25 Days of Insights into the Holiday Season

Get ready to embrace the Holiday Season by unboxing 25 invaluable omnichannel insights, each as diverse and vibrant as the regions they hail from — the Middle East and Africa (MEA), Latin America (LATAM), Europe and the Asia-Pacific (APAC) regions.

Unbox the Full View of Holiday shopping with one insight revealed each day for 25 days.

Day 1

Day 2

Global online FMCG sales are picking up following a period of post-pandemic stabilization.

Source: NIQ Retail Measurement, Global e-commerce channel, Total FMCG, Latest annual and quarterly periods ended Q2 2023 vs. Previous year

Day 3

Day 4

49% of global consumers say they are now omnishoppers, regularly shopping across both online and offline channels.

NielsenIQ Barometer – Wave 3 (March 2023). 12 global markets (South Korea, China, South Africa, Saudi Arabia, India, Poland, Chile, Brazil, USA, France, Germany, UK)

Day 5

Research shows, that adapting and updating your product pages with product images can keep shoppers engaged and excited, which will lead to better conversions. Switch up your image and feature sets to support all seasonal and promotional updates throughout the year, allowing the customer to replicate a virtual in-store experience.

Source: The anatomy of a high-converting product page: A guide

Day 6

84% of global consumers are prepared to spend less, the same, or nothing on holiday gatherings and celebrations this season. Despite prevailing cautiousness among global consumers, approximately 18% plan to spend more on socializing and gatherings this year.

Source: NIQ Mid Year Consumer Outlook Survey 2023

Day 7

Day 8

21% of yearly global FMCG value sales occur during national holidays (thanksgiving, Chinese NY, Christmas, Ramadan, Global NY, Halloween, Easter, Valentine’s Day)

Source: NIQ Global Strategic Planner. Data ending: 23 Apr 2023

Day 9

Day 10

According to NIQ’s Holiday Habits Survey 2023, more Indian consumers (38%) are noting Non-Alcohol based as an essential part of holiday celebrations vs Alcohol based beverages (30%).

