Determining whether a company is a fintech isn’t straightforward anymore. With the proliferation of banking-as-a-service (BaaS) tools, it’s easier than ever for platforms to integrate financial services—such as business expense cards, monetary accounts, and loan access—directly into their product. With these tailored financial services, platforms become a one-stop destination, enabling customers to manage all aspects of their business in a single place.

This guide covers the basics of BaaS for software platforms in the United States (the financial services and products covered here work differently in Europe and Asia-Pacific). You’ll learn why you should embed financial services in your product, how to evaluate BaaS solutions, and how Stripe can help.

This guide focuses on the financial services available to platforms through BaaS—beyond payment processing. If you’re interested in embedding online payments, you can read our introduction to online payments and learn how to monetize payments.

What is BaaS and embedded finance?

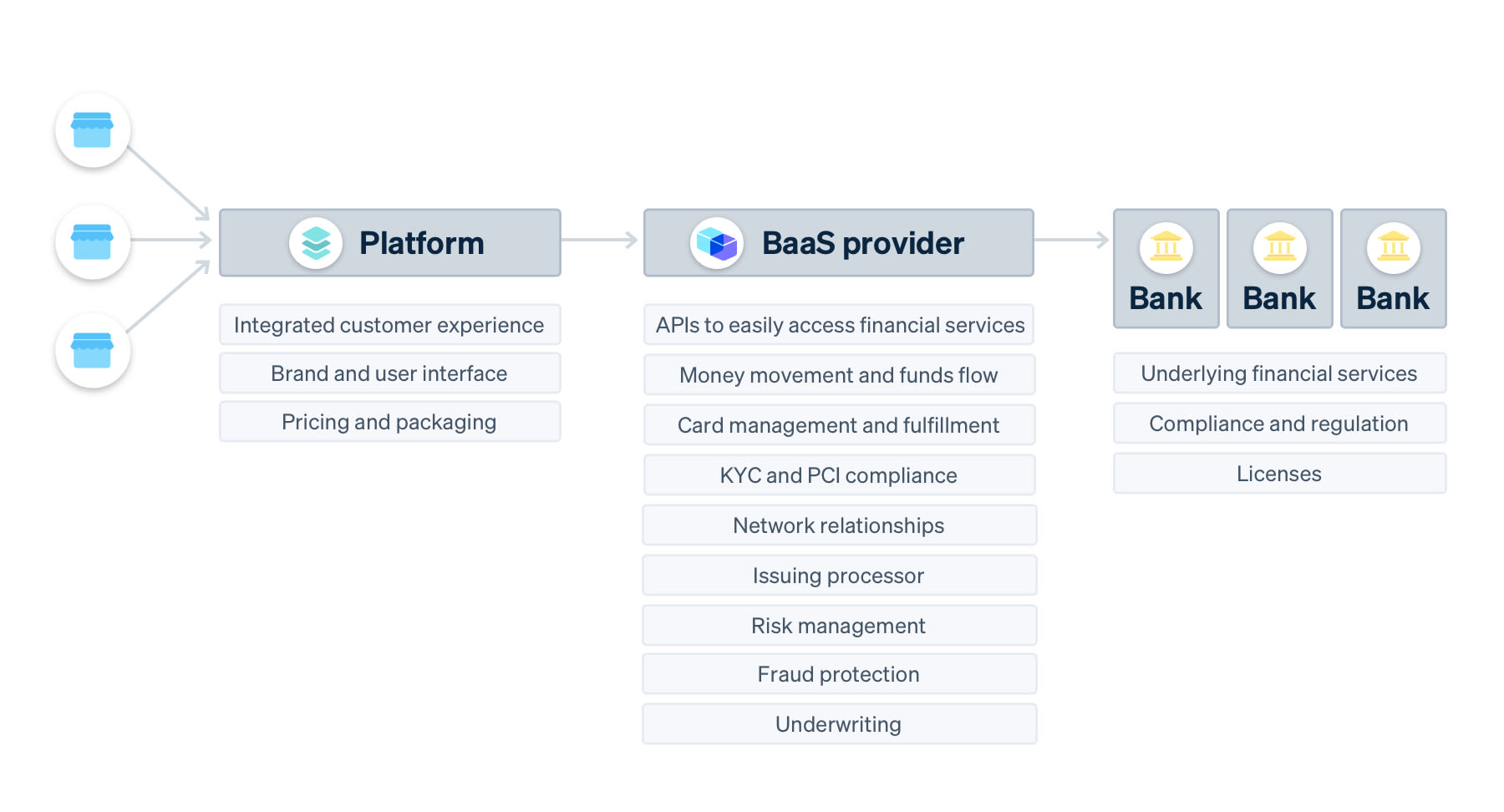

A BaaS provider makes it easy for any business, from fintech startups to established platforms, to embed the financial services traditionally offered by a bank— such as monetary accounts, cards, and loans—directly into its existing software. BaaS providers normally work directly with banks to provide the underlying service, and platforms can then use BaaS APIs to enable customers to hold funds, pay bills, manage cash flow, and access funding by working directly with the platform they’ve come to know and trust.

