NCERT Solutions are considered one of the best study materials while preparing for the CBSE Class 12 Economics Board examinations. These Solutions of NCERT are collated by the subject matter experts to help students improve their understanding of economic concepts.

Download the PDF of NCERT Solutions for Class 12 Economics Chapter 5 – Government Budget and Economy

Access NCERT Solutions for Class 12 Economics Chapter 5

NCERT Macroeconomics Solutions Class 12 Chapter 5

1. Explain why public goods must be provided by the government.

Public goods are those goods where there is no competition, and the use of goods is not restricted to only one individual. These goods are for use by all individuals in society. Such goods are used for the welfare of society.

Therefore, the government should provide public goods for the following reasons:

1. So that benefits of the public goods can be enjoyed by all members of the society.

2. So that the consumption of these goods will not impact the consumption of any other individual.

2. Distinguish between revenue expenditure and capital expenditure.

| Basis of Comparison | Capital Expenditure | Revenue Expenditure |

| Definition | Expenditure incurred for acquiring assets to enhance the capacity of an existing asset that results in increasing its lifespan | The expense incurred for maintaining the day-to-day activities of a business |

| Term | Long term | Short term |

| Value addition | Enhances the value of an existing asset | Does not enhance the value of an existing asset |

| Physical Existence | Have a physical presence except for intangible assets | Do not have a physical presence |

| Occurrence | Non-recurring in nature | Recurring in nature |

| Capitalisation | Yes | No |

| Impact on Revenue | Do not reduce business revenue | Reduces business revenue |

| Benefits | Long-term benefits for business | Short-term benefits for business |

| Examples | Highway, tunnel, metro projects, etc. | Pension, salary, etc. |

3. ‘The fiscal deficit gives the borrowing requirement of the government.’ Elucidate.

A fiscal deficit is referred to as a shortfall in the government’s income as compared to its spending. A high fiscal deficit means that the government is borrowing more money than it is earning. A higher fiscal deficit creates a burden of loan and interest payments for the future generation.

Fiscal deficit is determined by

Total Expenditure – Total Receipts excluding borrowings

4. Give the relationship between the revenue deficit and the fiscal deficit.

A revenue deficit is referred to as an excess of revenue expenditure as compared to earnings by revenue receipts of the government. A fiscal deficit is a bigger phenomenon where the difference is between the total expenditure and total receipts obtained by the government. When the revenue deficit increases correspondingly, the fiscal deficit also increases.

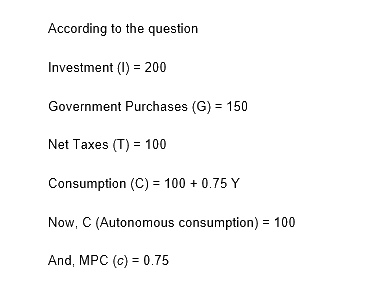

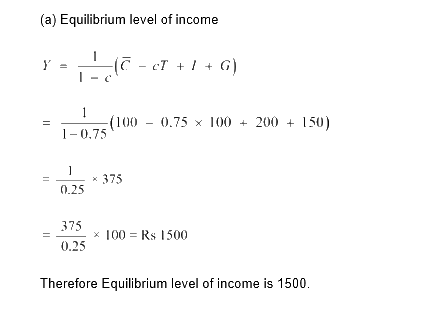

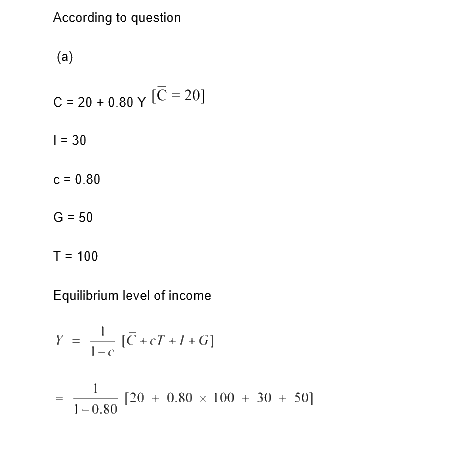

5. Suppose that for a particular economy, investment is equal to 200, government purchases are 150, net taxes (that is, lump-sum taxes minus transfers) is 100 and consumption is given by C = 100 + 0.75Y (a) What is the level of equilibrium income? (b) Calculate the value of the government expenditure multiplier and the tax multiplier. (c) If government expenditure increases by 200, find the change in equilibrium income.

