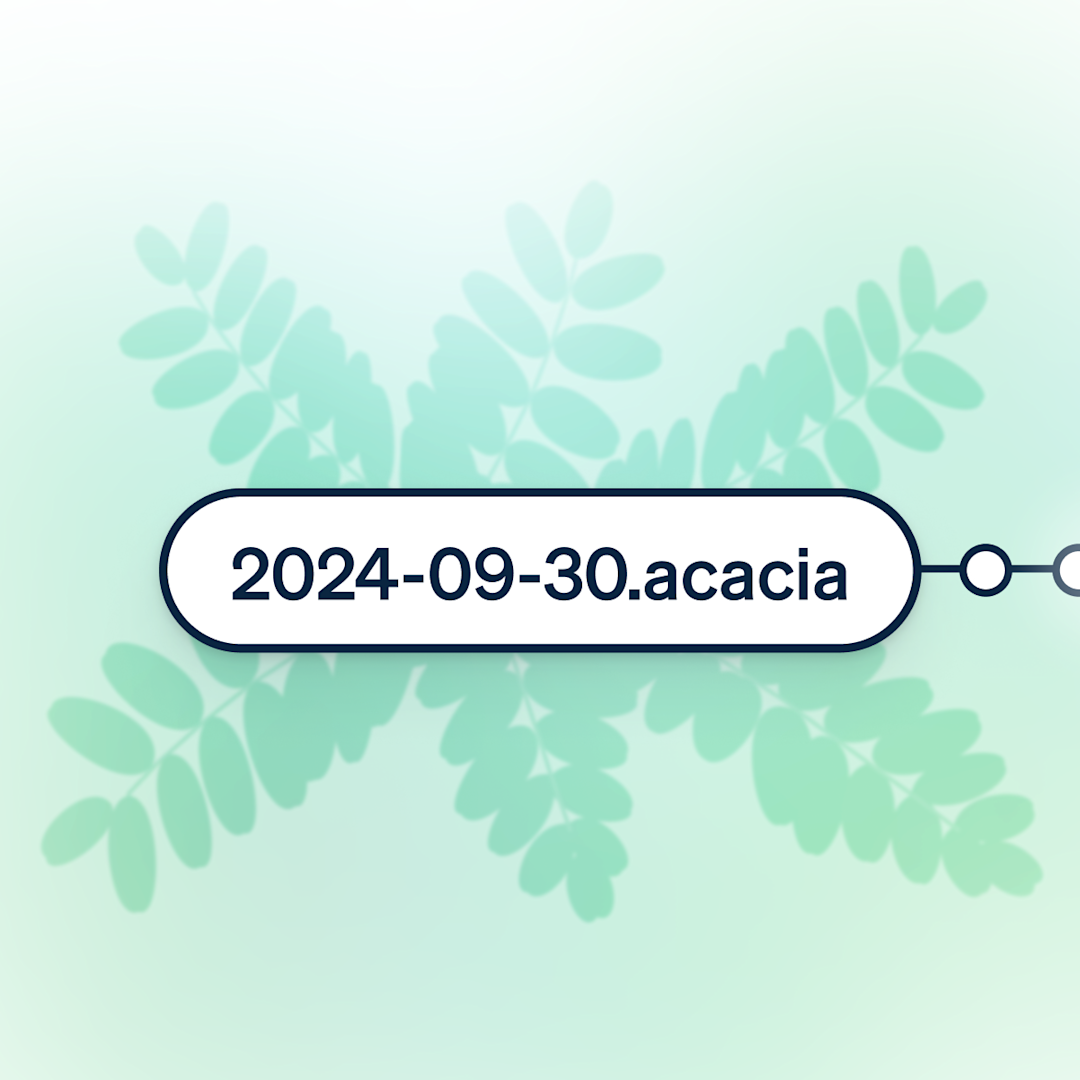

Starting today, we’re introducing a new release cadence and versioning system for all API endpoints that combines twice-yearly major updates with monthly feature enhancements. This set release schedule gives you the predictability and clarity that you need to better plan your engineering cycles.