Source: NIQ Holiday Habits Survey 2023

Day 11

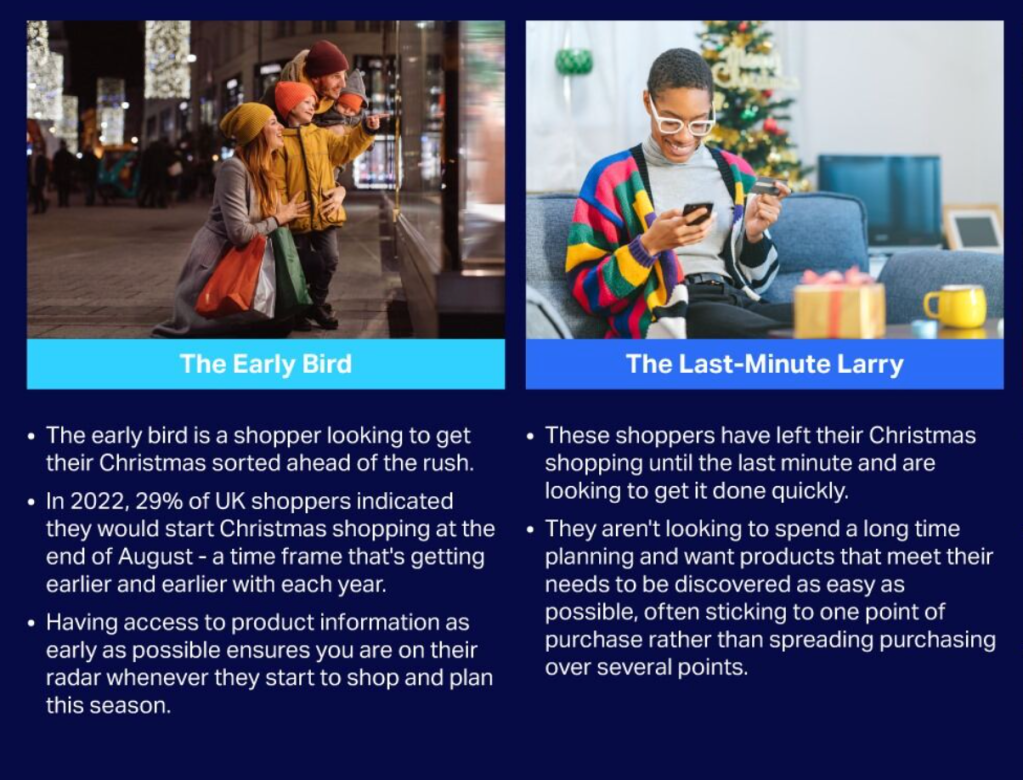

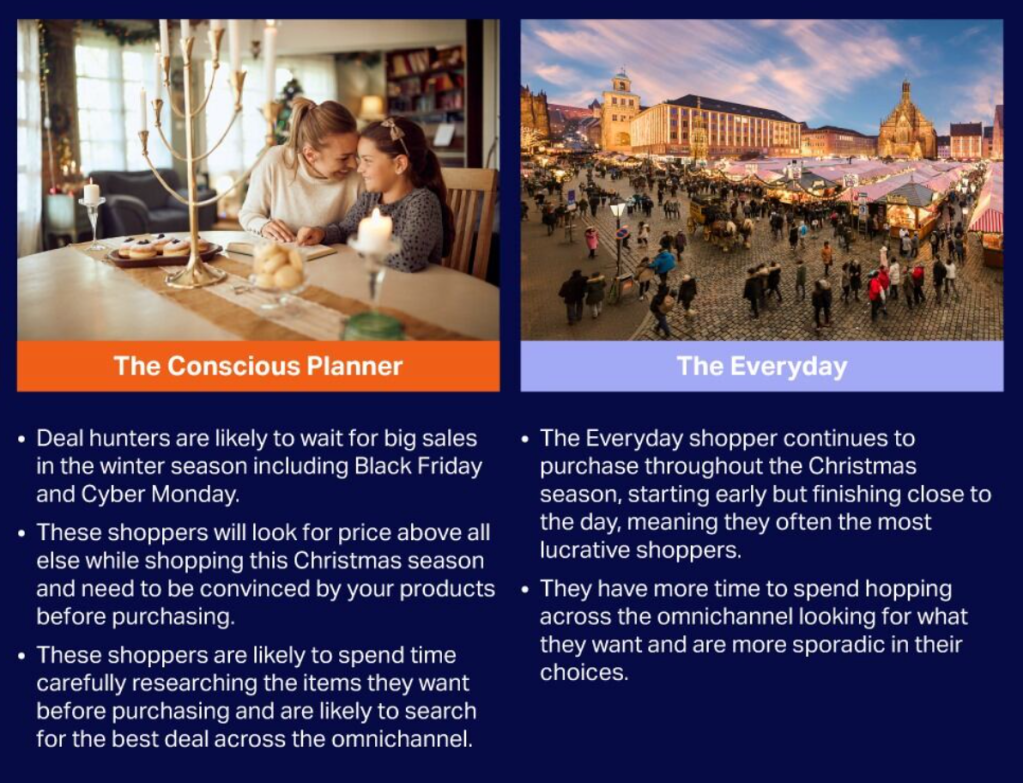

NIQ Brandbank had identified 4 Christmas shopper profiles

Source: NIQ Brandbank report – 5 steps to winning the digital shelf this Christmas season

Day 12

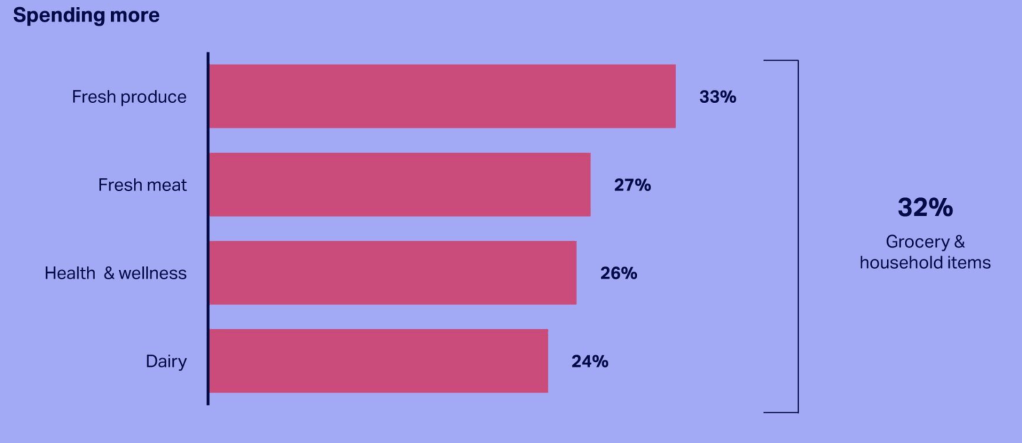

Despite pressured times, consumers are still willing to spend more for some categories. Top 4 cateogories for which consumers are willing to spend more