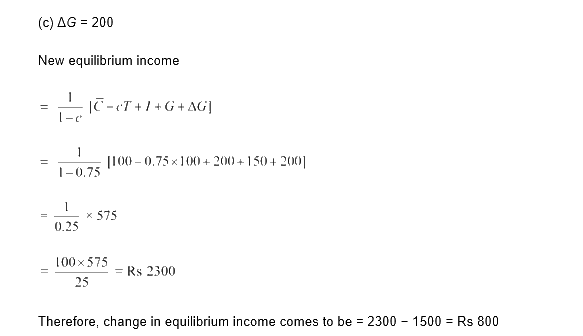

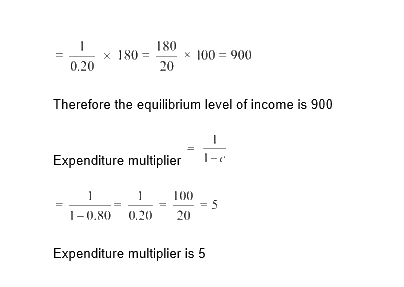

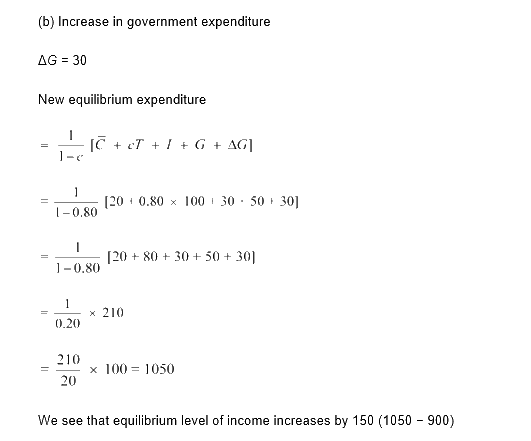

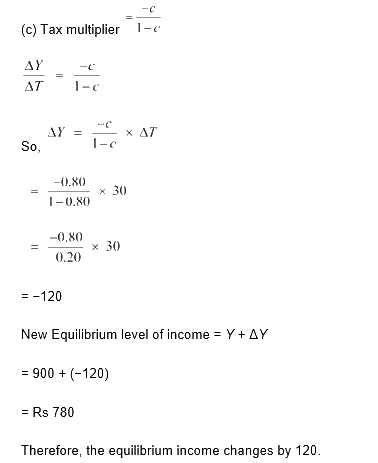

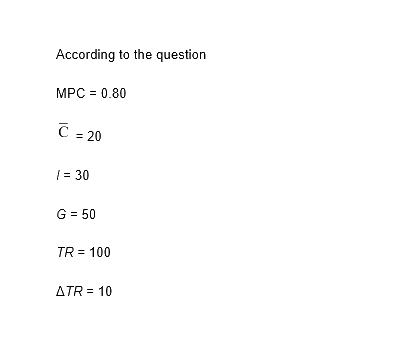

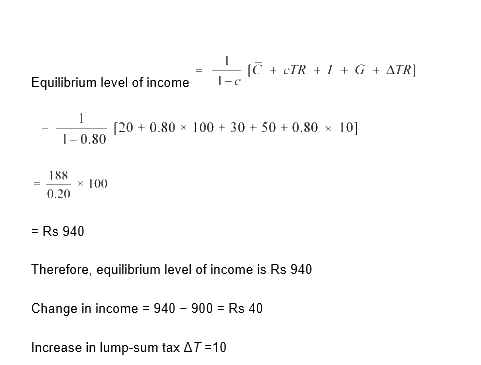

6. Consider an economy described by the following functions: C = 20 + 0.80Y, I = 30, G = 50, TR = 100 (a) Find the equilibrium level of income and the autonomous expenditure multiplier in the model. (b) If government expenditure increases by 30, what is the impact on equilibrium income? (c) If a lump-sum tax of 30 is added to pay for the increase in government purchases, how will equilibrium income change?

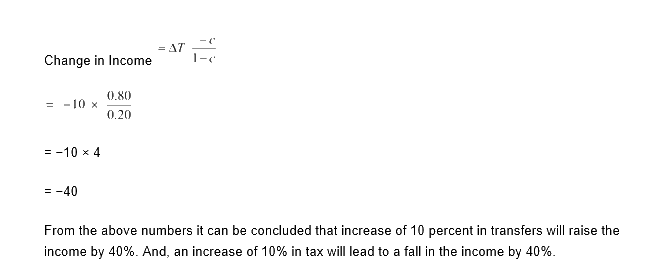

7. In the above question, calculate the effect on the output of a 10 per cent increase in transfers and a 10 per cent increase in lump-sum taxes. Compare the effects of the two.

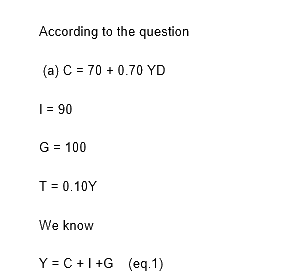

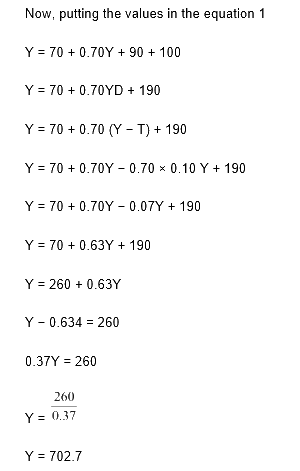

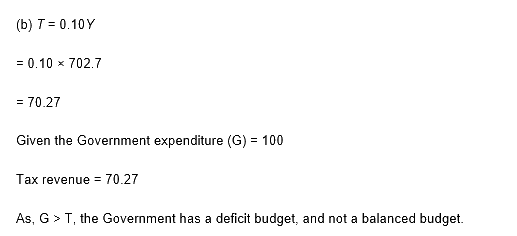

8. We suppose that C = 70 + 0.70Y D, I = 90, G = 100, T = 0.10Y (a) Find the equilibrium income. (b) What are tax revenues at equilibrium Income? Does the government have a balanced budget?