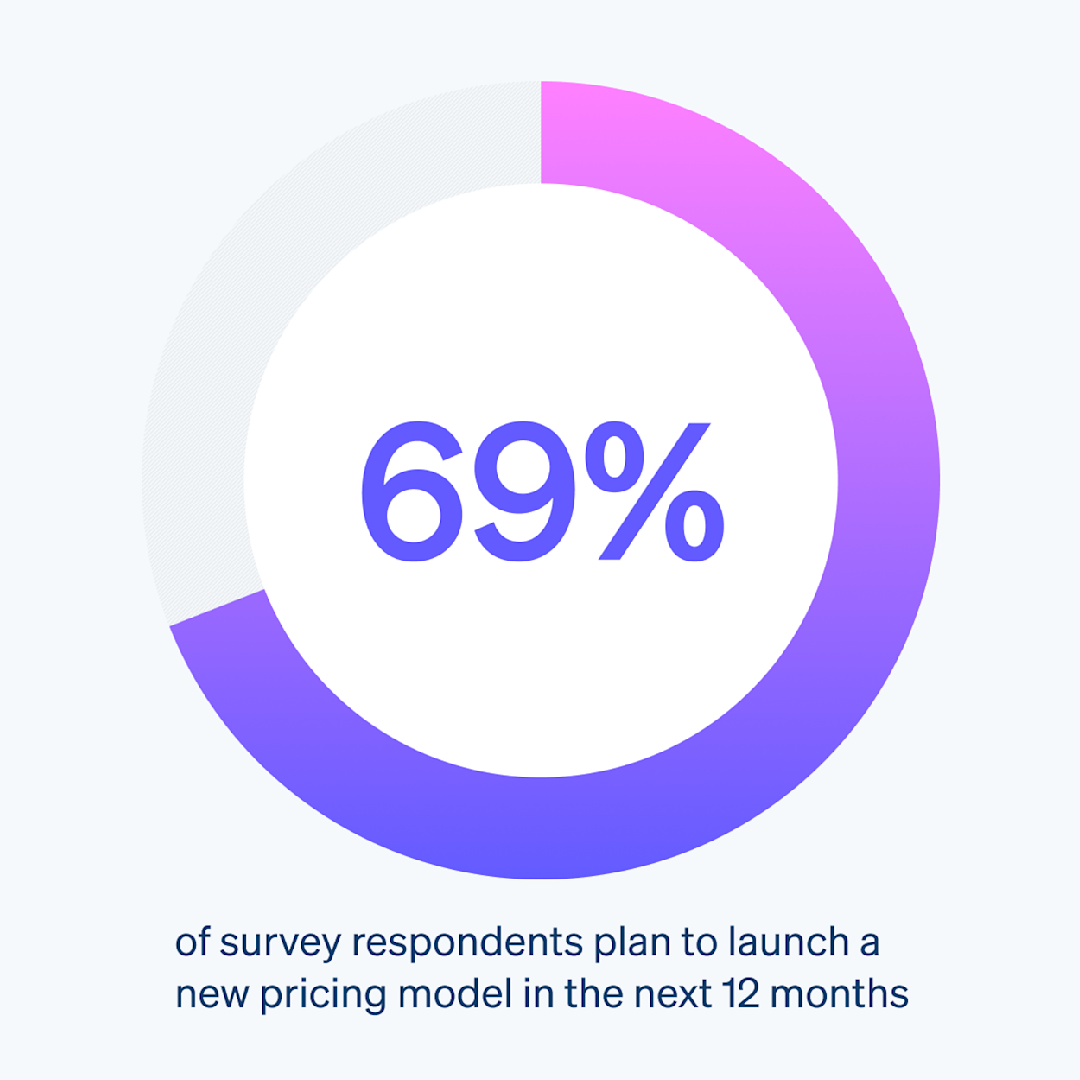

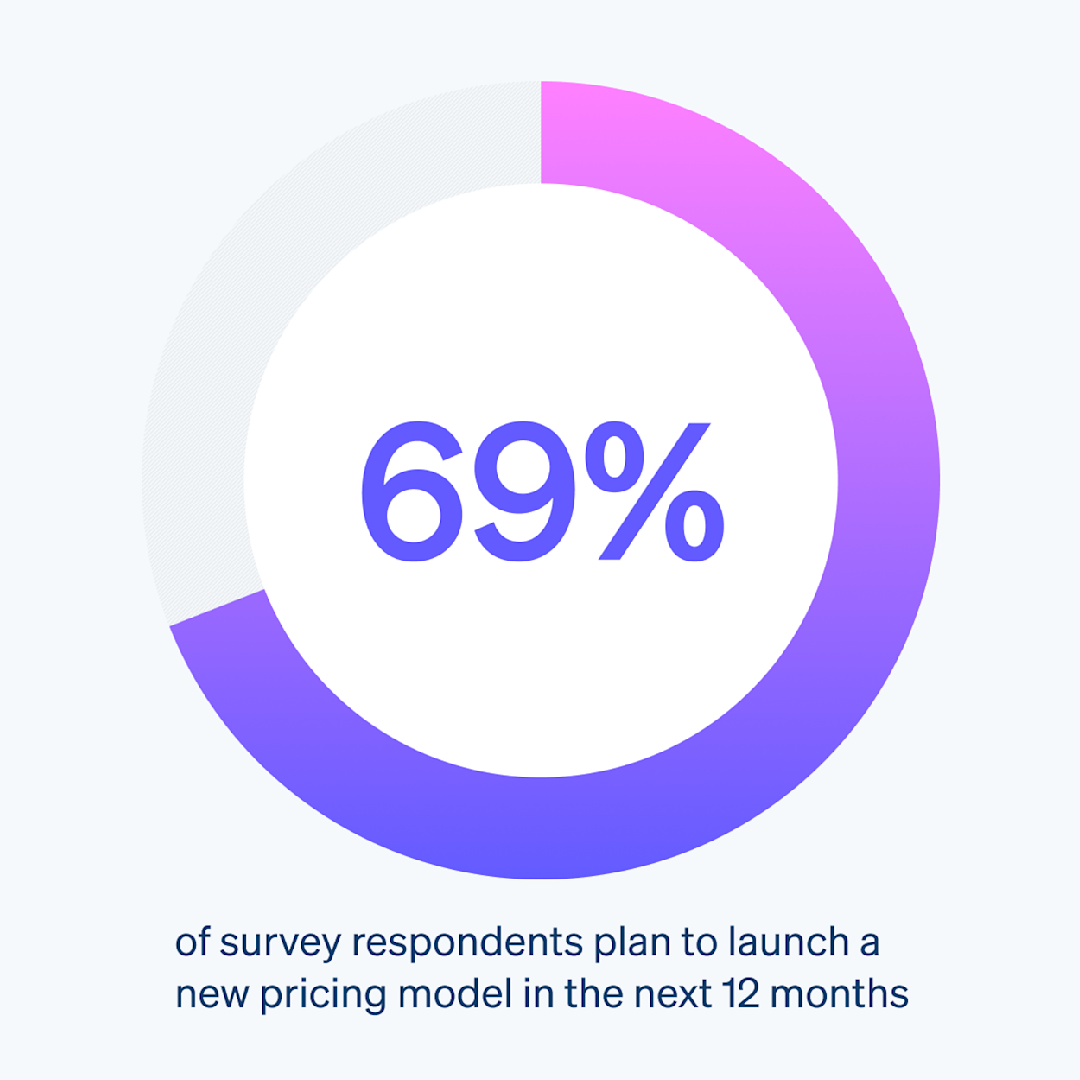

We surveyed more than 2,000 subscription business leaders from around the world to understand how they are responding to the growing trend of pricing-as-a-product. We learned that businesses increasingly want to experiment with pricing models, but there is one thing in their way: their billing systems.

