Updates about CAIIB Syllabus 2022 – The syllabi of CAIIB have been restructured to make them more conceptual and contemporary. The CAIIB examinations under the revised syllabi are tentatively proposed to be held from November/December 2022 onwards or latest from the May / June 2023 onwards, in any case. The last exams under CAIIB as per the old syllabi (present syllabi) will be held during November/December 2022 after which, it will be discontinued.

The Certified Associate of Indian Institute of Bankers (abbreviated as CAIIB) is conducted by IIBF biannually i.e. twice in a year. The aim of the examination is to provide advanced knowledge to the candidates necessary for better decision making covering risk, financial and general bank management, etc. Further information on CAIIB Exam can be found in the given link.

Candidates willing to appear for various other Government exams can check the linked page for updated information.

The article aims to provide a detailed CAIIB exam pattern and syllabus. Aspirants will also be able to download the CAIIB Syllabus PDF for reference.

CAIIB Syllabus PDF- Download PDF Here

| Need assistance to complete the vast CAIIB Syllabus? Check the links below and edge over competitors! |

CAIIB Exam Pattern

The exam pattern of CAIIB as given by IIBF is as follows-

- The examination is conducted in Online Mode.

- There are three papers in the CAIIB exam, 2 compulsory papers for all candidates i.e. Advanced Bank Management and Bank Financial Management and 1 elective paper (comprising 11 subjects) of their choice.

- All the three papers (individually) will be carrying 100 multiple choice questions of 100 marks.

- Time duration allowed to complete each paper is 2 hours i.e. 120 minutes.

- The exam paper will be bilingual i.e. both in English and Hindi Language.

The highlights of CAIIB exam pattern is given below-

| CAIIB Exam Pattern | |||

| Papers | Number of Questions | Maximum Marks | Duration |

| Advanced Bank Management | 100 | 100 | 2 hours |

| Bank Financial Management | 100 | 100 | 2 hours |

| Elective paper | 100 | 100 | 2 hours |

Candidates who aspire to write CAIIB exam can check also check IIBF Exam to get relevant information on similar exams.

CAIIB Marking Scheme

- There is no negative marking scheme as per the examination pattern.

- Candidates will be awarded 1 mark for each correct answer.

- Candidates are required to secure a minimum of 50 marks out of 100 in each paper.

- Those who secure at least 45 marks in each subject with an aggregate of 50% marks in all subjects of examination in a single attempt will also be declared to have completed the examination.

- The credits for the subject that candidates pass in an attempt can be retained till the expiry of the time limit of passing CAIIB exam.

CAIIB Selection Process – Time Limit to Pass the Exam

As per the CAIIB selection process candidates are required to pass the examination within the time period mentioned below-

- Within a time limit of 2 years (i.e. 4 consecutive attempts).

- Those unable to clear the exam in 2 years are required to re-enrol themselves afresh.

- Candidates who re-enrol for the exam will not be granted credit/s for subject/s passed, if any, earlier.

- The time limit of 2 years will start from the date of application for the first attempt which is counted irrespective of whether a candidate appears for any examination or otherwise.

Aspirants preparing for any competitive exams can check the following links for assistance-

- Free Online Mock Tests for Government Exams

- Government exam Previous Year Question Papers with Solution PDFs

CAIIB Syllabus

The CAIIB syllabus is mentioned in detail in the official website of Indian Institute of Banking & Finance. Candidates in the exam are asked questions based on knowledge testing, logical and analytical exposition, problem-solving, conceptual grasp, and case study.

As per the syllabus given by IIBF, candidates have to study three papers for the Certified Associate of IIBF exam.

