Offer payment flexibility in minutes with Affirm on Stripe

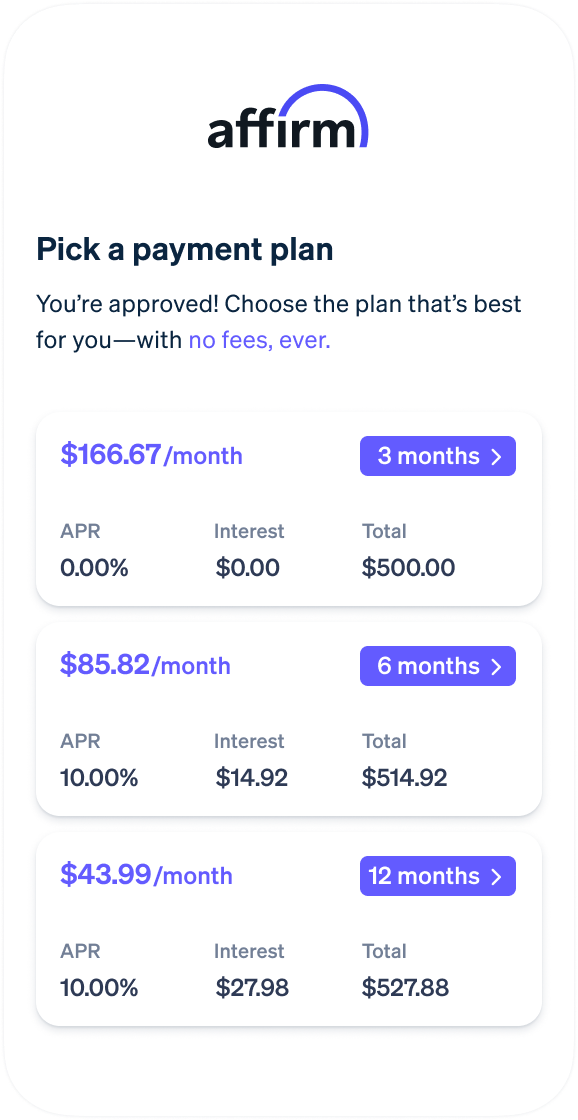

Boost average order value with Affirm by providing simple payment plans that go up to 36 months and include interest-free options. Payment plans are personalised to each purchase while you are paid in full up front.

Make big purchases more budget friendly

Affirm has over 31 million addressable customers in the US and CA and provides loans up to $20,000. Large payments can be broken into bi-weekly or monthly installments up to 36 months depending on location.

Increase sales with Affirm on Stripe

Businesses who add Affirm can see up to 14% increase in revenue on Affirm eligible sessions and up to 21% relative increase in conversion on purchases of $250 more.

Get paid up front with no credit or fraud risk

You are paid the full amount of the purchase upfront. Affirm handles collecting payments from your customer and losses from customer credit or customer fraud risk are covered.

Simplify your operations

Add Affirm to any Stripe integration for unified monitoring, reporting, and payouts. There’s no application, onboarding, or underwriting process to get started.

How it works

Relevant payment options for your customers

Buy now, pay later options can give your customers more flexibility at checkout. Based on purchase amount and customer profile, Affirm displays relevant payment plans to boost conversion, from four interest-free payments over six weeks to monthly instalments up to 36 months. You get paid the full amount up front and are not responsible for consumer credit or fraud risk.

Fully integrated

Get started fast on Stripe

With Stripe, you can get up and running with Affirm in minutes. There’s no additional paperwork for eligible businesses to get started, and everything from maintenance to reconciliation is simpler with a unified payments integration.

Flexible UI options

Our optimised payment surfaces let you turn on Affirm and other payment methods from the Stripe Dashboard. Stripe’s machine learning algorithm then dynamically shows customers the most relevant payment methods.

Offer Affirm on your platform

Through Connect, platforms and marketplaces can easily distribute Affirm with no work required by eligible merchants.

With Stripe’s Payment Element, we were able to integrate Affirm, test, and then launch in production within one day. More than 25% of purchases are being paid through buy now, pay later, and our conversion rate continues to improve as customers have more flexibility to purchase the products they want.

With the Stripe-Affirm partnership, we were able to bypass the technical complexity of adding a payment method and got started within a few minutes. Nearly 5% of our transactions use this flexible payment option, and we’re seeing an increase of more than 30% in our average order value.

Stripe’s integration with Affirm helped our team launch a new payment method with minimal engineering effort. Plus, customers who used Affirm spent 20% more on average when they were able to pay over time.

Our customers were interested in the buy now pay later (BNPL) options. Through the Stripe and Affirm partnership, we’re able to offer our customers more flexibility in how they transact with us and increase our monthly sales volume.

Ready to get started?

There’s no paperwork for eligible businesses to start accepting Affirm on Stripe. Stripe supports Affirm for businesses in the United States and Canada.

Eligibility

Check if your business category is supported in the docs, or visit your Dashboard settings to confirm if you are eligible and get started.

Pricing

Learn more about our transparent per-transaction pricing.