Businesses in the UK can now offer Pay by Bank. Accept payments in real time, and reduce payment costs with Stripe’s open banking–powered payment method.

Manual payouts will now land in your bank account on the same business day due to new local banking integrations in the UK. No extra fees, no integrations changes needed.

Businesses in the US can now offer Amazon Pay. Allow your customers to pay using the same checkout experience that millions of Amazon customers know and trust.

Businesses in the US can now reach new customers with Cash App Pay. Allow customers to pay with the wallet that's number one in both app stores.

Build custom experiences for interactions from ordering to loyalty management—or run your custom POS on an all-in-one device.

Businesses can now accept more buy now, pay later methods globally through one integration on Stripe: Klarna in AU, NZ, CA, CH, PT, PL, CZ, and GR; Affirm in CA.

Integrating and upgrading to the Payment Element is now easier than ever with server-side confirmation and a new integration path that lets you collect payment details before creating a PaymentIntent or SetupIntent.

Businesses in the US and Canada using Checkout and Payment Links can now dynamically localize pricing to 30 countries with one click in the Dashboard.

Businesses can now accept in-person payments in Switzerland and Norway with Terminal's flexible APIs, SDKs, and pre-certified card readers.

You can now customize how Stripe calculates your MRR and churn, and export your SaaS and billing metrics in CSV format.

We’ve been testing a suite of new developer tools over the last year with thousands of users, including Slack and Notion. Today, we’re announcing that the first is available to all new users by default: Stripe Workbench, our new home for developers within the Dashboard that helps you debug, monitor, and grow your Stripe integration.

Global businesses have told us they’re interested in replicating the fraud prevention success seen in Europe by requesting 3DS. Last year, we had a front-row seat as several Stripe users chose to do exactly that, but the results in the US were very different from what we have seen in Europe.

In this post, we share three ways our usage-based product is unique in the market—integrating naturally alongside your other billing pathways, while scaling with you as your usage-based pricing ambitions grow.

Businesses in the US can now accept bank payments within Link. Instant Bank Payments offer the cost savings of bank payments with the confirmation speed of cards. Learn more

You can now request access to Verifi—Visa’s solution for dispute prevention—directly from Stripe to reduce your dispute rates. Learn more

Remote sellers can now use Stripe to register for sales taxes in the US. The simplified process allows you to prefill application details across multiple state registrations. Learn more

Stripe announced a new partnership with FreedomPay, a leader among independent third-party gateways, so that enterprises can integrate Stripe with their existing in-person payments stack. Learn more

Stripe Tax supports global filing by automatically connecting Stripe transaction data with filing partners. Learn more

Stripe Tax expands support for remote sellers of digital goods to 10 additional countries: Belarus, Costa Rica, Ecuador, Moldova, Morocco, Russia, Serbia, Tanzania, Ukraine, and Uzbekistan. Learn more

Businesses can now A/B test Apple Pay and Google Pay from the Stripe Dashboard. Learn more

You can now configure payments pricing from your Stripe Dashboard. Set conditional payments pricing based on payment method, country, and other factors, without any code. Learn more

New platform tax reporting features allow platforms and marketplaces to gather and validate required information, generate tax reports, and deliver statements to sellers in the EU, the UK, NZ, AU, and CA (private preview). Learn more

New margin reports provide aggregated and transaction-level data across your payment volumes, fees, and revenue (general availability). Learn more

New features to support card programs for fleet users, such as enriched data, enhanced chip profile configuration, and the ability to build logic-based workflows. Learn more

Segment SaaS and Billing data by product and price, and drill down to understand performance, identify trends, and forecast SaaS performance (public preview). Learn more

You can now embed gross and net volume charts on your website to help connected accounts understand their business trends. Learn more