2 Compulsory Papers-

- Advanced Bank Management

- Bank Financial Management

1 Elective paper (anyone from the list given below):

- Corporate Banking

- Human Resources Management

- Rural Banking

- Information Technology

- International Banking

- Risk Management

- Retail Banking

- Central Banking

- Co-operative Banking

- Treasury Management

- Financial Advising

Each paper mentioned above comprises several modules. The detailed CAIIB syllabus of each paper is as mentioned below –

CAIIB Syllabus – Advanced Bank Management

Topics covered in CAIIB Syllabus Paper I are –

| CAIIB Syllabus – Advance Bank Management | |

| Module A – Economic Analysis | The fundamentals of Economics: Scarcity and Efficiency – Microeconomics & Macroeconomics in brief – Types of economies – Market, Command and Mixed Economies – Macroeconomics: Business cycles – Money and banking – Unemployment & inflation – Interest rate determination and various types of interest rates, Indian Economy (a) Overview of the Indian economy including recent reforms (b) Interaction between fiscal, monetary & exchange rate policies in India – Financial Markets (i) Money Market (ii) Capital Market (iii) Foreign Exchange Market – globalization and its impact – Challenges ahead – Banking & Finance – current issues |

| Module B – Business Management | Concept of time Value of Money – Net Present Value – Discounted Cash Flow – Sampling methods – presentation of data – analysis and interpretation of sample data – hypothesis testing – Time series analysis – mean/ standard deviation – correlation – Regression – covariance and volatility – Probability distribution – Confidence interval analysis – estimating parameters of distribution – Bond valuation – duration – modified duration.

Linear programming – decision making-simulation – Statistical analysis using spreadsheets. Features of Spreadsheet – Macros, pivot table, statistical and mathematical formulae |

| HRM in Bank | Fundamentals of HRM, development of HRM in India, Relationship between HRM and HRD, Structure and functions of HRD, Role of HR professional, Human implications of organizations; training and development, attitude and soft skills development, role and impact

of training, career path planning and counseling, employee behavior, theories of motivation and their practical implications, role concepts and analysis, self-development., Performance Management and appraisal systems; Reward/ punishment and compensation systems., HRM and Information Technology, information and data management, knowledge management |

| Module D – Credit Management | Principles of Credit Management Credit Appraisal Analyzing Financial Performance – Relationship between items in Balance Sheet and Profit and Loss Account. Trend Analysis, Comparative Statement – Common Size Statement, Preparation of projected Financial Statements. – Ratio analysis – Interpretation and analysis of different Ratios, Limitation of the use of ratios. Statement of Sources and Applications of Funds.

Structuring a Credit Proposal – Working Capital Concept and Management Appraisal techniques for different constituents – trade cycle – credit rating – Technical and economic feasibility studies – Credit Rating – Rating Methodology – Objectives and benefits of rating – Term Lending – Debt Service Coverage Ratio – Cash Flow Analysis – Cash Budget – Bill Finance – Deferred Payment Guarantee – Credit Scoring – Credit Delivery System – Documentation – Post sanction supervision, Control and monitoring of credit – Consortium finance, Multiple banking, Syndication of loans. Infrastructure financing. Dealing with credit defaults, Stressed assets, Corporate Debt restructuring, SARFAESI, NPAs, recovery options, write-off. Disclosure of the list of defaulters: objectives and procedure. Appraisal methodology for different types of clients/ products. |

CAIIB Syllabus – Bank Financial Management

Topics that candidates are required to cover under CAIIB Syllabus Paper II is as mentioned below –

| CAIIB Syllabus – Bank Financial Management | |

| Module A – International Banking | Forex Business; factors determining exchange rates, Direct and indirect quotations, spot/ forward rates, premium and discount, cross rates.