BaaS providers are integral for a variety of businesses, from neobanks to marketplaces. When a software platform uses a BaaS provider, this is typically called “embedded finance” because the platform adds the financial services as part of its core software. Many platforms already offer a version of embedded finance today by providing payment processing, ACH access, or wire transfers through a payments provider. A BaaS provider enables platforms to add even more financial services to their product.

The evolution of embedded finance

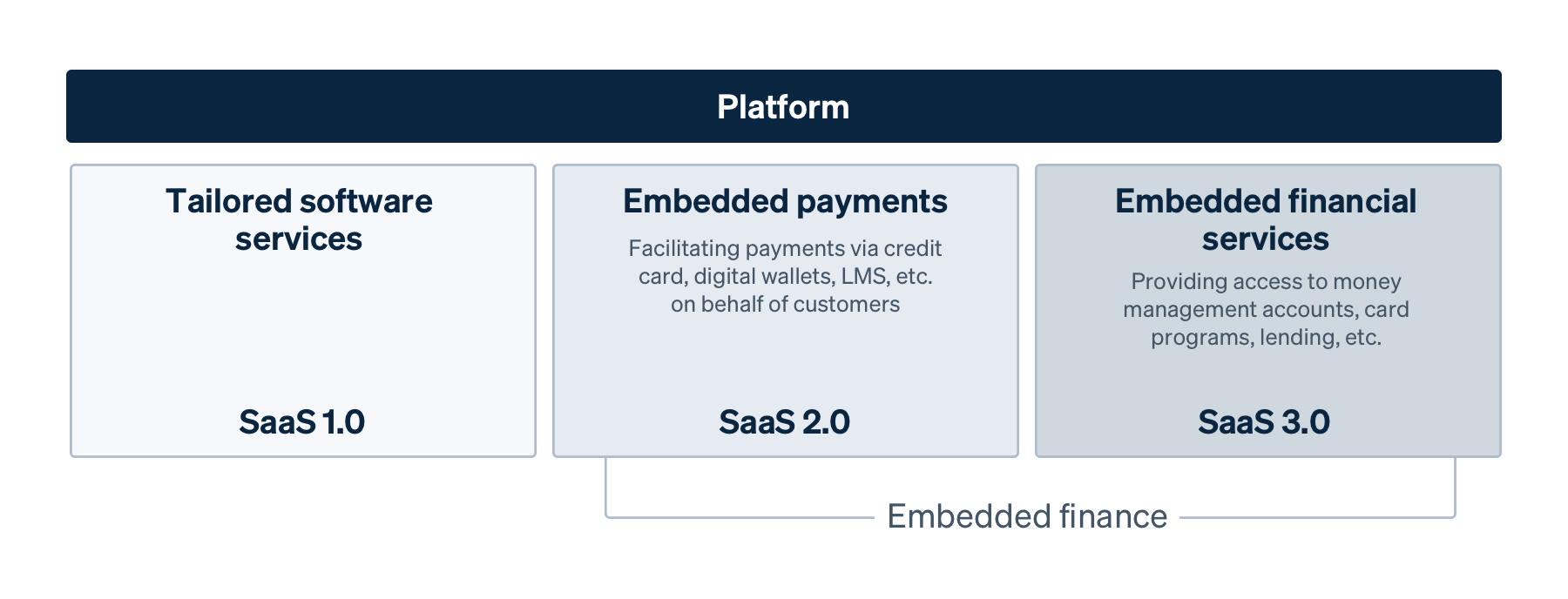

A decade ago, almost every platform could be considered “SaaS 1.0,” where they simply offered tailored software services (like appointment scheduling for salons) and generated monthly recurring revenue from customer subscriptions. Today, most platforms are considered part of the “SaaS 2.0” generation, which facilitates online payments for their customers—marking their first step into embedding financial tools into their product. This feature has become table stakes for platforms; without embedding online payments, platforms have a much harder time competing in the market. Facilitating online payments also helps SaaS 2.0 platforms generate more revenue—in addition to charging for monthly subscriptions, they can also charge customers for access to payment processing.