Instant payouts are now available in 20 additional European markets. Learn more

You can now benchmark your business performance against similar subscription businesses on Stripe to identify strengths and opportunities for your business. Learn more

You can now access improved authentication analytics that give you quicker load times, improved filtering, and critical data, including 3DS request reason and volume. Learn more

You can now offer dynamic spending controls for cardholders with our new embedded component for Issuing. Learn more

You can now query your SaaS metrics in Sigma or export them to any data warehouse using Stripe Data Pipeline. Learn more

Our Vault and Forward API now supports six endpoints for payments providers, and we plan to add six more endpoints by the end of the year. Learn more

Your users can now pay vendors through ACH or wire and add saved recipients with our new embedded component for Treasury. Learn more

Standard payouts from your Stripe balance to your Stripe Treasury accounts now arrive within two hours, thanks to our new partnership with Fifth Third Bank. Learn more

You can now configure comprehensive fraud prevention logic for your card program from the Dashboard with our new Issuing rules engine, the newest addition to our advanced fraud tools. Learn more

Businesses in Germany can now offer payment on invoice—a buy now, pay later method for B2C online purchases. Learn more

You can now access rated and aggregated usage analytics in the Usage tab in Billing analytics (GA). Learn more

You can now access improved card acceptance analytics with a revamped UI, a clearer view on success rate drop-off, and more dimensions to slice data. Learn more

Sigma users can now visualize their SQL query results with bar or line charts. Learn more

Stripe Tax expands location reports for Canada simplified GST/HST registration types. This allows you to easily view your tax liability data formatted specifically for remitting in Canada. Learn more

Buy now, pay later (BNPL) methods, little-known less than a decade ago, now account for more than $300 billion in transactions worldwide. However, they tend to be priced at a premium, so our users wanted to know whether the financial benefits would offset the added costs. With that in mind, we ran an experiment to help Stripe businesses assess when and how to offer BNPLs.