Basics of forex derivatives; forward exchange rate contracts, Options, Swaps. Correspondent banking, NRI accounts Documentary letters of Credit – UCPDC 600, various facilities to exporters and importers. Risks in foreign trade, role of ECGC, types of insurance and guarantee covers or ECGC. Role of Exim Bank – Role of RBI and exchange control – Regulations in India, Role and rules of FEDAI – Role of FEMA and its rules |

| Module B – Risk Management | Risk-Concept – Risk in Banks – Risk Management Framework – Organizational Structure – Risk Identification – Risk Measurement/ – Sensitivity – Basis Point Value (BPV) – Duration – Downside Potential – Value at Risk, Back Testing – Stress Testing – Risk Monitoring and

Control – Risk Reporting – Market Risk identification, Measurement and management/ credit risk – rating methodology, risk weights, eligible collateral for mitigation, guarantees; credit ratings, transition matrices, default probabilities, Credit risk spreads, risk migration and credit metrics, Counterparty risk. Credit exposures, recovery rates, risk mitigation techniques, -Operational and integrated Risk Management – Risk management and capital Management – Basel Norms – Current guidelines on risk management |

| Module C – Treasury Management | Concepts and function; instruments in the treasury market, development of new financial products, control and supervision of treasury management, linkage of domestic operations with foreign operations.

Interest rate risk, interest rate futures, Mix/ Pricing of Assets, Liabilities – On-Balance Sheet Investment and Funding Strategies – Stock options, debt instruments, bond portfolio strategy, risk control and hedging instruments. Investments – Treasury bills, money market instruments such as CDs, CPs, IBPs Securitisation and Forfaiting; refinance and rediscounting facilities. Derivatives – Credit Default Swaps/ Options. |

| Module D – Balance Sheet Management | Prudential norms – Capital Adequacy. Implementation of ‘Basel Norms guidelines: RBI guidelines. Banks Balance Sheet – Components of assets/ Liabilities/ ALM Implementation – Gap Analysis – Mechanics, Assumptions, and Limitations – Illustrations of Actual Gap Reports – The Relationship Between Gap and Income Statement – Funding

Liquidity – Trading/ Managing Liquidity – Contingency Funding – Business Strategies: Profit and profitability analysis, Asset Classification – provisioning – effect of NPA on profitability, Shareholder value maximization & EVA- profit planning measures to improve profitability.Disclosure guidelines |

CAIIB Syllabus – Elective Papers

Candidates have to select any one subject out of the eleven given options for Elective paper by IIBF.

