Businesses want secure payments that maximize conversion and improve customer experience. Network tokens help meet both of those goals. They are a new way to process card payments that help keep customer payment data more secure while increasing authorization rates, providing a more seamless customer experience, and potentially reducing payment costs.

What is tokenization?

Primary account numbers (PANs) are the 15- or 16-digit numbers found on every credit or debit card. A card’s PAN is widely accepted across businesses, making it easy to transact online. However, this also makes PANs valuable to bad actors to use for fraudulent purchases, leaving consumers vulnerable to stolen cards and businesses to data breaches. Stripe uses tokenization, which replaces sensitive PAN information with Stripe tokens, a nonsensitive string that can be used only by the business that collected the card. This process allows businesses to stay PCI compliant while reducing the risk of data breaches, because if the tokens are stolen, they cannot be used by fraudulent actors.

What are network tokens?

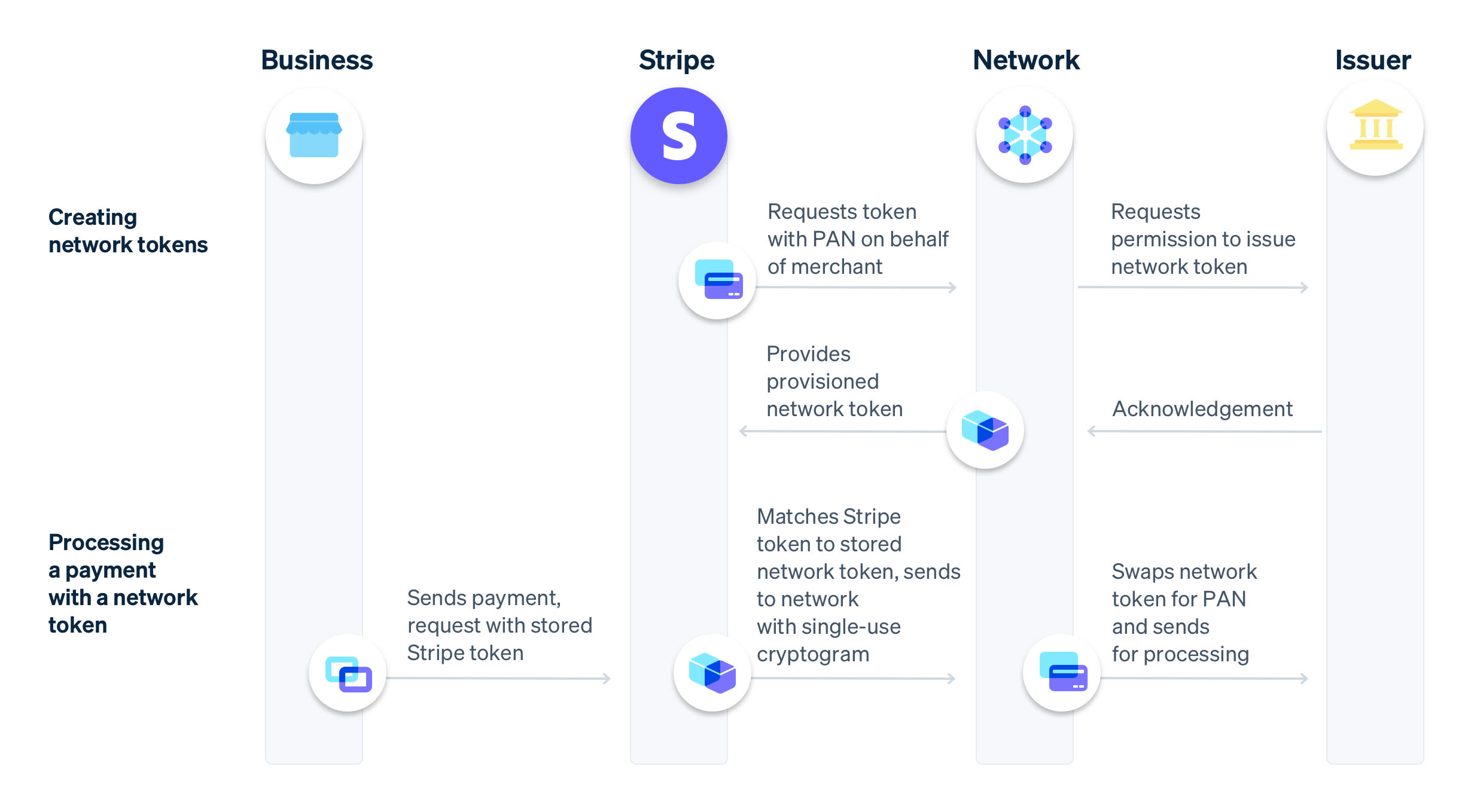

Network tokens are payment credentials that can substitute PANs for online purchases. Stripe works with card networks like Visa, Mastercard, and American Express to tokenize a user’s repository of PANs into network tokens and maintains them so they stay current, even if the underlying card data changes. For example, if a customer lost their card, Stripe would get notified by the network and would update the token directly so it would continue to work without the customer having to update their payment information.

Benefits of using network tokens with Stripe

Built-in token management

Our optimized network tokens solution works out-of-the-box for all merchants who use Stripe Payments. Stripe has built integrations with networks and will request tokens on your behalf, saving you months of engineering and implementation work. Stripe also regularly adapts its approach to stay ahead of any underlying network changes, with no effort required from your side.

Increased authorization rates

If the underlying PAN associated with a network token changes or expires, the token will remain current and usable. This reduces the number of charges declined due to outdated credentials, increasing authorization rates, particularly on frequently used cards (e.g., subscription payments). Network tokens provisioned by Stripe will also work alongside other Stripe optimization products such as Card account updater and Adaptive Acceptance to yield higher authorization rates and optimize checkout conversion. To learn more about how to optimize your authorization rates, please review our guide and site.

Lower costs

For businesses on custom interchange pricing, using network tokens can also offer cost savings. Network costs can mean it’s often more expensive to use a traditional token or PAN than a network token for a given card transaction.

Optimized tokenization strategies

Stripe also optimizes for future transactions once a token is created, determining when to use a network token and when an underlying PAN may be more optimal to achieve higher performance and reliability. We maintain PAN redundancy to retry failed network token transactions on the underlying PAN to maximize overall acceptance rates for users. In addition, using a network token often requires a one-time cryptogram that needs to be fetched from networks. As a result, network tokens can be prone to high additional latency compared to using PANs. Stripe has optimized our infrastructure to minimize these latency impacts and maximize your payment success rate.

The Stripe approach to network tokens

Built-in ML tools and direct integrations with card networks from Stripe help to ensure you always have the freshest, most secure, and most accurate payment credentials and network tokens for an optimal user experience and streamlined checkout—with no integration work required.

Stripe’s network tokens solution is available for Stripe users worldwide in the US, Canada, Mexico, India, Australia, New Zealand, the EU, the UK, the UAE, Brazil, Malaysia, Hong Kong, Japan, the Philippines, Thailand, and Singapore. As more issuers around the world begin to adopt network tokens, we’ll continue rolling out in new countries.