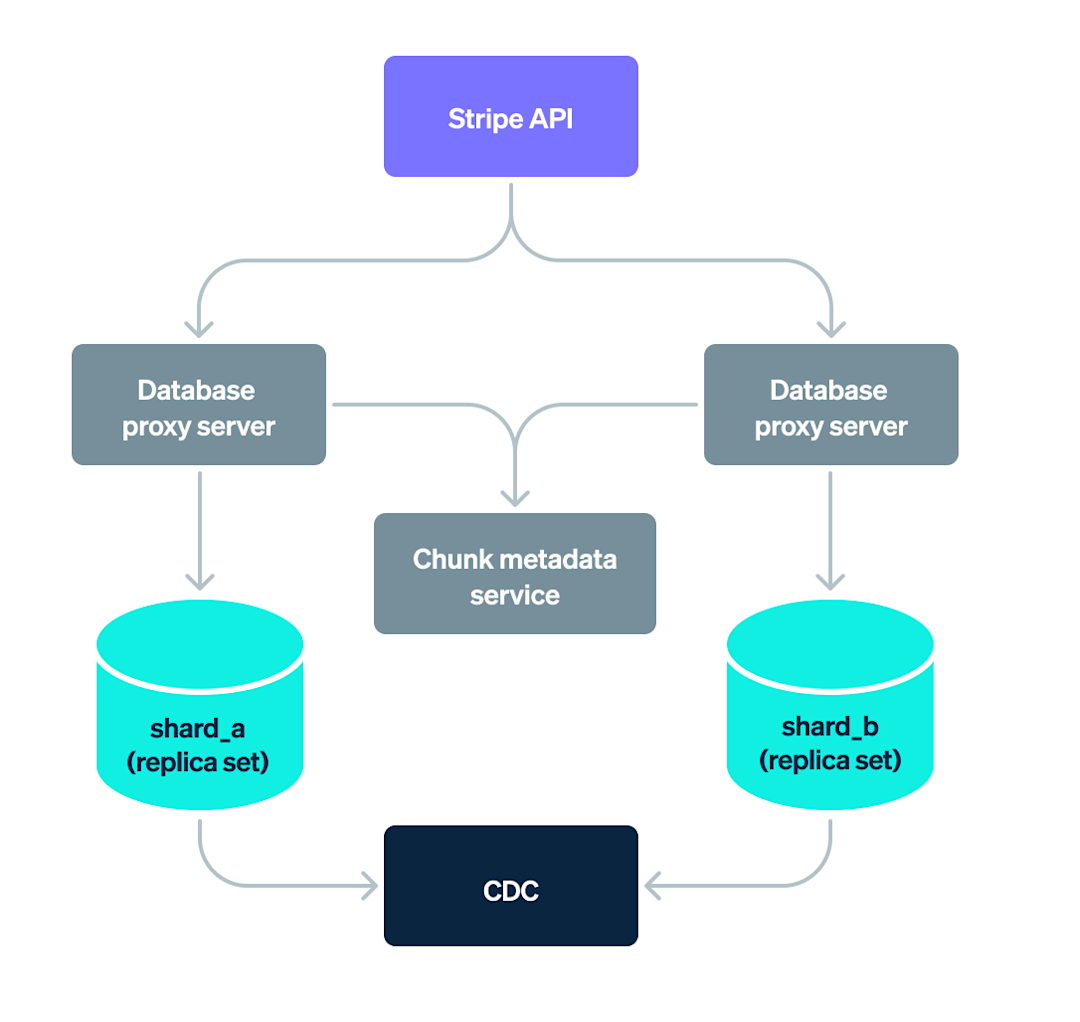

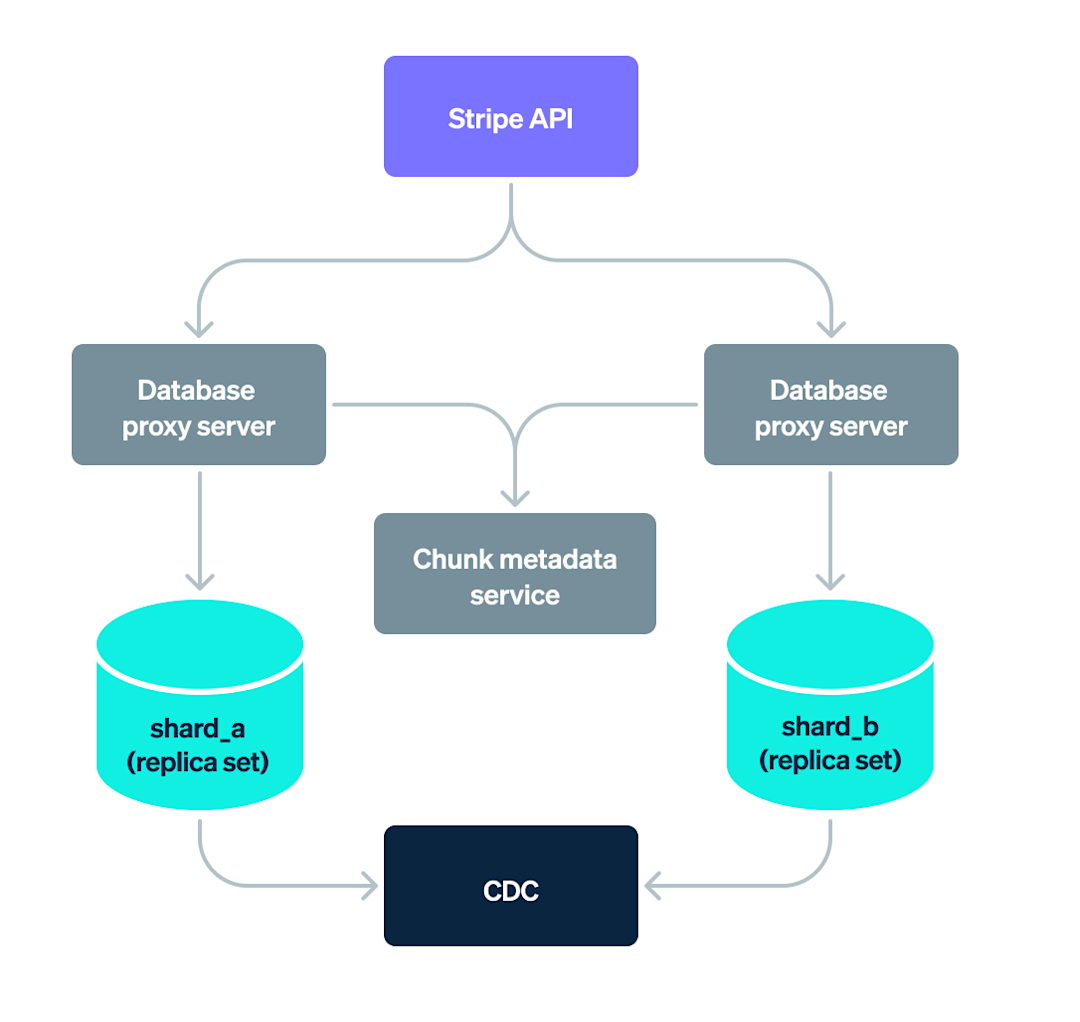

In this blog post we’ll share an overview of Stripe’s database infrastructure and discuss the design and application of the Data Movement Platform.

Last month we announced a new Billing migration toolkit designed to address your top pain points: engineering resourcing, the risk of disruptive errors, and migration time. Here’s how the migration toolkit addresses each.

We announced AI-powered payments, our biggest-ever upgrades to Stripe Connect, new support for usage-based billing, increased interoperability, and a lot more.

Please join us April 23–25 at Moscone West in San Francisco for our largest event ever.