The topic-wise CAIIB syllabus for all elective papers are given below-

CAIIB Elective Paper I – Central Banking

| CAIIB Syllabus – Elective Paper I |

Module – A: Rationale and Functions of Central Bank

|

Module – B: Central banking in India

|

Module – C: Monetary Policy and Credit Policy

|

Module – D: Supervision and Financial Stability

|

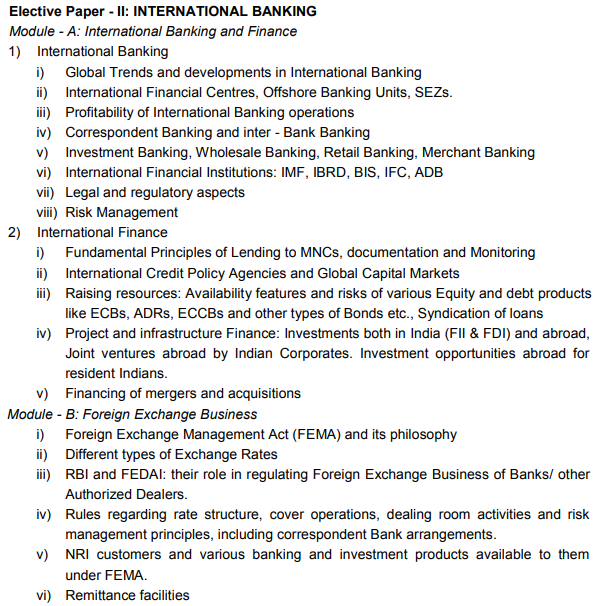

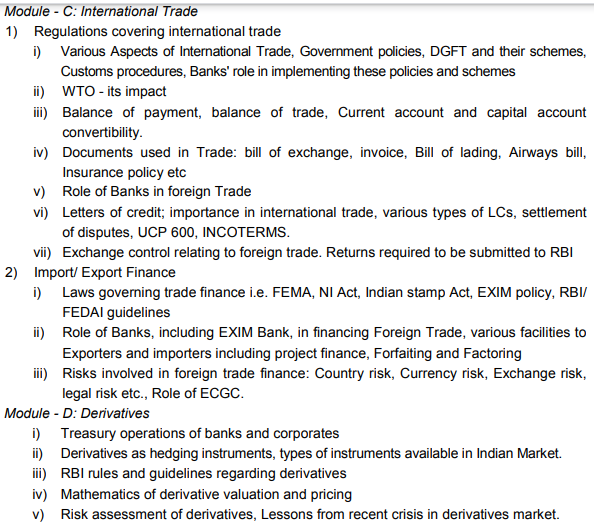

CAIIB Syllabus Elective Paper-II – International Banking

CAIIB Syllabus Elective Paper III – Rural Banking

| CAIIB Exam Syllabus – Elective Paper III Rural Banking |

Module – A: Rural India

|

Module – B: Financing Rural Development

|

Module – C: Priority Sector Financing and Government initiatives

|

Module – D: Problems and Prospects in Rural Banking

|

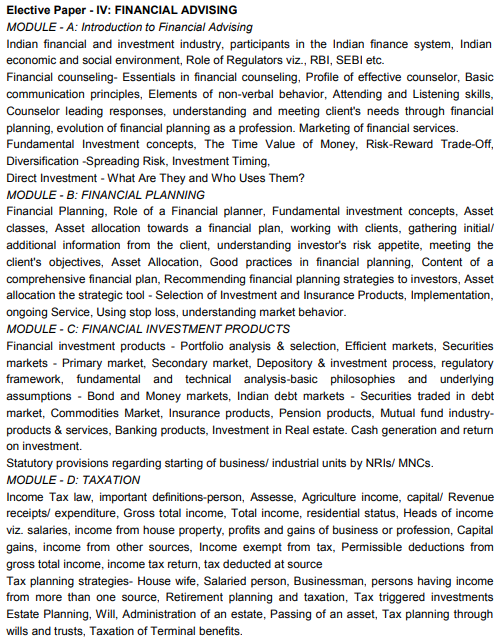