/

Source: NIQ Mid Year Consumer Outlook Survey 2023

Day 13

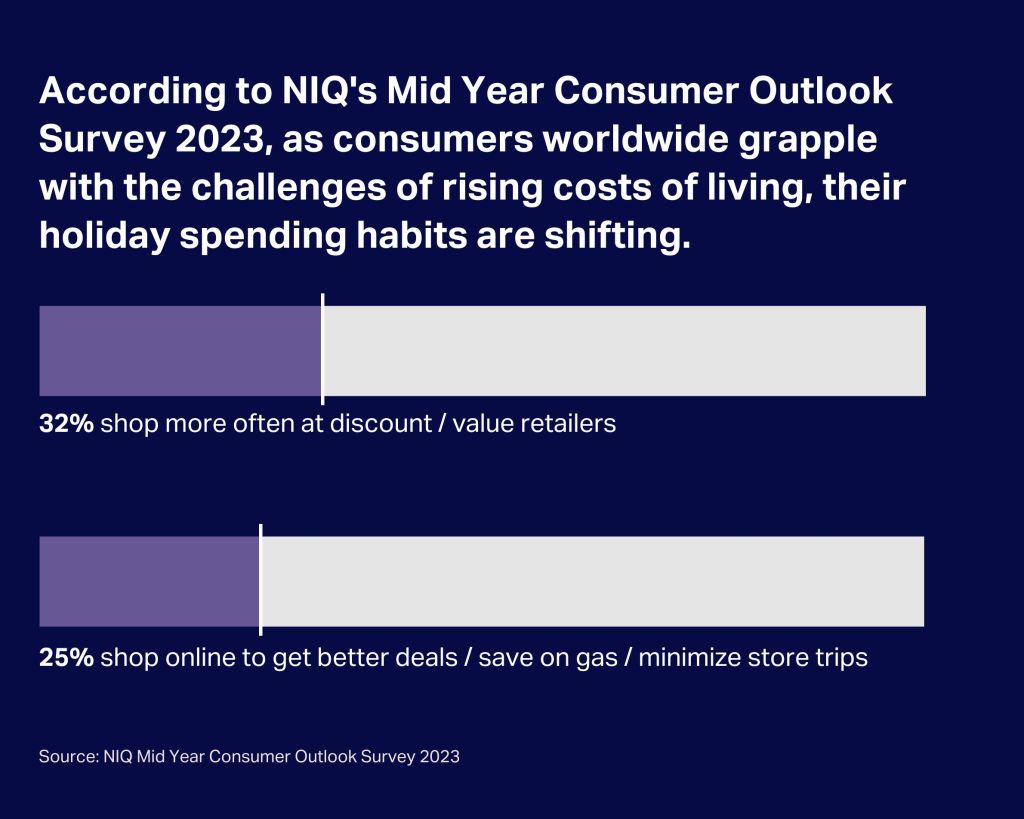

According to NIQ’s Mid Year Consumer Outlook Survey 2023, 95% of consumers have changed how they have shopped for FMCG in order to manage expenses, with an average global shopper implementing 4 saving strategies.

