Sales tax compliance can be complex and time-consuming to navigate, especially in the United States. Each state has its own sales tax authority that sets tax regulations for when businesses need to collect tax. These regulations have undergone many changes in the past few years and continue to change, making it challenging to determine when and where you are required to charge sales tax on transactions.

This guide will help you determine when you need to register to collect tax in the US so you can avoid the penalties and interest that come with noncompliance. It will also show you how to navigate the process of registering for a sales tax in individual states and explain what to do if you currently have an obligation to collect sales tax but haven’t registered yet. We’ll also share how Stripe can help you manage ongoing tax compliance.

When to register to collect sales tax

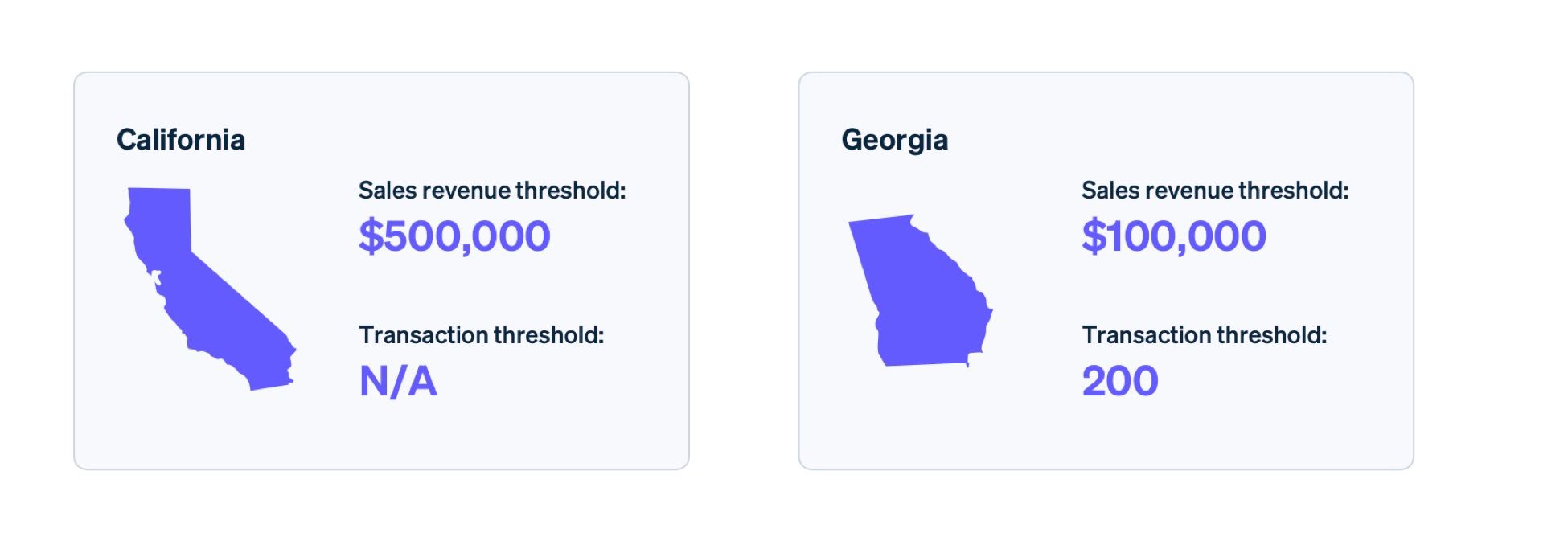

In the US, you are required to register for sales tax in each state in which you have met the physical or economic nexus standards or any other requirement of the state. For out-of-state sellers, economic nexus is generally the applicable standard for determining when to register to collect sales tax. Economic nexus thresholds are based on either sales revenue or transaction volume and sometimes both. For example, in California, you must register and collect sales tax once you exceed $500,000 in sales revenue from customers in California. However, in Georgia, you must begin collecting sales tax once you exceed $100,000 in sales revenue or complete 200 transactions from customers in Georgia.

Different economic threshold amounts in California and Georgia

Different economic threshold amounts in California and Georgia

Sales tax nexus definitions, like physical nexus, vary by state, but in general, having a physical connection of any kind can create “sufficient presence” (or nexus) and require you to register and collect sales tax in that state. This can include having an office or headquarters, equipment, or employees in a state, or even having a temporary presence—like attending an industry tradeshow. The location of your inventory storage can also create nexus in a state. (This includes inventory stored in an Amazon FBA warehouse or other third-party fulfillment center.)