CAIIB Syllabus – Elective Paper IV Financial Advising

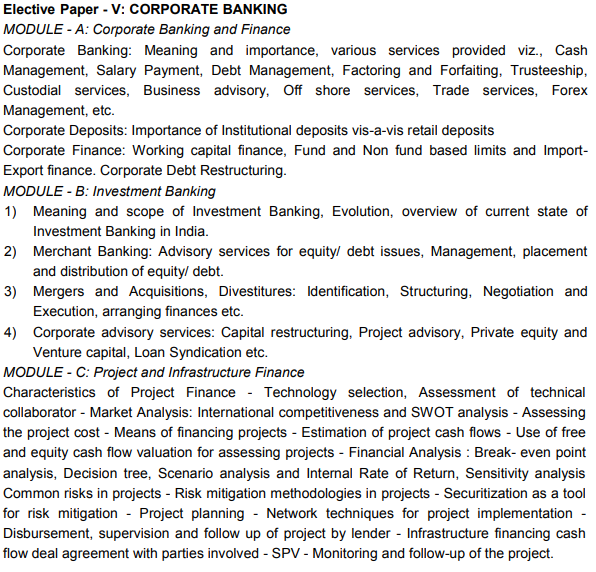

CAIIB Syllabus Elective Paper V Corporate Banking

CAIIB Syllabus – Elective Paper VI Retail Banking

CAIIB Syllabus Elective Paper VII Co-operative Banking

CAIIB Exam Syllabus – Elective Paper VIII Human Resource Management

CAIIB Syllabus – Elective Paper IX – Information Technology

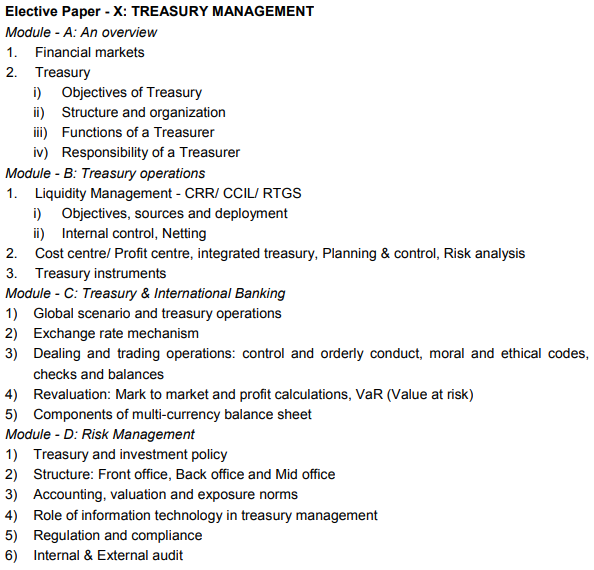

CAIIB Syllabus Elective Paper X Treasury Management

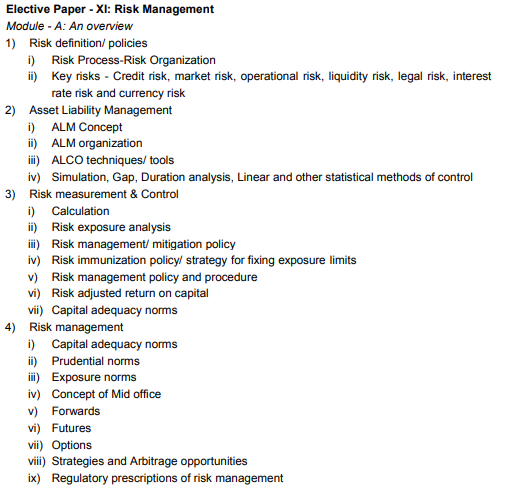

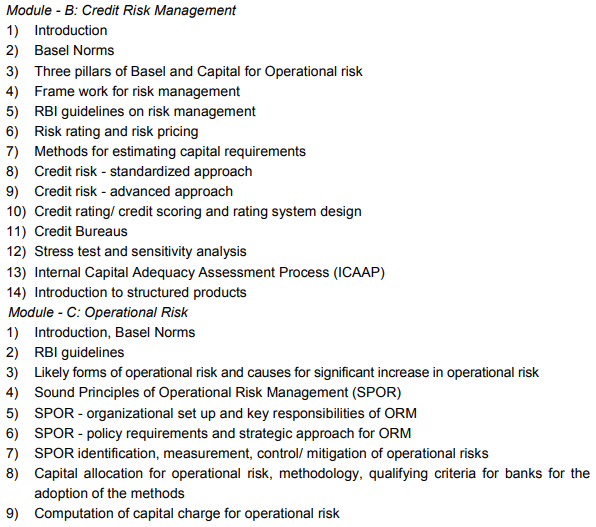

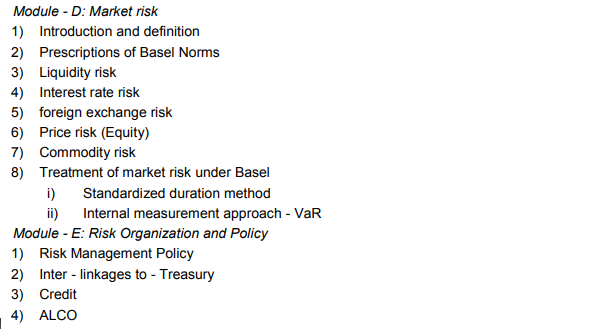

CAIIB Syllabus Elective Paper XI Risk Management

Aspirants preparing for various bank exam can check the following links for assistance-

| IBPS PO Syllabus | IBPS Clerk Syllabus | JAIIB Syllabus |

| IBPS RRB Syllabus | SBI PO Syllabus | SBI Clerk Syllabus |

Comments