Source: NIQ Mid Year Consumer Outlook Survey 2023

Day 14

Day 15

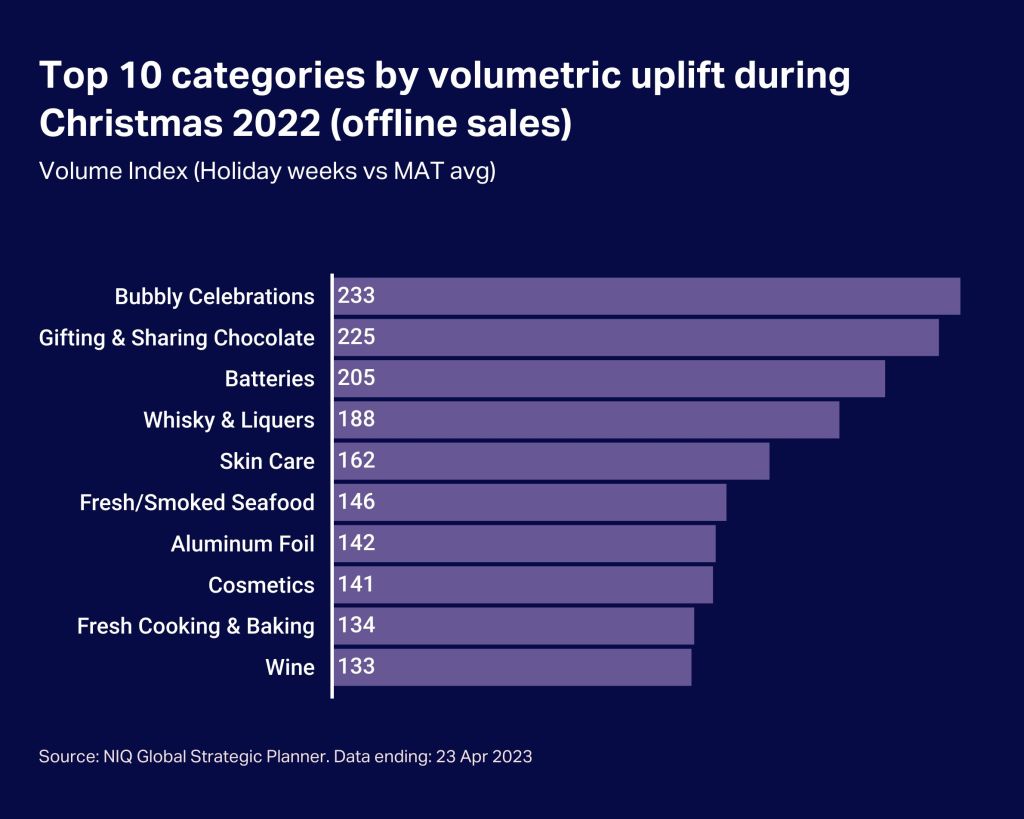

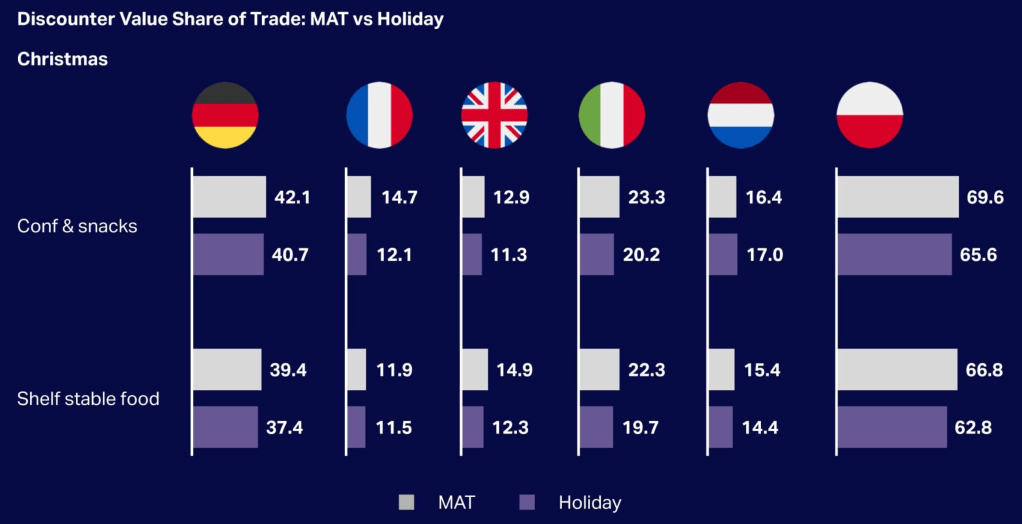

Christmas present an opportunity for branded players and other retailers to win share against Discounters.

Source: NIQ Global Strategic Planner. Data ending: 23 Apr 2023

Day 16

41% of global consumers say they are now doing more grocery shopping online than compared to 6 months ago.