Now, with the rise of banking-as-a-service solutions, platforms are beginning to evolve yet again to "SaaS 3.0"—offering additional embedded finance features (such as loans, accounts, and cards) to customers beyond payments.

How does BaaS work for platforms?

BaaS is a type of financial technology that helps software platforms access banking capabilities traditionally only offered by a licensed bank. Businesses can then conveniently provide custom banking services within their platform, and thus, prioritize a better overall experience for their customers.

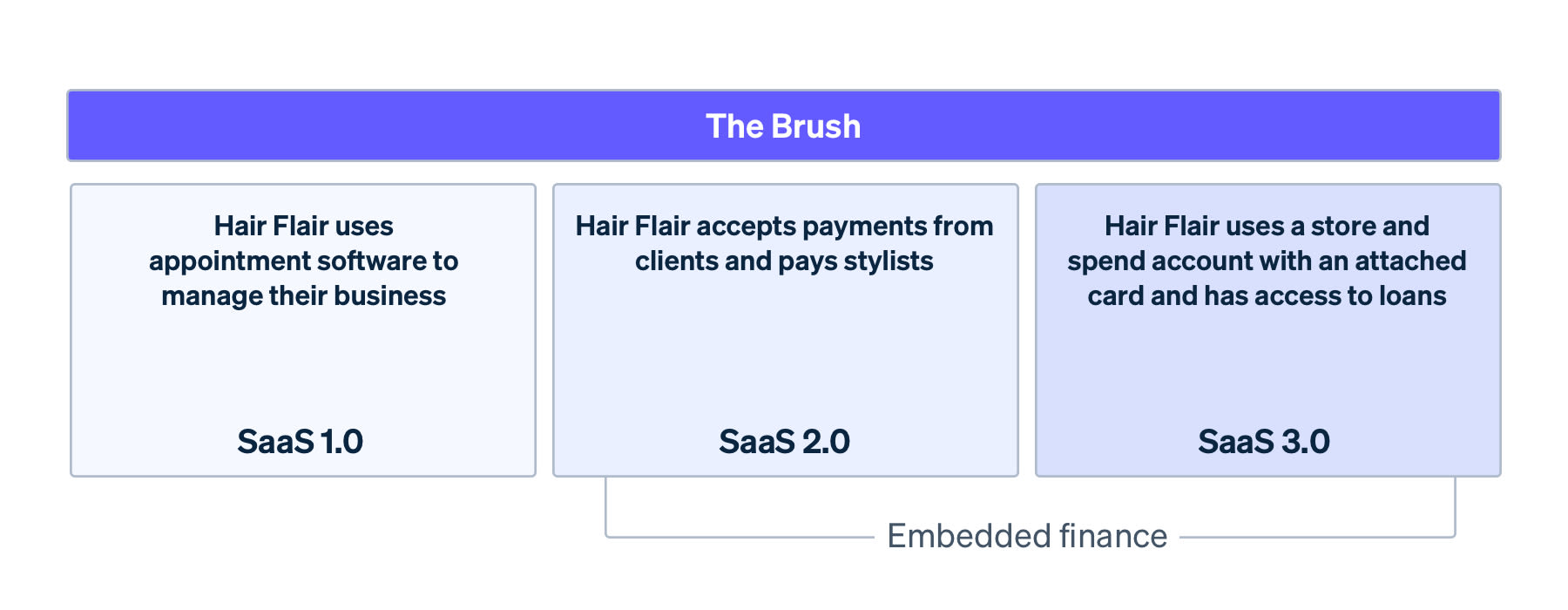

Here’s a specific example of how BaaS works for platforms: Imagine a platform that offers appointment software and payment processing for salons and barbershops (let’s call them The Brush).

Let’s take one of The Brush’s customers, Hair Flair. Hair Flair has used The Brush for three years to manage appointments and collect payments from clients. When Hair Flair wants additional financial services to run their business, they could have two options: 1) work with banks directly or 2) access the financial services via The Brush.

Work with banks directly

Hair Flair just opened their second location and the salon owners first need a place to store the funds they use to pay their stylists. To open a bank account, they have to go to a financial institution, like a local brick-and-mortar bank, and share their business information.

If Hair Flair isn’t approved for a business account, they’ll have to open a personal bank account, intermingling their business and personal finances. In this case, their account is created at the brick-and-mortar bank, but they now need to manage the flow of funds, moving money from their income on The Brush to their new account—and constantly waiting between two to three business days for money to settle before paying their employees.