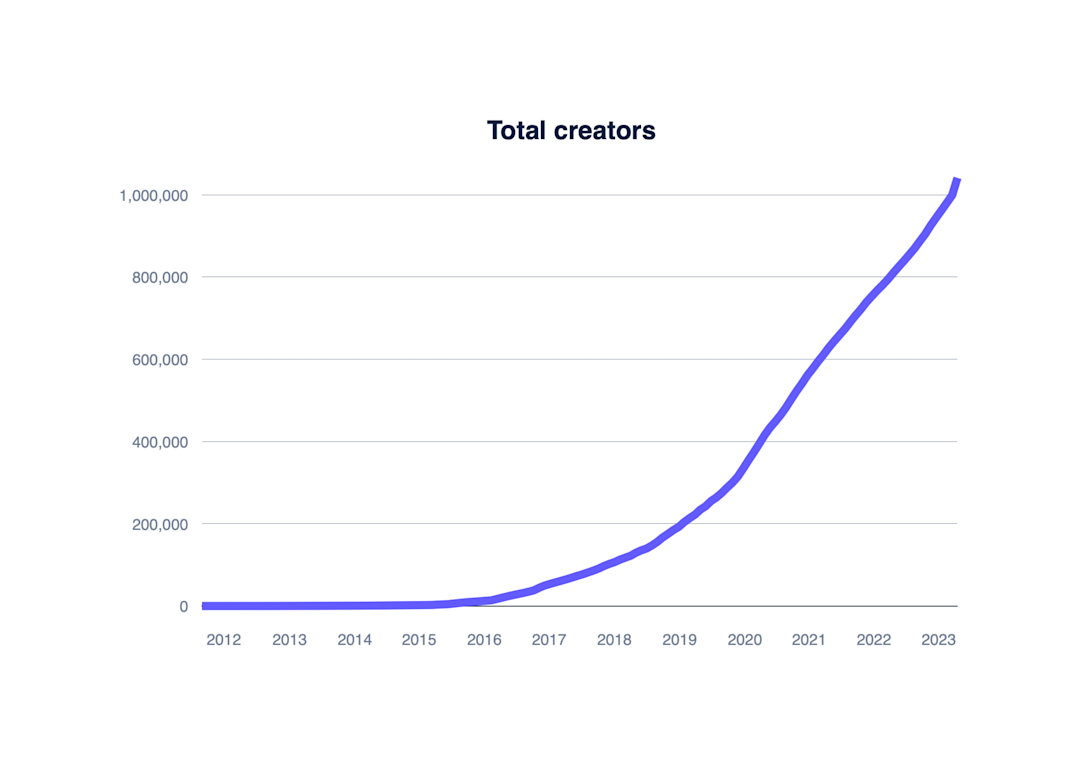

Stripe data shows that the creator economy has evolved but is still thriving. We’ve seen this evolution up close, as many of the largest creator platforms use Stripe Connect to onboard creators and pay out funds around the world.

At our annual user conference, we shared how we are helping businesses increase revenue with our global payments suite, how we are allowing platforms and marketplaces to generate more revenue and get to market faster, and how we are helping businesses find new efficiencies through developer tools and automated revenue and finance operations.

Today, we kicked off our annual user conference—Stripe Sessions. You can now watch the keynote and breakout talks on demand.

In this blog post we’ll share an overview of Stripe’s database infrastructure and discuss the design and application of the Data Movement Platform.

Stripe Billing allows businesses to manage customer relationships with recurring payments, usage triggers, and other customizable features.

This blog discusses the technical details of how we built Shepherd and how we are expanding the capabilities of Chronon to meet Stripe’s scale.

In this blog post, we’ll share technical details on how we built this state-of-the-art money movement tracking system, and describe how teams at Stripe interact with the data quality metrics that underlie our payment processing network.

You can now configure payment method settings from the Dashboard—no code required. We call this integration path dynamic payment methods.

We surveyed more than 2,000 subscription business leaders from around the world to understand how they are responding to the growing trend of pricing-as-a-product. We learned that businesses increasingly want to experiment with pricing models, but there is one thing in their way: their billing systems.

Global businesses have told us they’re interested in replicating the fraud prevention success seen in Europe by requesting 3DS. Last year, we had a front-row seat as several Stripe users chose to do exactly that, but the results in the US were very different from what we have seen in Europe.

Buy now, pay later (BNPL) methods, little-known less than a decade ago, now account for more than $300 billion in transactions worldwide. However, they tend to be priced at a premium, so our users wanted to know whether the financial benefits would offset the added costs. With that in mind, we ran an experiment to help Stripe businesses assess when and how to offer BNPLs.

If the first wave of digitization in broadcast media was about the move into streaming, this second one is about open-ended optimizations of the streaming experience. Top media companies are partnering with Stripe to add new content bundles, change pricing models, and personalize payments.

The rise of direct-to-consumer sales, subscription models, and connected car services have made payments and financial infrastructure key differentiators for auto brands. Leading auto companies are partnering with Stripe to better serve their customers and find new revenue opportunities.

We’re excited to announce a host of partnerships that allow Terminal to work with more third-party hardware, processors, and point-of-sale (POS) systems. This provides more choice and flexibility for integrating Terminal into your existing in-person payment stack and adding innovative checkout experiences.

Starting today, we’re introducing a new release cadence and versioning system for all API endpoints that combines twice-yearly major updates with monthly feature enhancements. This set release schedule gives you the predictability and clarity that you need to better plan your engineering cycles.

We’ve been testing a suite of new developer tools over the last year with thousands of users, including Slack and Notion. Today, we’re announcing that the first is available to all new users by default: Stripe Workbench, our new home for developers within the Dashboard that helps you debug, monitor, and grow your Stripe integration.

In this post, we share three ways our usage-based product is unique in the market—integrating naturally alongside your other billing pathways, while scaling with you as your usage-based pricing ambitions grow.

Last month we announced a new Billing migration toolkit designed to address your top pain points: engineering resourcing, the risk of disruptive errors, and migration time. Here’s how the migration toolkit addresses each.