Source: NielsenIQ Barometer – Wave 3 (March 2023). 12 global markets (South Korea, China, South Africa, Saudi Arabia, India, Poland, Chile, Brazil, USA, France, Germany, UK

Day 17

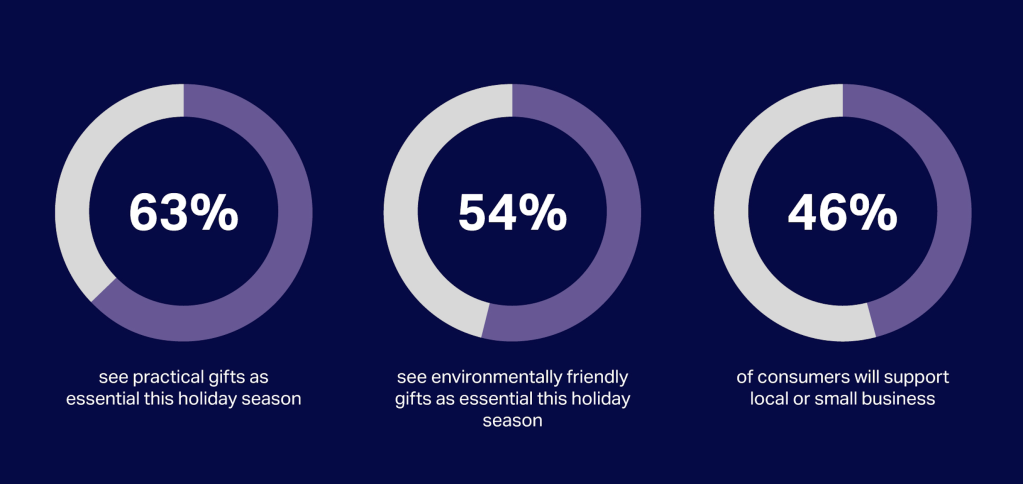

According to NIQ’s Holiday Habits Survey 2023, practical and meaningful gifts are being prioritized over luxury by Indian consumers.

/

Source: NIQ Holiday Habits Survey 2023

Day 18

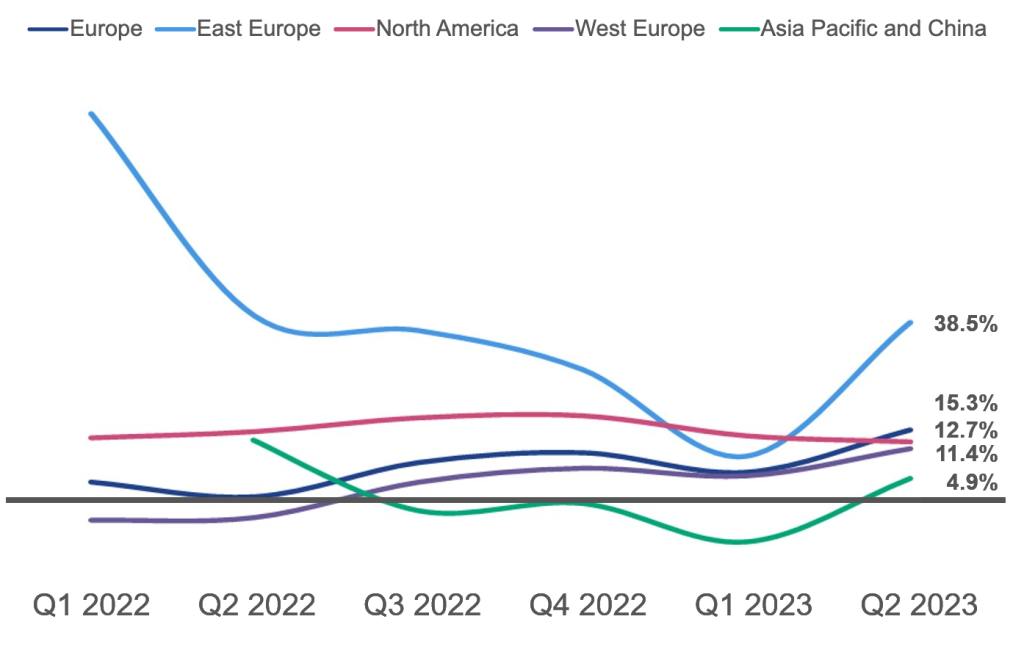

FMCG E-commerce performance continues to grow, marking +9.7% globally, with peaks in Eastern Europe (+26.7%) and North America (+15.7%).

Source: NIQ Retail Measurement, Global e-commerce channel, Total FMCG, Latest annual and quarterly periods ended Q2 2023 vs. Previous year

Day 19

According to NIQ Research, 69% of consumers state sustainability has become more important to them in the last 2 years. Shoppers will actively be looking for ways to make their Christmas shopping more sustainable across their shopper category

Source: NIQ Brandbank report – 5 steps to winning the digital shelf this Christmas season

Day 20

How to win your customers during holiday season – Use interactive content!