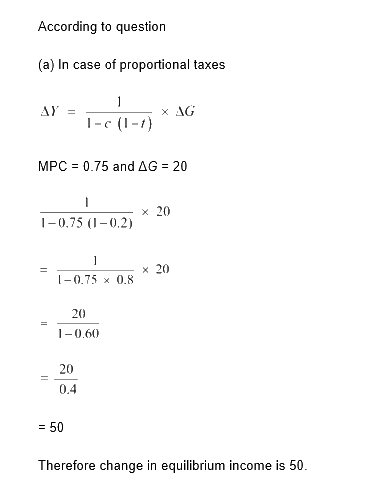

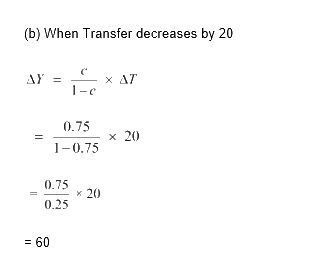

9. Suppose the marginal propensity to consume is 0.75, and there is a 20 per cent proportional income tax. Find the change in equilibrium income for the following (a) Government purchases increase by 20 (b) Transfers decrease by 20.

Therefore, the change in equilibrium income is 20.

10. Explain why the tax multiplier is smaller in absolute value than the government expenditure multiplier.

The tax multiplier always has a negative value and therefore is smaller in absolute value than the government expenditure multiplier. Government expenditure creates an impact on the total expenditure and the taxes through the multiplier. It also influences disposable income, which impacts the overall consumption level.

The following example will help in understanding the tax multiplier better.

Assume MPC be to 0.50.

Now, the government expenditure multiplier = 1 / 1 – c

= 1 / 1 – 0.50

= 1 / 0.50

=2

Tax multiplier = – c / 1- c

= -0.50 / 1 – 0.50

= −1

This shows that the government expenditure multiplier is always more than the tax multiplier.

11. Explain the relation between government deficit and government debt.

A government, in order to adjust the government deficit, which is created due to borrowings by the government, seeks more borrowings; these borrowings create further debt for the government in the form of interest payments. Therefore, an increase in the deficit will lead to an increase in debt.

12. Does public debt impose a burden? Explain.

Public debt is referred to the amount of money that a government owes to banks, financial institutions and other sources of finance. It is known to impose a burden on the economy in the following ways:

1. Government may impose taxes or print new money to repay the existing debts. Such a situation will hamper the productivity of the nation.

2. A high level of debt creates a burden on future generations in the form of interest and taxes being levied on the younger generation, which will result in lower consumption and savings.

3. More investments are attracted by the government by raising the interest rates on bonds and securities. Therefore, citizens’ money is utilised by the government and hence less private investment.

4. Wealth of the nation is depleted when loans are repaid to foreign institutions and countries.

13. Are fiscal deficits inflationary?

A fiscal deficit will not always result in inflation. If a situation arises when government expenditure increases and tax reduction is seen, it will cause a deficit in the government, which leads to an increase in aggregate demand. Firms will not be able to meet the demand thus generated, which will result in a price increase. Therefore, fiscal deficits can become inflationary, but they will not be inflationary in the case when resources are less utilised due to insufficient demand and less output. Then, if the government is spending more also, more resources will be employed in order to meet the growing demand, and there will be no pressure on price rise. In such a situation, a high fiscal deficit, along with high demand and greater output, will not create an inflationary situation.

14. Discuss the issue of deficit reduction.

Government can reduce the budget deficit by the following methods:

1. Decreasing expenditure

2. Increasing Revenue

Decreasing Expenditure can be achieved by

a. More planned activities should be undertaken by the government to reduce expenditure.

b. Encouraging the private sector to contribute to some major capital projects will help reduce expenditure.

An increase in revenue can be obtained by

a. Raising taxes or introducing new taxes can contribute to an increase in revenue.

b. By selling stakes in PSU, the process called divestment can bring in more revenue.

NCERT Solution for Class 12 Economics Chapter 5 – Government Budget and Economy. This chapter explains, in brief, a manner about how the budget and employment are determined.

Chief concepts of this chapter –

- Government Budget

- Objectives of Government Budget

- Public goods

- Revenue receipts

- Capital receipts

Conclusion

NCERT Solutions for Class 12 Economics Chapter 5 provide many illustrative examples, which help the students to comprehend and learn quickly. The above-mentioned are the illustrations for the Class 12 CBSE syllabus. For more solutions and study materials of NCERT Solutions for Class 12 Economics, visit BYJU’S website or download the app.

Also, explore –

Comments