According to a Stripe survey, 55% of businesses have to visit a local branch in person and 23% have to send a fax in order to open a bank account.

The salon owners also need capital to invest in marketing and studio renovations. They could apply for a loan from the same financial institution where they opened their bank account, but they end up finding a lower interest rate loan from another local bank. They apply for the loan in person and fill out a lengthy application with their business information. Unfortunately, since the bank isn't familiar with Hair Flair, or the typical cash flow that's expected for salons, Hair Flair isn't approved for the loan. They apply for a loan at two more banks and are approved for one a few months later.

Only 48% of small businesses have access to all of the financing they need.

Hair Flair also has a lot of expenses with their new location. Rather than using their personal card, they decide to apply for a business credit card to purchase new equipment and supplies.

They look for a card with low interest rates and end up getting their card at yet another bank, separate from where they applied for the loan and opened an account. They share all of their information again and now need to figure out how to manage money on the card with the funds from The Brush or from their financial account

Beyond setting up accounts at different banks, the owners at Hair Flair spend time each week reconciling finances across these accounts to track their money, pay bills, and avoid bounced checks. It also means a significant portion of their earnings may be tied up in transfers before they’re able to spend it.

Access financial services via a platform

The Brush, which started as appointment software for salons, now allows customers to access banking features, including the ability to process payments, access capital, get business cards, and open financial accounts—all in one place. All these benefits are on top of The Brush’s core scheduling and appointment-booking features.