Fact: Interactive content on your product page makes it 53 x more likely that your product will get a front-page Google search result.

Fact: 90% of all information that we perceive that gets transmitted to our brains is visual.

Fact: Using interactive content can supercharge your social media performance, increase SEO and create brand loyalty to convert sales

Source: NIQ Brandbank report -The anatomy of a high-converting product page: A guid

Day 21

Top 3 categories consumers in Western Europe bought online during Christmas 2022

Source: Foxintelligence 2022 Christmas data

Day 22

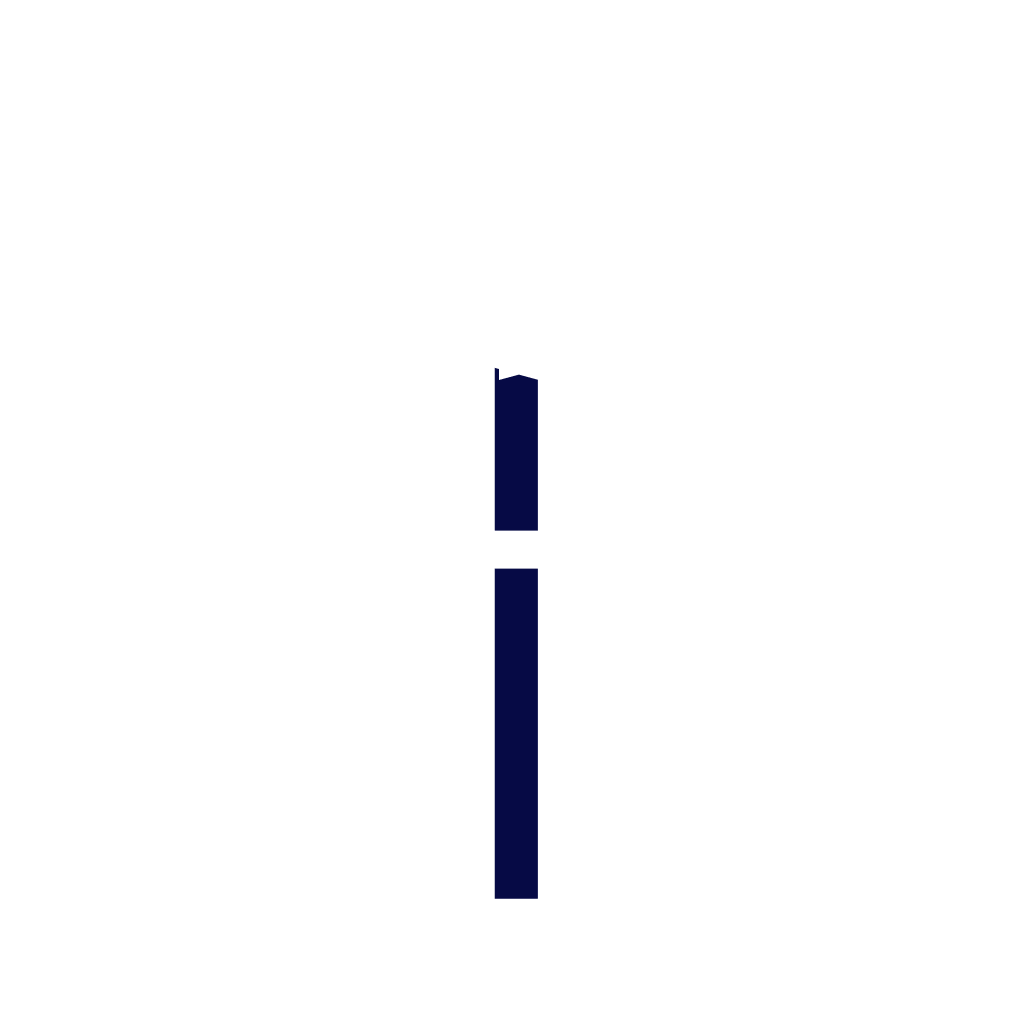

According to the NIQ Holiday Habits Survey 2023, Indian consumers will mostly gather in smaller crowds and enjoy a meal at home this holiday season.

