An inflection point: The evolving luxury buyer

In short, there’s no exclusive luxury buyer anymore. Consumers are spending across price points, categories, channels, and brands. Now, pure luxury beauty buyers are playing both sides of the store and have adopted a dual buyer status. Similarly, mass shoppers are behaving the same way and engaging in the luxury space.

As a result, different groups represent the luxury buyer. Millennials overall spend the most on luxury fragrance, and the AAPI community spends more on luxury skincare. Gen Z sometimes represents the luxury buyer too – a surprising counter fact to common stereotypes. Fueled by things like ‘buy now pay later’ schemes, Gen Z is engaging in the luxury space earlier than usual.

The heavy luxury buyer

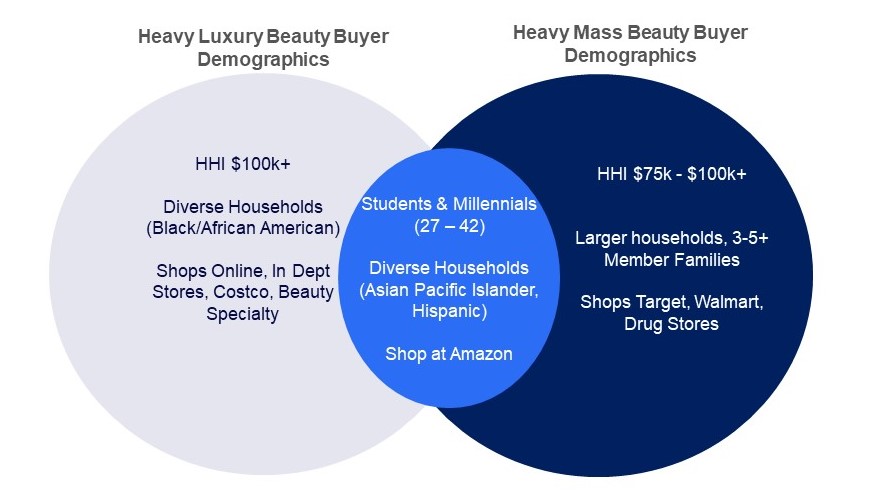

While the luxury buyer is a moving target, there’s still a group of consumers who are truly committed to the luxury segment.

They’re younger, tech savvy, and racially diverse – but as mentioned, the lines are blurring between luxury and mass and there’s a clear overlap. Students, millennials, and AAPI buyers see benefits in both luxury and mass products.

What categories resonate with the beauty buyer?

Ultimately most buyers will purchase across price points and product categories. Though there are some categories that luxury buyers are more likely to purchase, and some categories that are appealing to both sides of the dual shopper:

- Fragrance and face cosmetics are categories in which shoppers often gravitate towards luxury products.

- Consumers will select the best product overall in facial skincare and haircare categories – regardless of segment.

Consider: Luxury fragrance can serve as an entry point for consumers who haven’t tapped into the luxury segment yet – especially as 41% of total fragrance sales fall under luxury. Consumers value access to unique scents and opportunities for expression. This especially rings true for younger consumers who are embracing luxury fragrance at growing rates.

Winning today’s beauty consumer

The beauty industry is in constant flux, and the face of today’s luxury consumer will continue to change. There are a few factors at play:

- Aspirational indulgence: Most beauty consumers aspire to use the best of the best. Mass shoppers are continually finding new luxury entry points like seasonal sales to meet these aspirations.

- Retail evolution: The retail landscape is changing – and it’s no different for beauty. Key mass players are teaming up with luxury brands to expand the luxury footprint.

- Routine expansion: Brands are increasingly offering options for beauty consumers who want to dabble in luxury but don’t want to spend more than they do. Dupe product availability and mini-sized best sellers are opening entry points at a lower investment. But sometimes, that small entry point is all it takes.

Get the full report

Connecting with today’s beauty buyer can seem like a bit of a feat, especially in an industry that’s faced with constant innovation and change. To stay one step ahead, access our full report on luxury vs. mass beauty trends.