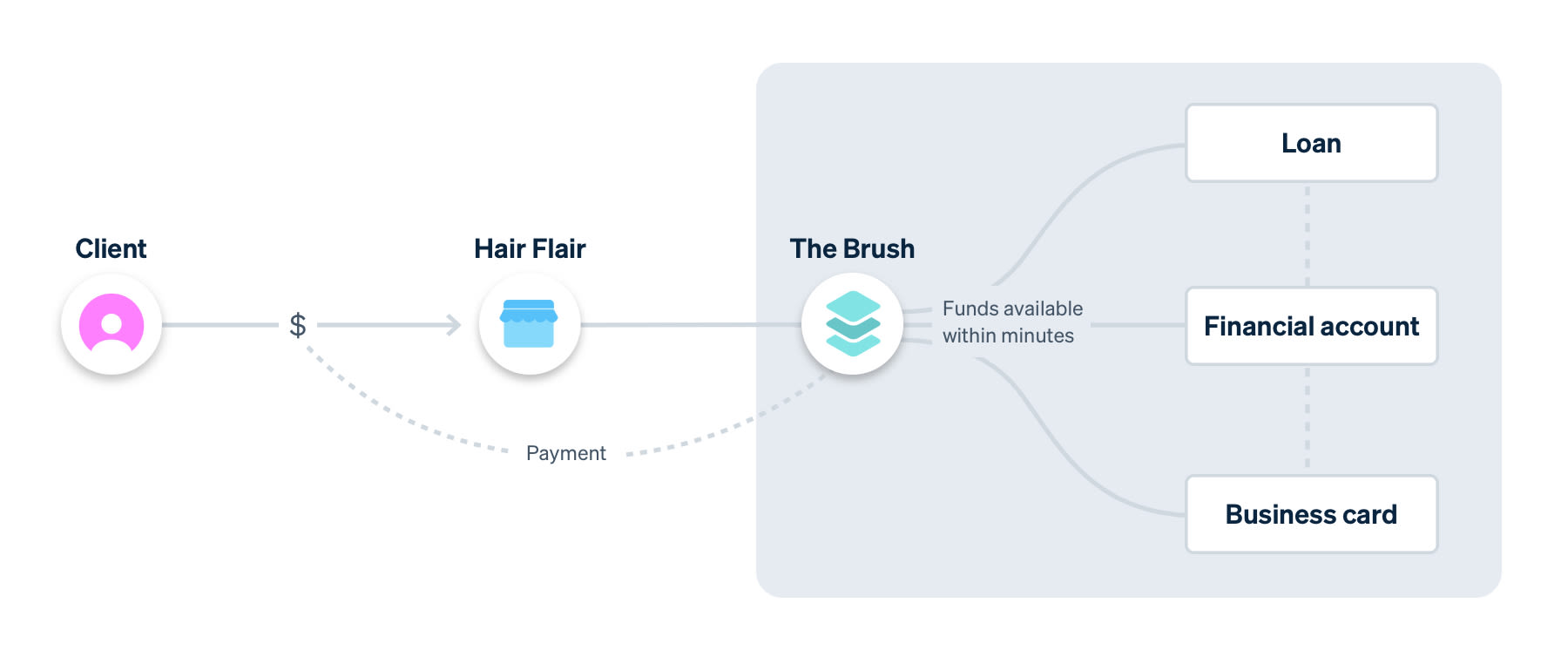

Because Hair Flair processes all client payments on The Brush, The Brush has a complete understanding of the salon’s financial history, and the platform inherently understands the salon industry and typical capital needs. This time, when Hair Flair applies for a loan, The Brush’s bank partner determines Hair Flair’s eligibility based on Hair Flair’s payment volume and history on their platform and approves the loan the next day. The capital becomes available on Hair Flair’s financial account they have through The Brush, without having to submit extra paperwork.

And Hair Flair can easily spend that extra capital on their business card they have through The Brush. The card is tied to their financial account and can access all of their funds (earned and borrowed) in one place. Funds are immediately available, so they can use their card as soon as clients pay for their services. They can use the card to pay for business supplies and expenses and, if the platform decides to do so, they can earn rewards as they spend (like getting money back on salon-related purchases or receiving a free month of The Brush).

And lastly, the owners at Hair Flair save hours each month reconciling finances. With all financial activity (customer payments, loans, and business expenses) in one place on The Brush’s platform, the owners can always access up-to-date financial reports without bouncing between different tools and systems. They also don’t have to worry about forgetting a transfer or missing a payment on a loan. The Brush is Hair Flair’s one-stop shop to run their whole business.

Shopify is a leading global commerce company, providing trusted tools to start, grow, market, and manage a retail business of any size. Dealing with financial services is an essential part of running a business, yet most of today’s financial services aren’t designed for the needs of independent business owners. Shopify Balance offers Shopify merchants a fast, simple, and integrated way to manage their funds, pay bills, and track expenses. This gives them easier access to financial products and greater control over their finances.

What are the benefits of embedded finance?

With embedded finance, platforms—like The Brush—can solve core business problems for

customers like Hair Flair, creating a better overall experience. But embedding financial services doesn’t just give customers a better experience; platforms see real benefits, too.

Boost customer lifetime value (LTV): There are two primary ways to increase LTV: encouraging customers to use more of your product or to have them use it for a longer period of time. Supporting financial services can help with both by creating a software ecosystem for customers that provides a variety of useful features in one place. For example, more than 70% of Stripe customers who accept a loan via Stripe Capital go on to accept a second Stripe Capital loan, allowing Capital to invest more money into customer acquisition for first-time borrowers.

Decrease churn: Processing payments, having an account, using credit or debit cards, and accessing capital are a necessary part of running a business. Embedding these financial services in your product gives customers an important reason to keep using your software, naturally decreasing the likelihood of churn.

Create new lines of revenue: Embedded finance has the potential to be a significant portion of revenue for platforms. In fact, it is estimated that SaaS companies can increase their revenue 2–5x by adding financial services. Depending on which financial services you enable, you can earn money by capturing interchange revenue (a fee that accompanies card transactions), charging a payment processing fee, or for helping bank partners provide financial services to your customers.

Improve customer experience and overall satisfaction: Embedding financial services into your software saves time, energy, and resources for your customers. Rather than bouncing between disparate systems and navigating complex banking requirements, they can do everything in one place. This encourages customer loyalty, leading to happier customers who are more likely to continue using your product and recommend it to others.

How to get started with BaaS

Before you get started adding more financial services to your platform, you need to make sure you know which services make the most sense to offer to your customers. There is no one-size-fits-all approach—most businesses start with embedding payments, but the services they offer through a BaaS provider differ from there. For example, Lightspeed Capital, a large-scale commerce platform, started with embedded in-person and online payments and, two years later, began to give its customers access to loans. We suggest you run user research to understand your customers’ pain points and determine which financial services can best meet their needs. (If you’re a platform currently using Stripe, reach out to baas@stripe.com or your Stripe contact to see if we can help.)

Here are five things you should look for in a BaaS provider:

1. Includes payments services

The simplest option is to use one solution that offers both payments and BaaS services. This significantly reduces the complexity required to go to market and scale your offerings, lowering internal cost. Because everything is in one system, you don’t have to worry about complicated funds management and customers only have to share their information once, during onboarding, to access a variety of different financial services. This also allows you to continue focusing on your core product while your provider handles the work needed to solve your customers’ financial pain points.

