Trusted experts. Guaranteed coverage at tax time.

We'll pay up to $25,000 if you receive a penalty for any reason. Our Tax Resolution team will also help resolve issues with the IRS.**

Exclusive to QuickBooks

Get coverage that you can’t find anywhere else.

Peace of mind

It doesn’t matter who made the error. We’ll make it right.

Less time consuming

We deal directly with the IRS so you don’t have to.

More money for you

We’ll pay up to $25,000 in tax penalties per year.

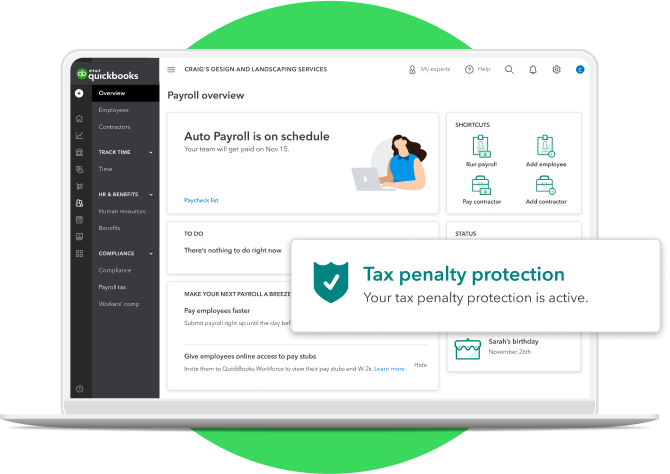

Follow these 3 easy steps to get tax penalty protection

1. Submit your forms electronically

Submit your electronic services authorization forms to Intuit so we can enroll you with the applicable federal, state, and local authorities. This way we can submit filings and process tax payments on your behalf. If you expand to new states, you’ll need to enroll in electronic services there as well.

2. Experts will review your payroll setup

Let one of our payroll experts review your payroll setup and resolve any problems the expert identifies when checking your account. Once everything is correct, your tax penalty protection will be activated and a badge will appear on your overview screen.

3. Send us a copy of your payroll tax notice

In order to receive full penalty and interest reimbursement (up to $25,000), send a copy of your payroll tax notice (all pages) to taxnoticeresolution@intuit.com within 15 days from the date printed on your first notice. Our Tax Notice Resolution Team will take it from there. If the team needs additional information, they’ll make 3 attempts to reach you via email and/or phone, typically over the course of 5 business days. If you don’t respond by the end of the day after the third attempt, Intuit will no longer be liable for any incremental penalties or incurred interest.

You must meet the requirements above to be eligible for tax penalty protection.

What you’ll get:

- Tax notice research and resolution assistance for payroll tax errors that occurred after you started using QuickBooks Online Payroll Elite. We will represent you (before the IRS and other agencies) and help you resolve your problem.*

- We’ll cover the penalty and interest for the payroll tax error—up to $25,000 per year (see what’s not covered below). First, the Tax Notice Resolution Team will confirm instructions to resolve the notice, including what you should pay and where. Then we’ll refund your bank account via ACH transfer or mail you a paper check. If anyone ever pays unnecessary penalties and/or interest amounts (for notices sent by mistake or for issues that resulted from a government error), the agency may reimburse you directly.

- If a tax agency refunds you for a tax penalty we reimbursed you as a part of this tax penalty protection, you will need to reimburse us for those funds.

Penalties that aren’t covered:

- Payroll taxes—you still owe payroll taxes, but we’ll cover the penalties and interest incurred for any payroll tax mistakes.

- Other offerings, such as HR advisory services or workers’ compensation.

- Penalties or interest incurred for any non-payroll tax error. These include:

- Administering employee benefits like health insurance

- Situations when your account wasn’t in good standing—Non Sufficient Funds (NSF) holds, credit card billing holds or failure to pass validation or verification checks for our money movement services

- Mistakes related to your federal, state, or local wage laws but not directly related to the calculation of pay and taxes (e.g. miscalculating overtime or labor law violations such as not paying minimum wage, hiring underage workers, or not paying workers for total hours worked)

- Miscategorizing worker classifications (like labeling someone as a contractor when they should be an employee)

- Penalties or interest incurred outside of QuickBooks Online Payroll Elite, from errors made during periods prior to your first payroll date with Elite. This may include errors from paychecks or tax payments/tax form filings made outside of Elite (including tax payments or tax form fillings made in other QuickBooks Online Payroll offerings).

- Penalties and interest incurred after 15 days from the payroll tax notice date (the date found on your notice—not to be confused with the date of receipt of the notice). We will still cover the original penalty and interest identified on your first notice, but will not cover additional penalty or interest accruements if you don’t submit your notice within 15 days of the first notice date.

- Penalties or interest accrued on an issue that occurred previously, and where Intuit has previously provided instructions to fix. This includes the what you need to do section above and is not limited to instructions our specialists provide via email during onboarding, your ongoing product usage, or notice resolution.

- Penalties or interest due to willful or fraudulent omission or inclusion of information inputted by you to the payroll services.

- Combined penalties and interest over $25,000 per year per business. A payroll tax notice this large is very rare. So, we’ll be on the lookout for any issues that might cause it.