/

Source: NIQ Holiday Habits Survey 2023

Day 23

Based on the findings of the NIQ Insider Survey, 60% of senior executives from FMCG companies worldwide expect a rise in online shopping within the coming years.

Source: NIQ Insider survey – 129 senior leaders (APAC, China, EMEA, North America, Western Europe). March 2023

Day 24

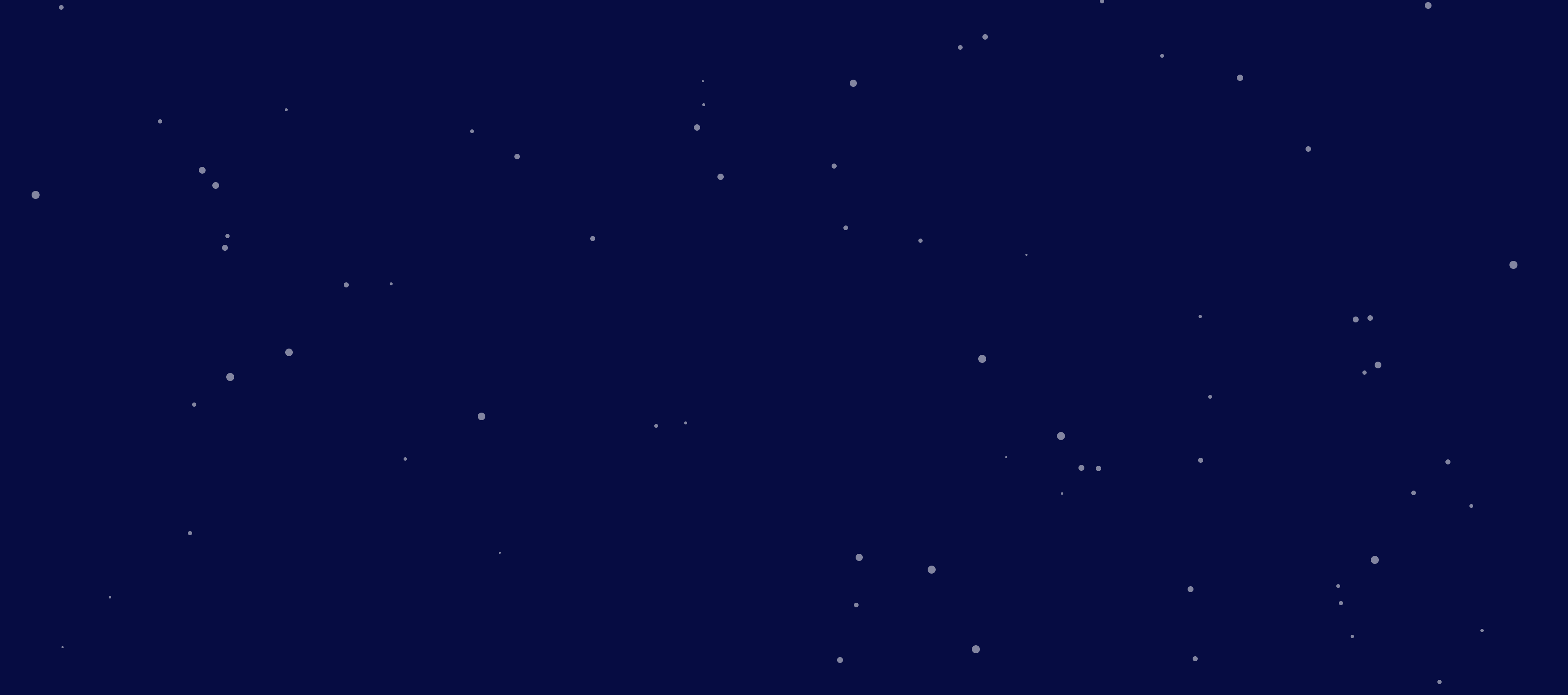

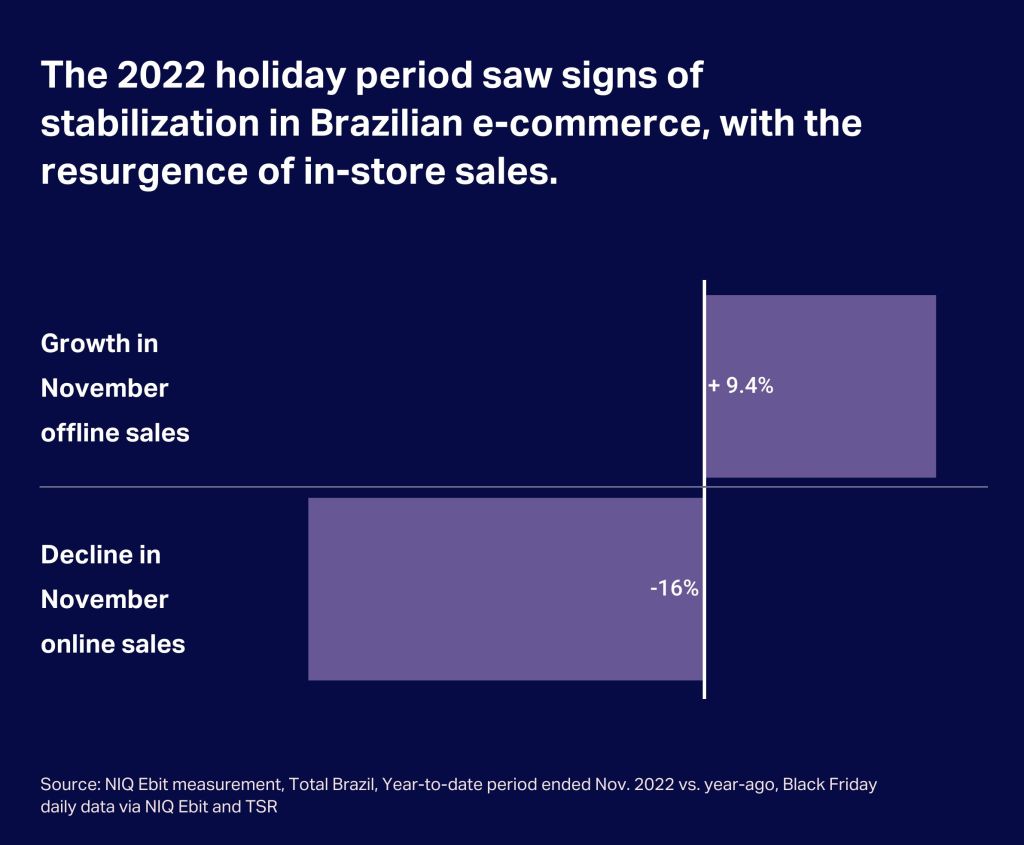

For Brazilian shoppers, Christmas is the second most important event for online shopping, right after Black Friday.