This also brings the most value to your customers. Accessing your payments service, financial accounts, and cards through one provider could easily allow you to pay solopreneurs or contractors on your platform, using the money your customers earn from sales. The solopreneur or contractor would have access to those funds in seconds via a financial account and card, while you wouldn’t incur any additional working capital needs.

2. Support for a variety of financial services

When you first start providing embedded finance services to customers, you may start with only one service, such as cards. As customer demand grows, you may want to provide access to additional services, such as financial accounts. These various financial services are all related to dealing with money—accessing it, storing it, spending it, and moving it—so your systems need to be able to talk to each other and pass important customer information. Rather than scaling your embedded finance offerings using various point solutions, look for a single system that can support a variety of financial services as you expand.

3. The ability to quickly go to market and iterate

You may want to test product/market fit to see if there is demand for the financial services you want to integrate into your product. And depending on how your customers react, you want the ability to iterate or scale quickly.

For example, let’s say you add payments to your core solution, allowing your customers to accept money on your platform. You see a lot of interest, but customers tell you that they also want the ability to easily pay for business expenses with their revenue, so you want to test offering your customers a card. The best BaaS solutions should allow you to quickly add different capabilities and test them before rolling them out more broadly.

4. Ease of integration

The best BaaS providers make it as easy as possible for you to get started. While there will be some integration time required, you should be able to access developer-friendly APIs and build on top of ready-to-use financial infrastructure. This way, you can focus on how your core business and embedded finance can work together, rather than building banking infrastructure from scratch, yourself.

5. Streamlined compliance and regulation management

Services offered through BaaS providers are part of a regulated industry, resulting in a long list of compliance and regulatory requirements you must manage and maintain. For example, offering expense cards means managing user verification, ensuring PCI compliance, understanding KYC requirements, and maintaining measures to reduce fraud.

Your BaaS provider should significantly help handle compliance and regulation requirements on your behalf, minimizing the number of internal resources you need to maintain them on your own. This is especially helpful to think about during onboarding—ideally your provider helps with the requirements upfront, so customers should only have to enter their information once when they first join your platform, regardless of how many financial services they access.

How Stripe can help

Stripe is the easiest and most flexible way for platforms to build and launch their own full-featured, scalable embedded finance features—whether it’s payments, lending, cards, or bank account replacements. Stripe’s banking-as-a-service APIs, along with our robust payments solution, let businesses—from fintech startups to established platforms—embed financial services directly into their existing software. Companies like Shopify, Housecall Pro, and Lightspeed partner with Stripe to solve critical problems for their customers and create additional lines of revenue for their businesses.

Each of our products offer APIs that are building blocks for platforms to combine in different ways, depending on what their customers need and what makes sense for the platform’s business.

Payments solution: Stripe Connect allows you to embed multiparty payments and offer a variety of financial services, like collecting payments from customers and paying out third parties. Platforms earn revenue by collecting fees for services provided.

Business financing: Stripe Capital enables fast and flexible financing to help your customers grow their business. Many small businesses struggle to get competitive loans, especially if it’s difficult to underwrite their business. Stripe removes that barrier with a complete lending program through a single integration.

Business card: Stripe Issuing allows you to instantly create and issue virtual and physical cards with your branding. Customers use the cards to make purchases for their business, with faster access to the funds they earn through sales. You get insight into how customers are spending their funds, while Stripe handles card production, fulfillment, and shipping. Platforms earn a share of interchange that’s collected every time a card is used.

Bank account replacement: Stripe Treasury’s APIs create FDIC insurance–eligible accounts for your customers that can earn yield, send ACH or domestic wire transfers, and support check deposits (available soon). Stripe handles upfront negotiations with a network of banks, embeds KYC within your product so you don't need to build a costly KYC program, and advises you on remaining compliance requirements. Most platforms build Stripe Treasury and Stripe Issuing together to offer customers a way to store, spend, and manage money.

Get in touch with our team to learn more about how your platform can use Stripe to originate loans, issue cards, or create financial accounts.

Visa® Commercial Credit Cards are issued by Celtic Bank, a Utah-Chartered Industrial Bank, Member FDIC.

Stripe Treasury is provided by Stripe Payments Company, licensed money transmitter, with funds held at Evolve Bank & Trust and Goldman Sachs Bank USA, Members FDIC.

Capital Loans are issued by Celtic Bank, a Utah-Chartered Industrial Bank, Member FDIC. All loans subject to credit approval.