It’s important to note that five states do not have a state-wide sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. This means that you do not need to collect general sales tax in these states. However, Alaska does authorize the levy of sales tax at the municipal level. In most situations, merchants will only need to register at the state level for sales tax purposes with a few exceptions that we’ll share below.

Once you determine where you need to collect tax, your next step is to register with the state or local tax authority. This is crucial since you must be registered to collect tax before you start calculating and collecting sales tax. Keep in mind that these guidelines pertain to direct sellers. If you sell exclusively on marketplaces, you should consult a sales tax expert to determine if you need to register for a sales tax permit since the tax guidance for marketplaces varies.

In the US, businesses should only register once they’ve identified where they have nexus, either through a physical connection or economic nexus standard or any other requirement of the state. No matter which type of products you sell (e.g., digital goods, services, or physical products), your registration process remains the same.

- Home rule states allow individual home rule cities to administer their own sales taxes as well as define their own tax bases. These cities can define their own tax rules and sellers may be required to complete additional registrations in these areas. The following are home rule states: Alabama, Alaska, Arizona, Colorado, and Louisiana.

- Alaska is a home rule state. See endnote one for more information. The Alaska Remote Seller Sales Tax Code was passed on January 6, 2020. However, from there, local jurisdictions decide whether to adopt the code. And once a local jurisdiction has adopted the code, businesses have 30 days to begin collecting sales tax from Alaska buyers located in that jurisdiction.

- Arizona is a home rule state. See endnote one for more information.

- Colorado is a home rule state. See endnote one for more information.

- Louisiana is a home rule state, although they are called parishes in Louisiana. See endnote one for more information.

- Sellers must meet both the sales and transaction number thresholds in New York and Connecticut.

How to register for a sales tax permit in the US

Since each state has its own sales tax authority, you must individually register to collect sales tax in states where you have met tax registration requirements. To register for a sales tax permit, start by going to the state tax authority website. You can find the link for each state here, or let Stripe Tax manage the entire US tax registration process for you.

There is an exemption for states participating in the Streamlined Sales and Use Tax Agreement (SSUTA). This agreement was created to try and simplify the sales tax registration process. Currently, 24 states have passed legislation to conform to SSUTA: Arkansas, Georgia, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Nebraska, Nevada, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Washington, West Virginia, Wisconsin, and Wyoming. Sellers can register for the Streamlined Sales Tax Registration System (SSTRS) here. Once registered, users will set up accounts individually with each state and will need to separately register if they have sales tax obligations in any non-SSUTA-conforming state.

If you previously met the tax registration requirement in a state but did not register, you have a few options. If a few months have passed since you exceeded the tax registration requirement, it would be helpful to consult sales tax experts to determine the best way forward for your business. Most states have a voluntary disclosure program to help sellers resolve prior sales tax liabilities, and you may also be eligible to participate in a state’s amnesty program as a way for you to come into compliance. Do not begin collecting tax until you have properly registered with the state or local tax authority.

How Stripe can help

With all of these nuances, determining where you have a sales tax obligation and need to register gets complicated. For sellers following the economic nexus standard, Stripe Tax helps you monitor your obligations and alerts you when you exceed a sales tax registration threshold based on your Stripe transactions.

Stripe Tax can help you:

- Understand where to register and collect taxes: See where you need to collect taxes based on your Stripe transactions and, after you register, switch on tax collection in a new state or country in seconds. You can start collecting taxes by adding one line of code to your existing Stripe integration or add tax collection to Stripe no-code products, such as Invoicing, with the click of a button.

- Register to pay tax: Let Stripe manage your tax registrations in the US and benefit from a simplified process that prefills application details—saving you time and ensuring compliance with local regulations.

- Automatically collect sales tax: Stripe Tax always calculates and collects the correct amount of tax, no matter what or where you sell. It supports hundreds of products and services, and is up to date on tax rule and rate changes.

- Simplify filing and remittance: With our trusted global partners, users benefit from a seamless experience that connects to your Stripe transaction data—letting our partners manage your filings so you can focus on growing your business.

Learn more about Stripe Tax.