Source: NIQ Ebit Purchasing Intention Q4 2023 survey – Fieldwork: Sept 12-18th, 2023

Day 25

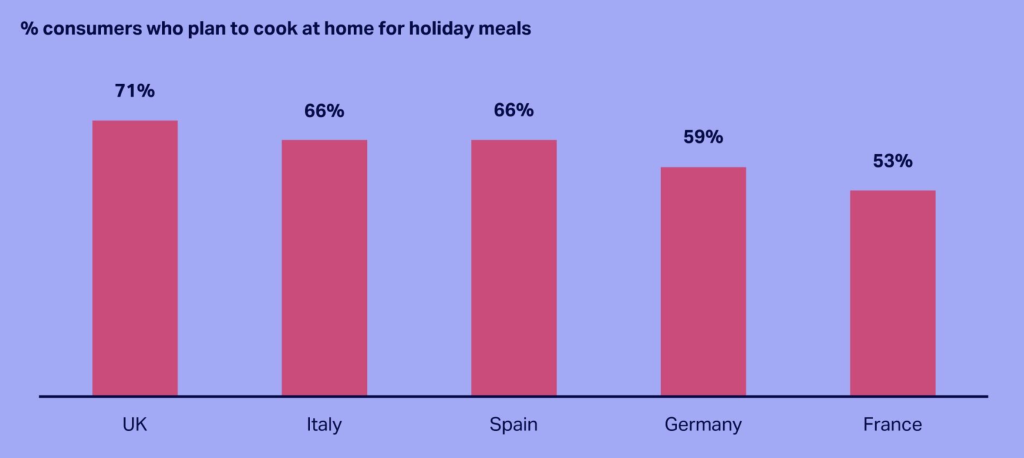

According to NIQ’s Holiday Habits Survey 2023, most Western European consumers are planning to enjoy a meal at home with family and friends during the Christmas holidays

/

Source: NIQ Holiday Habits Survey 2023

Don’t miss out on the next insight!

Receive a daily reminder when a new insight is revealed.